Japanese Yen Long term Forecast – Jun’17

Jun, 13, 2017 By Vikram Murarka 0 comments

13-Jun-17

Yen 110.04/Nikkei 19899/ Gold 1265/ US-Japan 10Yr yield spread 2.15%

EXECUTIVE SUMMARY:

Recap: In our May’17 report, Dollar Yen was expected to remain rangebound in 108-115 for the next 2-3 months with a possible extension to 116-118 by the year end.

Dollar Yen failed to rise above 115 but the following decline also failed to breach 108 to the downside. Our current studies point towards the pair maintaining its stability inside the range of 108-115, keeping our view unchanged.

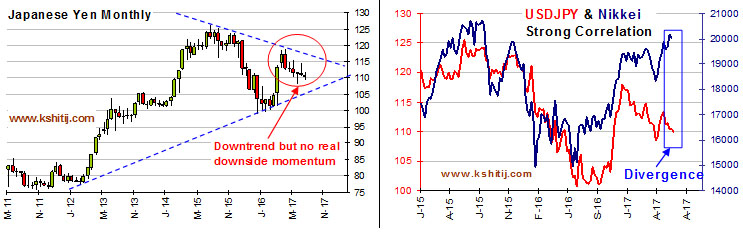

USD/JPY Monthly Candles

The left side chart shows the long term chart of Dollar Yen in a large contraction phase (evident from the blue dotted converging lines). The trend has been down for the last 6 months but the small ranges of the candles point to lack of bearish momentum, which is often a precursor to upmove. Therefore, the higher levels of 114-115 can be tested again in the coming months with high chances of the 3-month low 108 holding on.

The right side chart shows the strong correlation between Dollar Yen and Nikkei but the last 2 months show a divergence between the equity index and the currency pair (blue rectangle). With Nikkei looking poised for 21000 levels (+5.5% from the current levels of 19900), the divergence may resolve to the upside and push Dollar Yen higher towards 112-114.

Quarterly Projections

The change in our quarterly projections is minimal. Only the closing levels for the current quarter has been modified down as the bounce from 109-108 may not take it to 113.00 within the next 2 weeks.

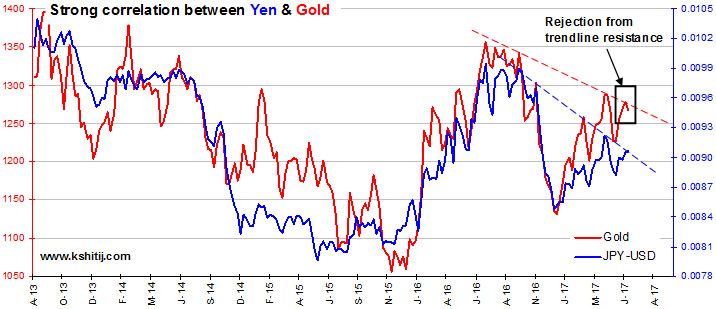

Yen-Gold Correlation: Bearish for Yen

Gold and Yen (against Dollar) have a strong correlation as both are perceived as safe haven in the risk averse phases. As seen on the chart above, Gold is turning down following a rejection from a long term resistance (red trendline) which may push Gold lower to 1230 levels (-2.6%) and also weaken Yen to 112-113 in the coming weeks.

US-Japan 10Yr Yield Spread

The US-Japan 10Yr yield (2.15%) spread has declined to 2.10% levels contrary to previous expectations of a rise to 2.40-50% (discussed in the May’17 report).

The US-Japan 10Yr yield (2.15%) spread has declined to 2.10% levels contrary to previous expectations of a rise to 2.40-50% (discussed in the May’17 report).

But now the spread is trying to bounce from the trendline support near 2.10% which may push it to the higher resistance of 2.20-25% which may boost Dollar Yen in the near to medium term too. The activity near 2.20-25% may determine the next path for Dollar Yen but it is most likely to keep the pair in the range of 108-114.

Conclusion

The expected rise in Dollar-Yen for 115-116 came short as the monthly high for May was registered at 114.37 before a corrective decline took it to 109.00. Still, the preferred view of oscillation in the range of 108-115 remains unchanged as neither of the boundaries may be breached in the next couple of months.

Array

You may also like:

Euro Long term Forecast – Jun’17

9, Jun 2017

Aussie Long term Forecast – Jul’17

8, Jul 2017

Japanese Yen Long term Forecast – Jul’17

8, Jul 2017

Euro Long term Forecast – Jul’17

8, Jul 2017

Aussie Long term Forecast – Aug’17

5, Aug 2017

Euro Long term Forecast – Aug’17

5, Aug 2017

Japanese Yen Long term Forecast – Aug’17

5, Aug 2017

Euro Long term Forecast – Sep’17

7, Sep 2017

Japanese Yen Long term Forecast – Sep’17

13, Sep 2017

Japanese Yen Long term Forecast – Jan’18

19, Jan 2018

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877