Aussie Long term Forecast - Jun'17

Jun, 10, 2017 By Vikram Murarka 0 comments

10-June-17 / AUDUSD 0.7523/ Copper 2.6445 / USDCAD 1.3470

Recap:

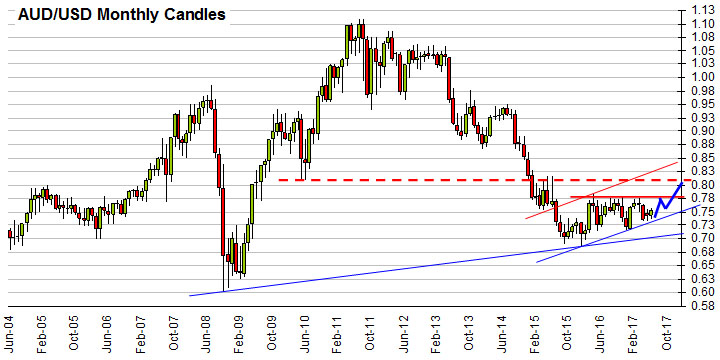

In the May report we had moderated our bullish view and stated a possibility of seeing a medium term bottom at 0.73 preceding the bullish reversal towards 0.80. In line with what we said, May saw a low of 0.7325 from where Aussie has been moving up. But a confirmed break above 0.7750-0.7800 is needed to initiate further bullishness towards 0.80 and beyond.

EXECUTIVE SUMMARY:

Our bullish stance for Aussie remains intact while we wait for confirmation on a break above major resistance area of 0.7750-0.7850. Sideways consolidation below the mentioned resistance levels could continue for another couple of months before any actual breakout takes place. Overall we prefer Aussie bullishness in the longer run.

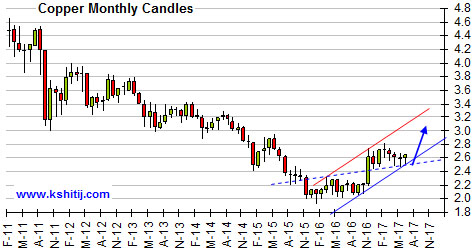

Copper

Copper started rising since Nov’16 after the sideways consolidation below 2.40 for almost a year from Nov’15 to Oct’16. Thereafter the short term channel uptrend has been holding well with a possibility of 2.50 being an immediate bottom for the coming months.

Copper started rising since Nov’16 after the sideways consolidation below 2.40 for almost a year from Nov’15 to Oct’16. Thereafter the short term channel uptrend has been holding well with a possibility of 2.50 being an immediate bottom for the coming months.

Taking into consideration that 2.50 would be a bottom for at least the next few months, we may expect a sharp rise towards 2.80-3.00 in the next 2-3 months.

USDCAD

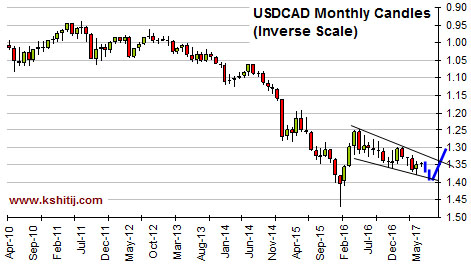

The USDCAD monthly chart alongside is shown on an inverted scale to easily identify its inverse correlation with AUDUSD.

The USDCAD monthly chart alongside is shown on an inverted scale to easily identify its inverse correlation with AUDUSD.

USDCAD is trading in a downward channel and could be ranged within the 1.36-1.39 region for the next 2-months followed by a sharp breakout on the upside. A possible downward wedge-formation is expected and if it turns out correct, it could push the currency pair towards 1.30 or even higher in the next 5-6 months.

Aussie and Canadian Dollar, both being commodity currencies, follow Copper closely and are positively correlated with each other. As mentioned above if Copper holds above 2.50 and moves up, it could lead to strength in the Aussie and Canadian Dollar (against the US Dollar) also along with itself.

While both Copper and the Canadian Dollar indicate a possible upmove for the longer run, we prefer bullishness for the Aussie in the longer term unless any reversal signal is visible in the price action.

Aussie Monthly Chart

The chart above clearly shows higher lows in price action from the bottom of 0.6827 seen in Jan’16 and if it continues, we could see a rise in Aussie in the coming months. As mentioned in our previous report, 0.78 is an important near term resistance which could get tested in June-July before possibly breaking on the upside targeting 0.80 within Sep-Oct’17.

Looking at the current scenario there could be a ranged phase for the next couple of months within the 0.78-0.74 region before a final breakout on the upside. The bullish views in Copper and USDCAD mentioned earlier are also supportive of this view.

Quarterly Projections

Array

You may also like:

Euro Long term Forecast – Jun’17

9, Jun 2017

Aussie Long term Forecast – Jul’17

8, Jul 2017

Japanese Yen Long term Forecast – Jul’17

8, Jul 2017

Euro Long term Forecast – Jul’17

8, Jul 2017

Aussie Long term Forecast – Aug’17

5, Aug 2017

Euro Long term Forecast – Aug’17

5, Aug 2017

Japanese Yen Long term Forecast – Aug’17

5, Aug 2017

Euro Long term Forecast – Sep’17

7, Sep 2017

Japanese Yen Long term Forecast – Sep’17

13, Sep 2017

Japanese Yen Long term Forecast – Jan’18

19, Jan 2018

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877