The onus is on us as Forex Advisors to increase our reliability

Jul, 04, 2019 By Vikram Murarka 0 comments

Very frankly, as forex advisors, the onus lies on us to win the respect of our clients. This piece of thought is for ourselves at Kshitij.com as well as for our peers in the forex advisory space.

Here is a common enough scenario across all forex advisors - the advisor does a lot of studies, comes up with a forecast, devises a hedging strategy and dishes it out to his client. The client takes it gingerly, makes a herculean effort not to wrinkle his nose at it and then when he thinks the advisor is not looking, quietly consigns the advice to the garbage bin near his foot. And later, when the market moves in the manner predicted, it is the turn of the advisor to make a herculean effort to avoid saying, “I told you so!”

Ever wondered why corporate hedgers tend not to heed the words of their forex advisors? Well, there is a reason for it, rooted in human psychology.

The thing is, all of us human beings – clients and advisors alike, contrary to the assumption in economic theory, are emotional creatures and not the emotionless rational beings we are assumed to be. We are less like Mr Spock and more like Captain Kirk of Star Trek. This fact leads to many unanticipated consequences, which need to be accepted as the normal, rather than the abnormal. The whole new field of Behavioural Economics deals with this, and it is here that we find the answer to why clients do not listen to their forex advisors.

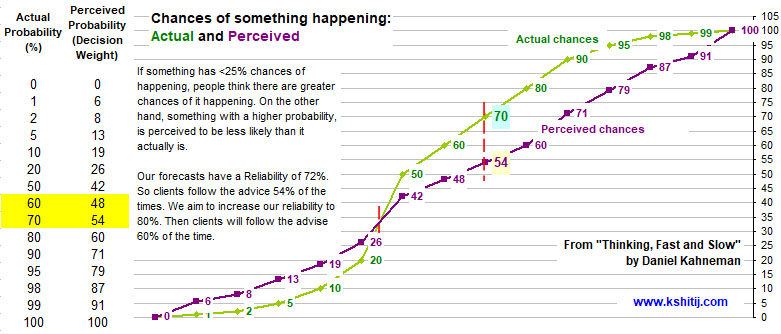

Dr Daniel Kahneman, the 2002 Economics Nobel laureate and one of the leading lights of Behavioural Economics, in his seminal book “Thinking Fast and Slow” has said that we human beings tend to overestimate the chances of those things which in actuality have very low probability. For instance, those things which have only a 1-2% statistical chance of occurring are estimated has having 6-8% chance in the human brain. Conversely, we also tend to underestimate the chances of those things which in actuality have very high probability. For example, something with a 98-95% statistical probability is humanly estimated as having a 87-79% chance of happening.

Why is this important to us and to this topic? It is seen that something which has a 60% statistical chance of occurring is underestimated by clients at 48% and something with a 70% chance is discounted to 54%. This means that if the suggestion of a forex advisor has 60% chance of being correct, in their minds, clients assume it to be 50%. And this is why they tend not to follow the advice as often as follow it. If the statistical chance of the advice being correct is 70%, it is discounted to 54% (a whopping 16 percentage points lower) in the client’s mind. It is at 70% Reliability that there is some hope that the clients may follow the advice a little more often. And, it is at 80% reliability that clients are likely to follow the advice 60% of the times! In other words, if forex advisors want clients to follow their advice most of the times, they need to exhibit a reliability of 80%.

It is not that corporate clients are a species from a different planet. Is not common that all of us follow the doctors’ advice no more than 50-60% of the times? Do we not discount the well meaning advice of our friends? Why, husbands are notorious for not listening to their wives (who are right even when they are wrong)! It is just the way the human brain is wired. We tend to make larger than necessary concession for the chance that our advisors may be wrong. In plain simple language, we don’t want to be caught on the wrong foot because of our advisor’s mistake!

Furthermore, when the corporate client does not even know the statistical track record of a forex advisor (other than experiential anecdotal knowledge maybe), how is he expected to place any faith at all in the advice? More ironically, when the forex advisor sanctimoniously says, “We are not in the business of forecasting currency movements, we are in the business of managing risk”, where does that leave the hapless importer/ exporter? He jolly well needs to know where the market is going, because how do you determine risk without having an idea of where the market is going, dammit!

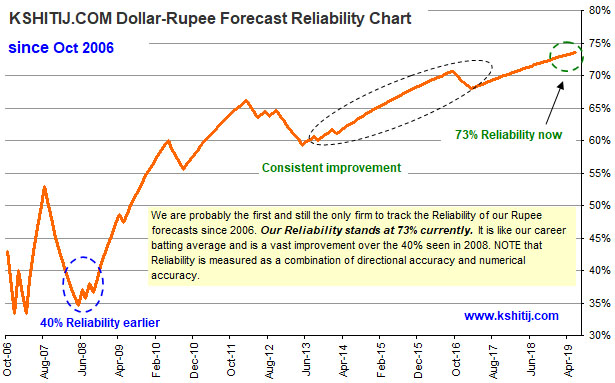

We, at Kshitij.com started publishing a track record of the reliability of our Dollar-Rupee forecasts in 2006. We were probably the first and are probably still the only ones to do so. Since there was no model available, we devised our own criteria. As per that, our Dollar-Rupee forecasts have a 78% reliability over the last 13 years. That is like a career batting average. But, we found the criteria to be a little loose and relaxed. So we tightened the criteria. As per this second (and tighter) set of criteria, we currently have a 72% reliability. However, not satisfied with that either, we have now tightened the criteria even further and we find we stand at 60% reliability. Talk about making life difficult for ourselves!

However, unless we make life difficult for ourselves, how can we make it easier for our Clients? Unless we raise the bar on our own currency forecasts, how can we help our clients manage their forex risk better? Unless the fitness instructor himself does not have a six-pack, or cannot jog for one hour, how is he going to win respect from Hrithick Roshan?

We believe the ability to forecast currency movements is the first thing expected from forex advisors and we are on a mission to get better at it. We had a reliability of only 35% in 2008 and now we are 72% or 60% reliability (depending on the criteria used). We owe it to our clients to get it up to 80%. We are working on it. Maybe we will get there. We see it as a human challenge and that is why Kshitij.com forecasts currencies in the first place!

Now, here’s another very important fact about human psychology. Human beings might be irrational, they might be emotional. But, in the end people are not unreasonable and they do have a heart. Clients do ultimately appreciate honest, undying effort. In this, we are happy to share that over time, slowly, as our forecasts have improved, our clients are listening more to us. And are thus benefiting more.

Performance measurement can be a huge “let us take it to the next level” movement for the forex advisory practice, because, ultimately, let’s face it, the onus lies on us.

To know about our all forecasts service details please click here.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877