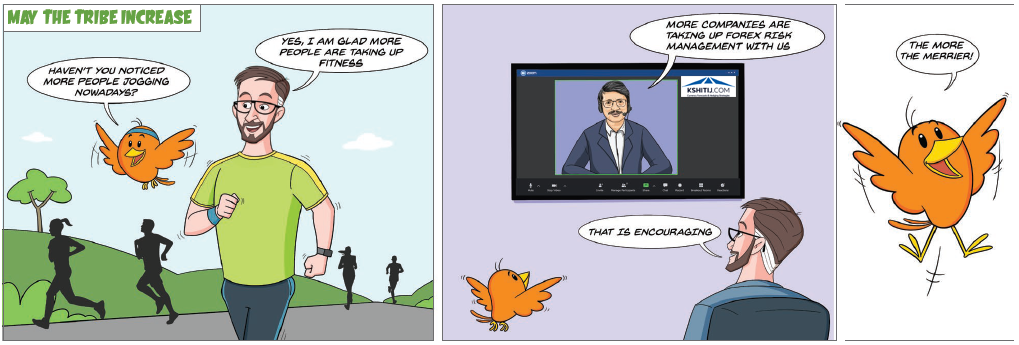

More people are taking fitness seriously.

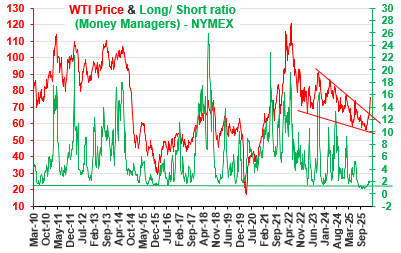

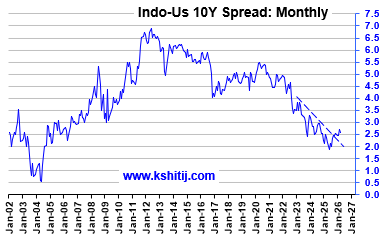

More companies are taking currency risk management seriously too.

That shift matters.

It shows a growing focus on discipline, structure, and long-term thinking rather than reactive decision-making.

Seeing more corporates engage meaningfully with FX risk is encouraging.

The more awareness there is, the better decisions the market makes collectively.

Because good habits spread.

And in risk management, that’s always a positive sign.

#FX #CurrencyRisk #RiskManagement #Treasury #Markets #Discipline