Hit The Sweet Spot with our NEER calculation

May, 29, 2023 By Vikram Murarka 0 comments

During the pandemic, in the charming city of Kolkata, a middle aged lady and her tech-savvy daughter started a cloud-bakery called "The Sweet Spot." The mother, Sharmila, whose tarts and bruschettas were to die for; and the daughter, Sayoni, whose beautifully designed and cleverly worded marketing campaigns caught the customers eye, believed that love and passion were enough to make their business flourish. Socially conscientious as they were, they asked a few of the local boys with bikes to take care of the delivery for them.

However, “The Sweet Spot” had a weak spot. Believing that their core business was simply to bake brilliantly, Sharmila and Sayoni neglected the importance of tracking and measuring the delivery time. Inconsistent deliveries - sometimes on time, sometimes late – started leading to customer dissatisfaction and cancelled orders. Thankfully, realising that even what they considered a non-core activity had a crucial impact on their business, the mother-daughter duo started tracking and measuring the delivery time, and tightened the screws on the delivery boys, gunning for on-time delivery. This made their little bakery hit the Sweet Spot again and serves as a reminder to all businesses of the ill effects of not measuring what should be measured in business.

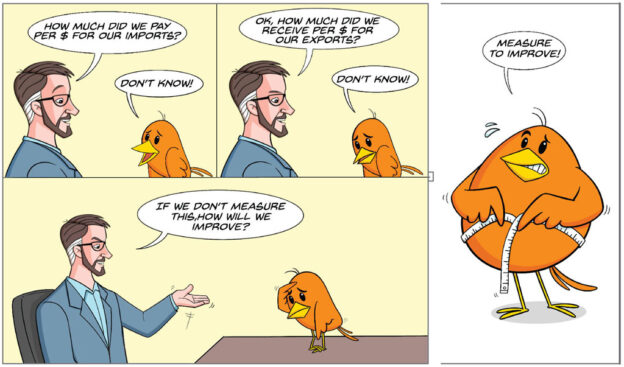

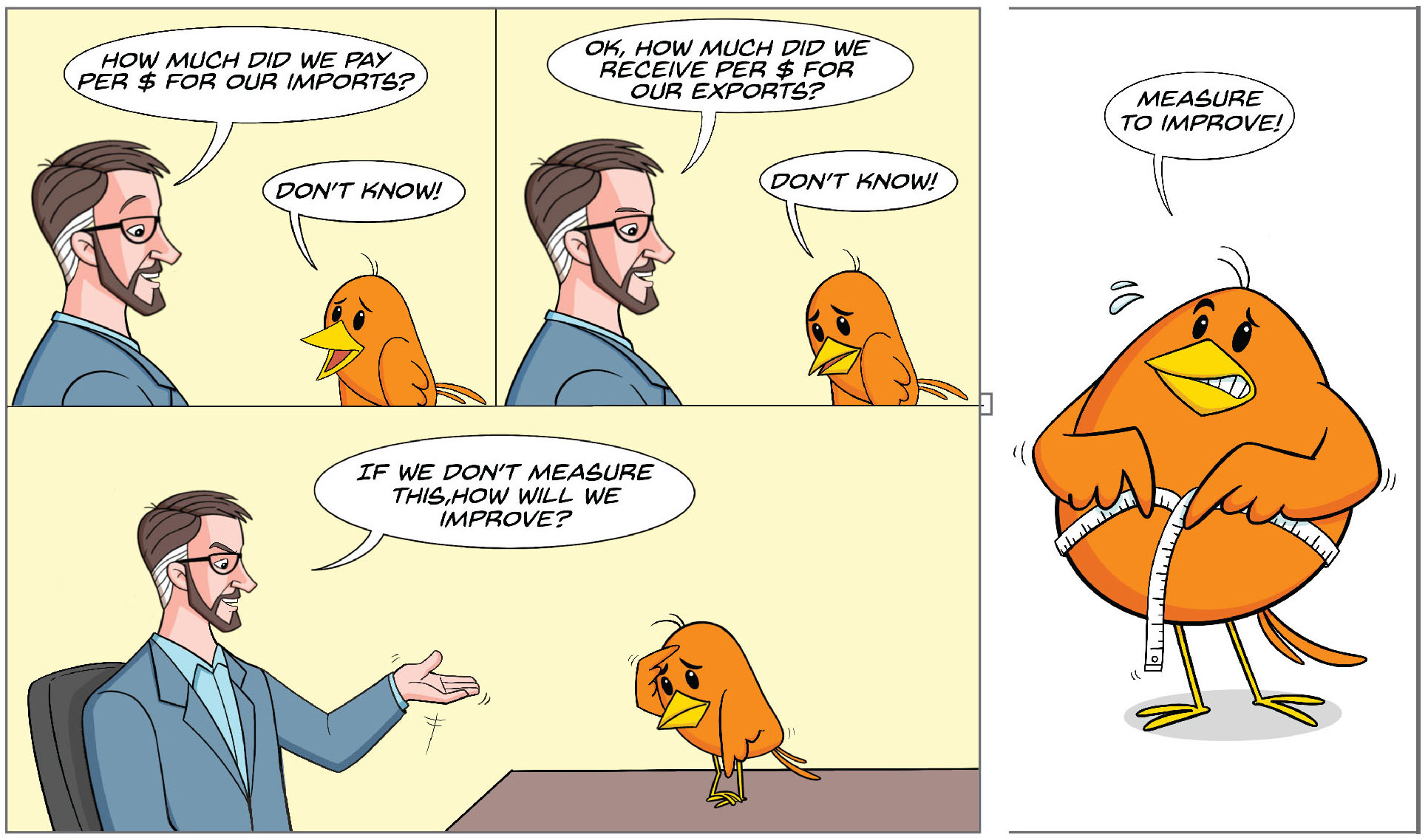

Most importers and exporters say that forex is a cost centre for them, not a profit centre. For importers, especially, forex is indeed a cost centre. However, quite surprisingly (or maybe not so surprisingly), most companies do not have an idea of their forex cost because they do not track the Net Effective Exchange Rate that they have either paid on their imports or received on their exports.

Most importers and exporters say that forex is a cost centre for them, not a profit centre. For importers, especially, forex is indeed a cost centre. However, quite surprisingly (or maybe not so surprisingly), most companies do not have an idea of their forex cost because they do not track the Net Effective Exchange Rate that they have either paid on their imports or received on their exports.

That, at least, is our experience with most clients we have worked with. Without tracking the NEER, it is not possible to (a) measure the performance of one’s forex hedging policy and strategy in a proper manner and to (b) compare the performance with that of another policy/ strategy, so as to find out areas of improvement and cost savings.

The reason why most companies do not calculate the NEER or have it readily available is simply that they are not required by any body, neither the management nor the authorities, to make this calculation. Which means this rate does not feature anywhere in management discussions! How surprising is that? Many a times, it seen that those who have both exports and imports, might not even know that they are ending up paying more per Dollar on their imports (say ₹81.73) than they are receiving per Dollar on their exports (say ₹81.65)!

On the other hand, perhaps it is not so surprising because most companies have been misled into thinking that “Forex is not my business”. On the other hand, we are of the philosophy that forex risk management is an integral part of business for every importer and exporter.

That is why we work shoulder to shoulder with our clients to instill this practice, to start measuring the Net Effective Exchange Rate.

That is then compared with the performance of the KSHITIJ Hedging Method to find out the scope for value addition.

When we worked the numbers for one particular client it was seen that they had an average export realization of ₹67.57 per Dollar over the period 2015-2020. In comparison, the KSHITIJ Hedging Method export realization rate was ₹68.58, a value-add of ₹1.13 per Dollar. On their average annual export volume of $30 million, that worked out to ₹3.39 Cr p.a.

Currently we are working with another company which uses currency options quite extensively, to include the option cost in their Net Effective Import Payment Rate. Then we shall try to see whether there is a scope for reduction of that rate through alternative methods of hedging.

One might think that this problem exists only with small and mid-sized companies, but that is not true. Even A-listed companies, many of which are household names, are quite likely not to be tracking their Net Effective Exchange Rates; because, as mentioned earlier, their managements do not see forex risk management as their business and so they are not even thinking of tracking the NEER and therefore their software systems like SAP etc are not geared up for it.

However, slowly the outlook is changing. Perhaps reliable long-term forecasts and hedging methodologies with proven track records did not exist earlier. Now we have more companies willing to explore the idea of proper forex risk management with us and we are happy that we have the solutions to their most vexing concerns.

The very first thing that you, as an importer or exporter, have to do is to start tracking and measuring your Net Effective Exchange Rate, because measurement is the first step to improvement. If you do not measure, how can you improve?

We can tell you how to measure or calculate your Net Effective Exchange Rate. Better still, we can work shoulder to shoulder with your team to crunch the numbers and come up with the answers, analysis and comparisons.

Once we have that, we can figure out if there is anything to be done for making your forex risk management performance hit The Sweet Spot.

Interested? Write to us at info@kshitij.com or call us at 00-91-33-24892010.

#ForexHedging #ImportsExports #ExchangeRate #CurrencyOptions #NetEffectiveExchangeRate #KshitijHedgingMethod

Array

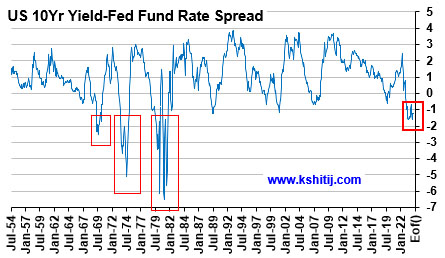

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

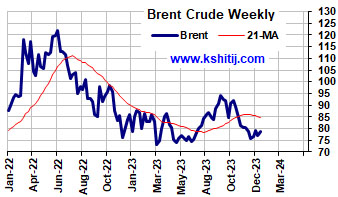

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

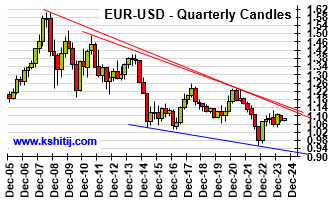

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877