The best hedge is when you don’t have to hedge

Apr, 27, 2023 By Vikram Murarka 0 comments

“All I want is a room somewhere

Far away from the cold night air

Lots of chocolate for me to eat

Lots of coal makin' lots of heat

Warm face, warm hands, warm feet

Oh, wouldn't it be loverly?”

So sang Audrey Hepburn in the 1964 classic, “My Fair Lady”, based on George Bernard Shaw’s 1913 play Pygmalion, which was later reproduced as the Dev Anand, Tina Munim, Girish Karnad starrer, “Manpasand”. Lovely songs. Do watch.

Let us paraphrase the song for our purpose in currency hedging:

“All I want is a good rate fair

One that goes up while I just stare

Up Long with my exports, oh so neat

Up, up, up with no hedge to beat

Good forecast, good rate, good profits

Oh, wouldn't it be loverly?”

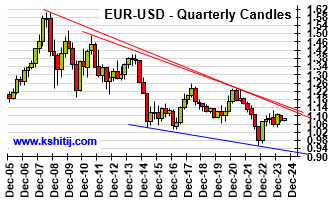

When you are Long on a currency, say the Euro, because you have exports invoiced in Euro (remember your exposure is your position), and you have forecasted that the Euro will go up from 0.98 to 1.06, and therefore you have decided not to hedge by selling forward (for a hedge is meant to only close out your original exposure position), and the rate actually does go up in line with your expectation and past your target to 1.10, you are apt to agree with the poet Robert Browning that,

”… The lark's on the wing;

The snail's on the thorn:

God's in his heaven—

All's right with the world”

This is a slice from real life. We have an India-based client that has Euro exports. For the last several months, we have been bullish on the Euro. As such, we have been hedging the Euro exports extremely parsimoniously, such that June-23 is hedged less than 50% and the hedge for July-23 onwards is 0%.

The same thing applies to our Importer clients in India, for who, again, we have been hedging very parsimoniously, only for very near term payments, at most up to 50% and only for the first and second months, more or less paying at the market.

The best hedge, truly, is when you don’t need to hedge, because the market is moving in favour of your original export (Long) or import (short) position, and by hedging you would only prematurely exit yourself out of an advantageous position. Remember that in both the real life scenarios described above, it is the Exposure, the actual exports or imports, that is making money and not the hedge.

It is important to recognize that while it is a matter of fortune to be in this advantageous position, it is true that “fortune favours the brave”.

You have to be brave enough to

- Believe that forex hedging, or managing forex risk, is indeed your business.

- Recognize that your exposure is your position

- Believe that currencies can be forecasted

- Be ready to be wrong and

- Understand that you should never be fully hedged, nor fully open

If this is your philosophy, as it is of the KSHTIIJ Hedging Method, then you are willing to “take the risk” and open yourself to the possibility of benefiting from the market moving in your favour. It is your business to try to give your business this advantage.

Contrast this with another company, this one based in the United Kingdom. They import in US Dollars and have to pay in British Pounds. Unfortunately, they had been told, and had come to believe, that forex is not their business and that they should “hedge” their imports as soon as they are invoiced. When we started talking to them in November 2022, we told them that the US Dollar is going to weaken and the Pound is going to strengthen and therefore their imports will become cheaper (as compared to the rate that was there when the import orders were placed) if they did not hedge, or hedged only minimally. However, they had already hedged their payments out till April 2023. As it turns out, the Pound has indeed strengthened and the Dollar has weakened, but they have been unable to save.

At the end of the day, it all boils down to philosophy.

“Oh, wouldn’t it be loverly,

If the market were making money for me.”

Array

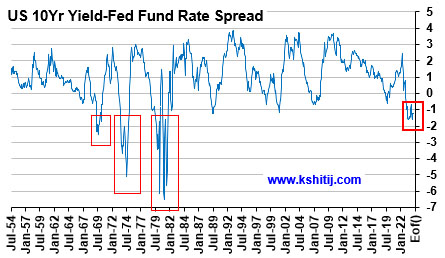

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

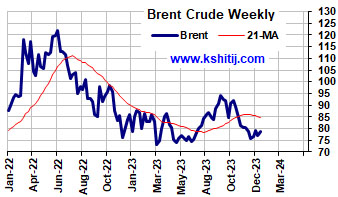

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877