Merriam Webster defines “Quality assurance” as “a program for the systematic monitoring and evaluation of the various aspects of a project, service or facility to ensure that standards of quality are met.”

Merriam Webster defines “Quality assurance” as “a program for the systematic monitoring and evaluation of the various aspects of a project, service or facility to ensure that standards of quality are met.”

Over the years, Kshitij.com has been constantly refining its forecasting processes and this has resulted in the reliability of our forecasts increasing from 40% in 2008 to 72% in 2016.

For, at Kshitij.com, we have a very simple understanding of quality. We can know that a bakery is good when the baker serves his own cake at his daughter’s birthday. A barber should be ready to cut the hair of his own son and a tailor’s son should be ready to wear the trouser his father stitches. In simple terms, we have to be ready to use our own analysis and forecasts. And, we ourselves are not all easy to satisfy.

Every step of a report is checked and rechecked multiple times before it can be published but sometimes, even that is not enough for us. Something like this happened recently.

STOP PRESS

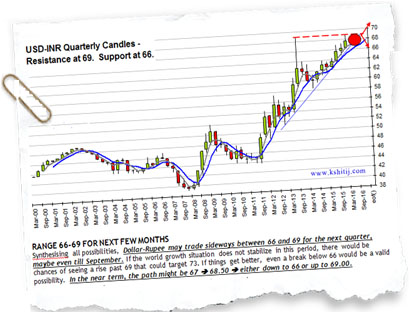

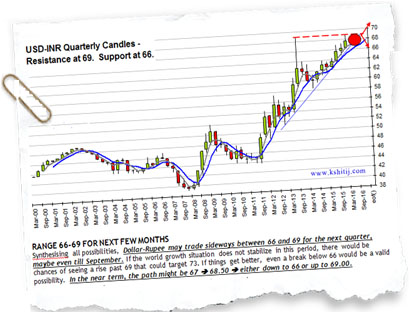

A few weeks back we were on the verge of publishing our January 2017 Quarterly Dollar-Rupee forecast. The report was ready to be sent to our Clients. But, something was troubling us. Just when we were going to press the “Send” button on the mail that was to go the clients, we held back for a final check. It was a classic Stop Press moment.

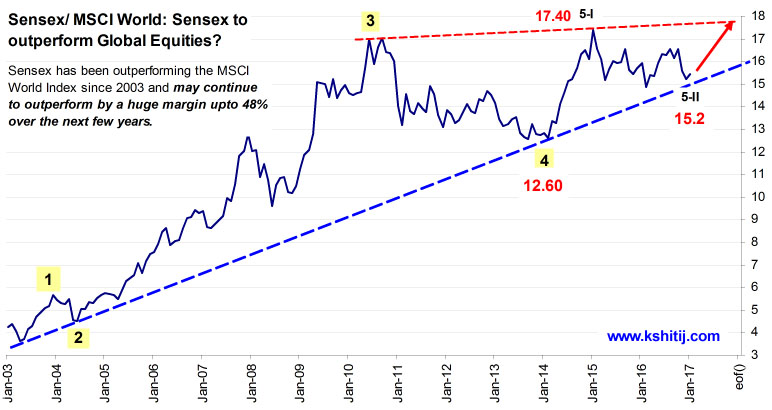

The report had a Sensex/MSCI World Equity Index ratio chart in it (see Chart A below). The chart was bullish, using both classical charting (trend lines) and Elliot Waves. The implication was that Sensex could outperform the MSCI World Equity Index by a monstrous 48% over the next few years. We were excited about sharing this bullish implication with our Clients.

| Elliot Wave projection details:

Assuming 5-iii to be at least 138.2% of 5-I gives us 21.83 as the 5-iii top, much above the red trendline, which provides the first resistance/ target near 17.80. If 5-iv retraces 38.2% of 5-iii, then 5-iv may end at 17.73 and a final 5-v may make a top at 22.53, assuming equality between 5-I and 5-v. A rise to 22.53 from 15.2 translates to a huge appreciation of 48.22% over the next few years. |

Still, we felt a bit uncomfortable with the chart since we did not know the historical context of the chart before Jan 2003. We wanted to see the price chart prior to 2003 as well just so that we knew what had happened earlier.

LOOKING FOR LONGER HISTORY

While we had a long history of Sensex in our proprietary database, we did not have a correspondingly long history of the MSCI World Index data. It was going to be hard work searching for historical data. But the team was feeling dissatisfied with the chart and so it went ahead and searched for the data.

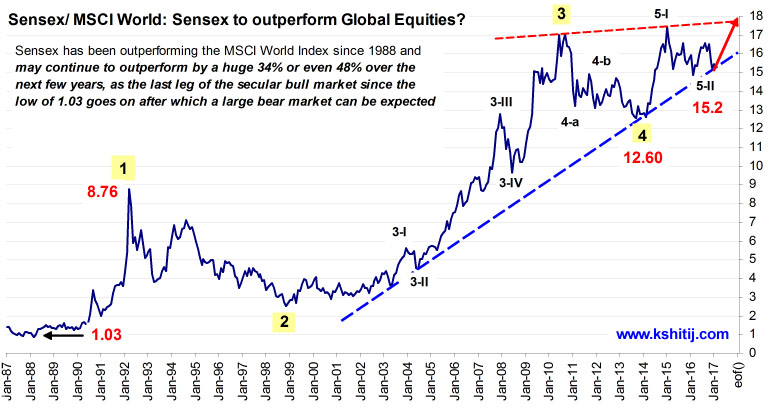

The search yielded the desired data for MSCI World (from 1987) which expanded the time horizon by 16 years going back to 1987 and when plotted on the chart, brought forth new perspectives. The trend structure was more clearly understood now and fresh insight was available.

| Elliot Wave projection details:

Assuming equality of the large 5th wave to the 1st wave (from 1.03 to 8.76) gives us 20.33 as the initial target, about 34% higher from the low of 15.2. Interestingly, equality of 5-iii to 5-i gives us 20, coinciding with the target of 20.33 seen earlier. This is just a little less than the 22.53 target calculated on the first chart. |

This new, longer period chart was also bullish using both classical charting (trendlines) and Elliot Waves. The highly bullish implication didn’t change but the perspective definitely changed a lot.

DIFFERENCE MADE BY THE LONGER TERM CHART

1) We got a major confluence target of 20.33 (appreciation of 34%)

2) If the large 5th wave takes an equal amount of time to the large 1st wave, then this target of 20.33 can be met in the next 2 years.

After the targets of 20.33-22.53 are met, we can expect a major bear market to unfold in the coming years, which would imply that the Sensex may underperform the World market for a decade, after the current upmove ends in a few years.

WHY WE DID ALL THIS

Looking at the final result, anyone might say that we could have very well used the old chart, since there was no change in the overall bullish outlook. One may ask if there was any point in the entire exercise of gathering extra data, modifying the chart, and finally even writing about it.

We used the new chart because a longer timeframe always gives a better perspective and gives a better understanding of where we are standing with respect to the historical context. The biggest perspective change we got is clarity that although the Sensex/ MSCI Ratio is in an uptrend for the next few years, this rally may well be the last major upleg of the uptrend that started in 1987-1990.

BECAUSE RELIABLITY MATTERS TO YOU

And what is the purpose of our writing about this entire process? As a Reader, you come to us looking for reliable forecasts. Here we have shared with you our thought process and the care we take before publishing any of our reports. The practical example in this article will help you know why our reports and forecasts are “Reliable”.

PS:

We are the only currency forecasting service in India to publish a track record of the Reliability of its Dollar-Rupee forecasts for the last 11 years (since 2006). Our Reliability has increased from 40% in 2008 to 72% in 2016.

If you need Reliable Dollar-Rupee forecasts, or forecasts on any other markets, write to us as info@kshitij.com