Aussie Long term Forecast - Jul'17

Jul, 08, 2017 By C S Vijayalakshmi 0 comments

AUDUSD 0.7602/ Copper 2.65 / CADUSD 0.7769

Recap:

In the Jun’17 report (AUDUSD was 0.7523) we had kept our bullish stance for Aussie intact while waiting for confirmation on a break above 0.7750-0.7850.

EXECUTIVE SUMMARY:

We remain bullish on Aussie but expect a dip in July, to be followed by resumption in the uptrend thereafter towards 0.80. A break above 0.7750-0.7850 has not materialized yet and remains an important level to be kept an eye on. An actual breakout may occur in August or September as mentioned in our June report also.

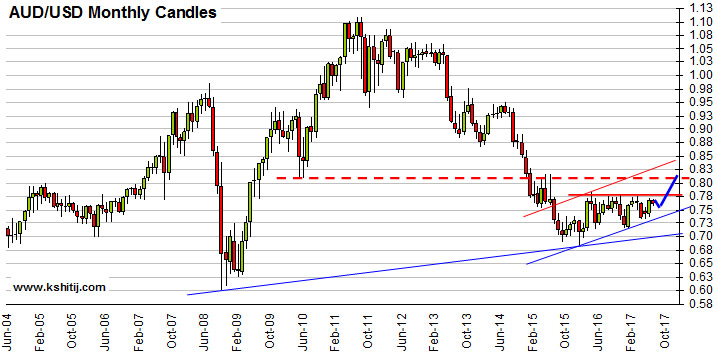

Aussie Monthly Chart

Aussie indeed rose in June in line with our expectations and has come up to test the near term resistance zone of 0.7750-0.7850. Clear contraction in price movement is visible from the chart above since Dec’15 and is probably nearing exhaustion within July or August. We expect a short-lived dip to 0.75 or slightly lower in July, to be followed by a sharp break above 0.78 over August and September, along the path shown by blue line on the chart above, heading towards 0.80.

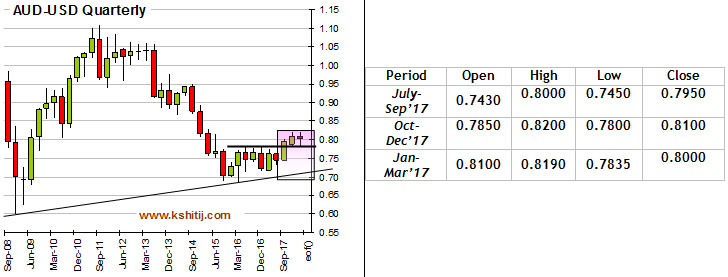

Quarterly Projections

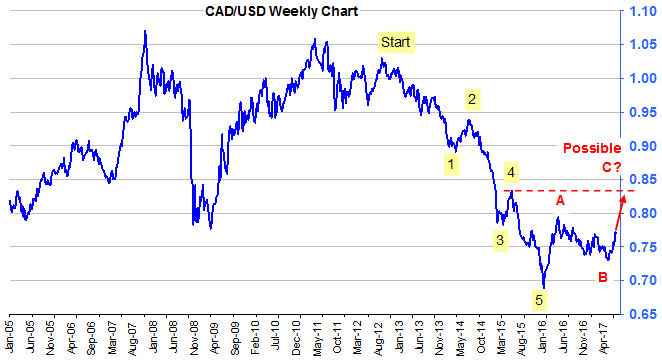

CAD/USD

CAD/USD strengthened in June (from 1.2947 to 1.3547), contrary to our expectation of a further fall and could continue to rise over July and August. In the chart above, we have broken up the fall from 1.029 in Sep’12 to 0.688 in Jan’16 into 5-waves (as per the Elliot wave principle), which is being followed by an “A-B-C” correction that may possibly end near 0.84. Wave “C” is assumed to be playing out currently which could extend to 0.84 on the upside over the next few weeks indicating bullishness for the near term. This could indicate strength in Aussie too towards 0.80.

COPPER: Bullish

COPPER: Bullish

We have been following Copper for the last few months and it has been beautifully holding above 2.5 since Dec’16. We may now expect a rise towards 2.80-3.00 in the coming months.

It has moved up well in June from 2.5155 to 2.71 in line with our expectation and could be headed towards 2.80-3.00 over July and August. This could also boost the rise in CAD and Aussie, both being commodity currencies.

Conclusion

Close directional correlation between CAD, Copper and Aussie, continues to exist. A rise in Copper and CAD is supportive of a possible rise in Aussie mentioned in the previous page. Mild correction to 0.75 in July followed by a rise in August towards 0.78 is the preferred path for Aussie.

C S Vijayalakshmi

Vijayalakshmi has the rare ability to look at charts using both Classical charting as well as Elliot Waves, which she combines with excellent proficiency in Excel. A growing presence in the social media sphere, she is also an accomplished danseuse and choreographer.

Array

You may also like:

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877