Euro Long term Forecast – Jun’17

Jun, 09, 2017 By Vikram Murarka 0 comments

9-June-17 / Euro 1.1194

EXECUTIVE SUMMARY:

Recap: In our May’17 report, we expected an expansion of the Euro range of 1.05-1.10 as the quarterly amplitude was unsustainably low at that point but had no particular directional preference.

The range has expanded in line with expectations and a breakout above 1.1000 helped Euro to make a high of 1.1285 so far but the current technical evidence points to the strong resistance cluster of 1.1300-1.1450 to hold and push it back inside the long term range of 1.0400-1.1500.

The chart above shows the breakout from the blue upside channel containing the price action from the Jan’17 bottom of 1.0340 to May’17, when Euro rallied above the resistance of 1.1000 and made a high of 1.1285 in early June. Now Euro is close to the major resistance cluster of 1.1300-1.1450, which is expected to hold, especially with Euro in the most overbought state since 2013.

The chart on the left shows the 10Yr German-US spread (-1.94%, LHS) turning down following rejection from the strong long term resistance near -1.80%. The spread is clearly not supporting further bullishness in Euro (RHS) and if the minor support near -1.95% gives way, the spread may decline further to test the major support near -2.00-05% and drag Euro down to 1.10-1.09.

The chart on the right side shows the Real 10Yr yield spread (-0.69%, RHS) failing to rise above the 6-year long trendline resistance and currently in a distinct downtrend, again in conflict of any Euro (LHS) bullishness. Therefore, from the perspective of the Interest rate instruments, downside looks like the path of the least resistance.

Dollar Index: Bullish (Bearish for Euro)

The chart on the left side shows the Dollar Index finding support at the lower boundary of the long term channel. The early signs are encouraging for a bullish reversal for the highly oversold Dollar Index.

The chart on the left side shows the Dollar Index finding support at the lower boundary of the long term channel. The early signs are encouraging for a bullish reversal for the highly oversold Dollar Index.

96.50 is not only the channel support but also the 61.8% retracement level (the golden ratio) of the last rise from May’16 low of 91.92 to the Jan’17 top of 103.82, reinforcing the strength of the support.

If Dollar Index rebounds as expected from the long term channel support, then Euro may see 1.1285 as a major top in the medium term. In case, Euro tests 1.1400 before the major decline, then Dollar may see a false break below 96.50 before the bullish reversal.

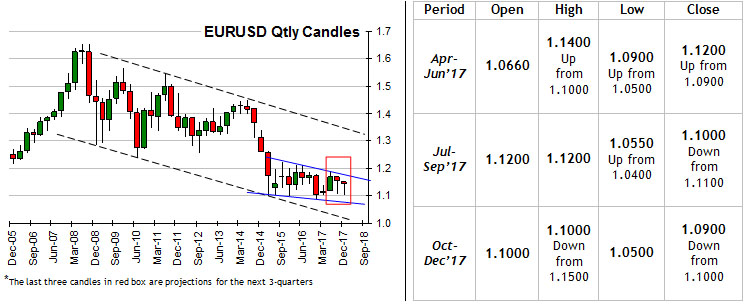

Quarterly Projections

Conclusion

Euro may find the upside limited to 1.1400 (best case), though it is highly probable for the current quarterly high of 1.1285 to be the major top, and decline towards 1.0800-1.0500 in the coming months.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877