In this issue, we take a detailed look at the pros and cons of the to-be-introduced exchange traded Dollar-Rupee Futures

The RBI has been working on the introduction of Rupee Futures for some time now. A chronology of the various reports submitted by the RBI’s working groups over the past year or so, is given at the end of this article.

The latest in the series of reports is the “Report of the RBI-SEBI Standing Committee on Exchange Traded Currency Futures”. It is widely believed that the RBI was prompted to take this step after the Dubai Gold and Commodity Exchange (DGCX) started trading Rupee Futures in June 2007.

For a while it seemed that the biggest roadblock to the introduction of exchange traded Rupee Futures in India would be a potential turf battle between the RBI, which has oversight of the banking sector (including the currency market), and the SEBI, which has regulatory powers over the NSE and the BSE, the two most active exchanges in the country. However, it is highly commendable on the part of the RBI that it has chosen to sublimate its position to the higher goal of introducing a new market into the country. In the process, it has only added to its already considerable stature.

Success of any market is measured by the depth, liquidity and volumes traded therein, which in turn, is a function of the (low) cost of transacting in that market. In the context of the proposed Dollar-Rupee Futures market, although the RBI has demonstrated its seriousness by dissolving the first roadblock, there are still some important issues that need to be clarified and tackled in order to impart a good start-off to Rupee Futures, without which the market might be a non-starter.

The Pro

Before I take up the difficulties, however, it would be in order to point out a very laudable aspect of the proposed Futures, which is nothing less than revolutionary. The Lot Size has been kept at a mere $1000, which is just about Rs 42,500/- at today’s rate. This is the one single feature that has the power to overcome all other difficulties, because it is an amount that can be easily afforded by a wide swathe of the populace. To put things into perspective, the value of 1 Lot of Rupee Futures is going to be half that of 1 Lot of the Mini Nifty.

The Cons

However, having gone through the Report, one cannot help but point some serious issues with the very present conception of the Rupee Futures market, wherein Dollars can neither be delivered nor be taken delivery of, and the Futures can only be cash-settled. This feature not only divorces, at the very time of birth, the Rupee Futures market from the thriving OTC Dollar-Rupee market but is also going to give rise to a number of big problems.

You may well say, “How come? Why knock the RBI? It is doing a good thing, trying to bring the offshore NDF (non-deliverable forwards) market back on shore. That has to be good – it is stopping the export of India ‘s financial market!” Look a little deeper, though.

First of all, it may be pointed out that the extant OTC Dollar-Rupee market is supposed to be, at least in spirit, a non-speculative market. Corporates are supposed to access the market only to hedge their forex exposures, not for speculative purposes. Of course, a large section of the market may snicker at this hoary intention, for the practice often differs from theory. However, the fact that, by regulation, the OTC market is supposed to be used only for hedging is a very important consideration when firms account for the profits and losses on “hedges”. Many a loss-making hedge is taken / given delivery of against the actual underlying exposures so that the trading losses do not show up as such. Cut to the Futures market. Since there will be no delivery involved, all the trades will be termed speculative. Corporates will not be able to camouflage speculative losses against their exposures under the garb of hedging. As such, it is unlikely that any Board, even that of an SME, will give the go ahead to its treasury to speculate in the Rupee Futures market.

Secondly, even if a small Exporter were to “hedge” himself on the Futures market, when it comes to realizing Rupees against his Dollar receivables, he would still need to transact with a Bank, which would charge him a usurious 20 paise per Dollar for deigning to oblige him. Effectively, therefore, the Futures market does nothing to bring down the costs of transactions or the costs of hedging.

Thirdly, let us suppose that skilled speculative trading gives rise to profits. Will Corporates want to pay capital gains tax thereon, if the taxman deems it appropriate to tax such profits? Remember that there is no capital gains tax on forex profits in the OTC market. However, there are high chances that the Finance Minister will want to levy STT (Securities Transaction Tax) on the exchange traded Dollar-Rupee Futures. If so, this will impose an additional cost on Futures trades, further driving a wedge between the OTC and the exchange traded markets.

Finally, the Report prescribes a Client level Open Position Limit of USD 5 million, at least in the beginning. This is really too meager an amount to justify participation by Corporates, even small ones, further distancing the OTC and Futures markets.

What is the intention?

It might be worthwhile asking, “What is the intention behind the introduction of Rupee Futures?” Let us assume that the intention is to (a) open access to the forex market to a larger section of the populace, (b) bring greater transparency into the market and (c) to reduce the costs of transaction. If so, perhaps the objectives might have been much more easily achieved by simply allowing existing interbank forex brokers to offer Forward Contracts (which are and would be deliverable) to non-bank Clients and to allow a proliferation of such a forex brokers. The idea would be to simply create competition for the banks, which currently run the forex market like a cartel.

Whether the market is OTC or Exchange traded is not what really matters. What matters is whether the Client can buy Dollars from or deliver Dollars to anyone else apart from the Banks and at what cost he can do so.

Conclusion

In its present conception, the RBI seems willing to accept the high probability risk that the Rupee Futures market could be a non-starter given that the contracts will be cash-settled against the very low probability (please refer to excerpts from the Nov 07 Report of the Internal Working Group on Currency Futures, given below) risk that physical delivery against the Futures will lead to dollarisation of the economy and increased volatility in the exchange rate.

Therefore, if the RBI really wants the Futures market to provide an avenue for small and medium enterprises to hedge their forex risk, it has to first allow for delivery against the Futures contracts. Apart from that, at the very least, it needs to permit a larger Gross Open Position Limit at the Client level.

References:

Chronology of RBI’s examination of the need to introduce Dollar-Rupee Futures

20-Apr-07

RBI sets up an Internal Working Group to explore the advantages of introducing currency futures

Nov 2007

Submission of the Report of the Internal Working Group on Currency Futures.

Apr 2008

Submission of the Report of the Internal Working Group on Currency Futures.

May 2008

Submission of the Report of the RBI-SEBI Standing Committee on Exchange Traded Currency Futures

Excerpts from the Nov 07 Report of the Internal Working Group (of the RBI) on Currency Futures

Please note that italics and bold are by the Author.

Pg 22….3.02….”While the abovementioned risks ( of dollarisation and increased volatility ) exist, their probability is relatively low”.

Pg 26…. 3.07…..” It needs to be noted that dollarisation of an economy, pursuant to the introduction of currency futures, is a possibility but not an inevitable outcome of introducing currency futures in the domestic market….. However, cash settled contracts could weaken the link between cash-futures arbitrage and has risk of greater speculative investments than one would anticipate in case of physical deliveries……prima facie dollarisation does not appear to be a significant probability.”

Pg 31 ….3.17….” it is important to recognize that the experience of the most liquid currency futures exchange has been distinctly in favour of physical delivery based settlement. For instance, in the CME, during the period January till September 2007, 99.77 per cent of the total volume in FX futures contracts was in physical deliveries. In contrast, cash settled FX futures contracts in Brazilian Real, Russian Rouble, Chinese RMB and Korean Won with US dollar were small and those for Chinese RMB with euro and Japanese yen do not appear to have taken off at all. If experience of other countries is any guide, it appears that physical delivery-based FX futures have been popular for countries with fully convertible currencies, while countries with less than complete convertibility prefer cash settled contracts, but volumes are restricted nevertheless. In either case, it is unlikely to significantly affect the liquidity of the spot market. From the viewpoint of monetary and exchange rate policies, physical delivery based contracts could result in lower exchange rate volatility, which reduces the need for intervention and so delivers better control on liquidity conditions.”

Pg 41….5.09……The Group had extensively debated the desirability of commencing currency futures in an environment where OTC contracts have restrictions especially the need for a crystallized underlying.The regulatory arbitrage between the OTC market and currency futures might give an initial boost to the futures market, but might also result in a clear demarcation between hedgers and speculators, with only the latter category dominating the futures market.”

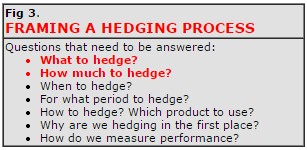

The process of managing the trades is called hedging. It involves framing the answers to the questions listed in the box alongside, and acting accordingly.

The process of managing the trades is called hedging. It involves framing the answers to the questions listed in the box alongside, and acting accordingly.