ISSUES IN CORPORATE RISK MANAGEMENT: Focus on Objectives; Learn from your mistakes

Jul, 02, 2005 By Vikram Murarka 0 comments

In the issue dated 25-Aug-04 we presented the case of a corporate that stuck to its long term objective even in bad times on a currency swap that went very bad initially; but ultimately booked handsome gains at the end of three years. We now present the case of a corporate that initially failed to realise profits because it lost focus of its objectives. But it learnt from its mistake and made good the next time the same opportunity presented itself.

Business Exposure: An Indian Importer, having all imports invoiced in US Dollars.

Objective: To diversify a part of the exposure into another currency to reduce Currency Concentration Risk, through off-balance-sheet transactions.

Forecast on 26-Feb-04: While below 1.30, there were chances of EURUSD falling to 1.18 (5.2%) over 2-3 months.

Strategy adopted:Bought a EURUSD Put at a strike of 1.2425 on a small part of its total exposure. The Put served as a proxy for currency diversification

Option Price Paid: 2.02%

The corporate created a synthetic Euro Payable, where it would gain if the Euro fell. But, the Euro fell only slightly and then started trading sideways.

The Option was losing time value and the Corporate was concerned that it had paid the 2.02% Premium in vain. Its focus shifted from its objective of Currency Diversification to minimizing the cost of hedging. So, in order to recoup part of the premium paid, it squared the Option. There was a sigh of relief. But, the Euro started falling almost immediately thereafter and went on to meet its target of 1.1850.

Had the Corporate stuck to its objective of reducing its Currency Concentration Risk, it would have retained the Hedge and made good money thereby. Nevertheless, it learnt from its mistake and replicated the deal in 2005 when a similar opportunity presented itself.

No mistake the second time:

In the first quarter of 2005, EUR-USD had fallen from its post introduction high of 1.3665 and had traced a classic Double Top (refer below). The forecast was bearish, targeting 1.20.

Recognising the opportunity, the Corporate again bought EUR Put/ USD Call Options with the same objective of diversifying the currency composition of its Imports as also of lowering the cost of Imports.

The market again hesitated for a while after the deal was done, causing some anxiety to the Corporate. But remembering the experience of 2004, it stood its ground. Finally the Euro fell and the Corporate made a very decent amount of money on expiry of the Option. This success has now given the Corporate enough confidence to be more proactive in managing its Currency Exposures.

Moral of the story: Its alright to make mistakes. But learn from it and do better next time. Do not give up on Forex Risk Management as "speculation" if things don't work out the first time. And, things do work out if the objective is well thought out, the hedge strategy is well laid out and you work according to plan.

Array

In our last report (29-May-25, UST10Yr 4.45%) we had stuck to our previous forecasts, calling for the US2Yr to dip to 3.2% and the US10Yr to 3.6%. Although those levels are …. Read More

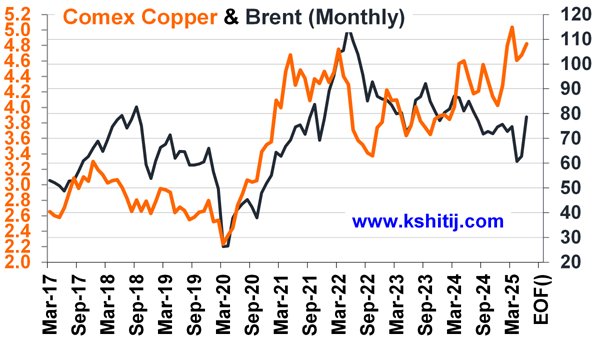

Brent rose sharply from $58.20 itself instead of extending the fall to our expected $55, meeting our long-term target of $70 much sooner than expected. The acceleration in crude prices have been triggered by … Read More

The Dollar Index has high chances of rebounding from support at 96, in which case, it could limit the immediate upside for Euro and lead to a decline in the coming months …. Read More

Our July’25 Dollar-Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our July ’25 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877