Trading Lessons 1 - When best becomes worst

Jul, 17, 2006 By Vikram Murarka 0 comments

Gentle Reader,

It is with great pleasure that we bring you this issue of "The Colour of Money". Here we recount two dramatic trading experiences, which gave rise to some enduring lessons, which are of relevance today and tomorrow, for Corporate Hedgers and Traders alike. Enjoy!

Good experience turns bad

Have you ever felt like a King in the forex market? How does it feel to wipe out 6 months' of losses in a matter of 2-3 weeks? It feels really good. But then, how would it be if such a sublime trading experience morphs into one of your worst trading experiences?

This happened to me in 1998 and thereafter. I had been bullish on Dollar-Yen since 1995 (see http://www.kshitij.com/risk/casestudy2.shtml, http://www.kshitij.com/research/majors2.shtml, http://www.kshitij.com/research/jpyloan1.shtml) when the market was near 100. I had been targeting 120 initially and then by 1997, I was looking for 140. Then, by mid-1998, the charts looked like they were peakingand fundamental factors also started suggesting that the market could be running out of oxygen. I had closed out my Longs and had started becoming bearish.

On the other hand, the GBP-USD market had been trading flat in the first half of 1998, whipsawing between 1.61 and 1.70. I was getting stopped consistently out of my Cable positions, accumulating huge losses in the process.

And then, the Dollar-Yen market broke in August 1998. The trigger was the Russian debt default and talk of interest rates rising in Japan. A lot of "carry trades", which had been in put in place since 1995, started being unwound and the LTCM debacle only added to the mess. Dollar-Yen crashed from 147.62 in mid-Aug-98, to a low of 111.73 by 09-Oct-98. The largest and sharpest fall was from 135.50 on 02-Oct-98 to 111.73 on 09-Oct-98.

I had been waiting for this and I shorted Dollar-Yen heavily, adding to my position along the way. I was able to capture a good part of the fall, as shown by the Blue segments in the chart below. My trades during this memorable period were:

|

|

I made a killing. All the losses incurred on Cable trading in the last 6-7 months were wiped out and I had a very handsome surplus to boot.

The purpose of recounting this story to you is twofold. Firstly, to touch upon a psychological aspect of this trade. Although I had started shorting Dollar-Yen at the right time and the market was going my way, trades were hesitant in the beginning. Then (and this is what is important) I thought, "This is a very good opportunity to wipe out your earlier losses. Have some courage and increase your position!" I did, and it worked. The courage paid off. It is something to remember and to trade by.

Warped view

The second reason for narrating this incident, and the more important one, is that this episode gave me a warped view of the market. I had made 9.86% in a few weeks, and I thought it could be done again, and again. I started looking for sixers/ home runs on every ball (trade). Adding to the headiness of this experience was the second part of the old market adage (which is never properly explained/ understood), "Cut your losses; Let your profits run". I was quick to cut my losses, no doubt. And I was also letting my profits run. But, somehow I was just not making money! In fact, I started running up losses again. My sublime experience had become a nightmare.

The problem was, I did not realize that the huge fall in Dollar-Yen in 1998 had been a once-in-a-lifetime episode. The currency markets, unlike the equity markets, do not (usually) produce large, long lasting trend movements (in fact, it would seem that central banks at the G7 have been working in co-ordination since 1998 to reduce forex volatility). As such, in day-to-day trading, there was a need for me to take many more quick singles and twos, instead of looking for a sixer on every ball. An occasional four was welcome, but that too might not happen to often.

Looking for answers

Looking for answers

I then started keeping a track of each trade and made a histogram of the profit/ loss per trade over a period of time, as shown alongside.

It showed me three very important things. The first, of course, was that "made a killing" trades happen only occasionally. Secondly, the few times I did not cut my losses quickly were responsible for most, if not all, the losses in any given period. Thirdly, I needed to somehow offset the many small losses that were a legitimate part of day-to-day trading.

This led me to the study of Currency Amplitudes. How much does a currency normally move in a given time frame? A study of the chart alongside shows, for example, Dollar-Yen has an average Daily amplitude of 1.26 (amplitude on the X-axis, frequency on the Y-axis). Further, there's a 68.5% chance of it moving 50-150 pips in a day, but only a 12.3% chance of it moving more than 200 pips.

This led me to the study of Currency Amplitudes. How much does a currency normally move in a given time frame? A study of the chart alongside shows, for example, Dollar-Yen has an average Daily amplitude of 1.26 (amplitude on the X-axis, frequency on the Y-axis). Further, there's a 68.5% chance of it moving 50-150 pips in a day, but only a 12.3% chance of it moving more than 200 pips.

Obviously, 300-400 pips profits were not going to happen every day! For short-term trading, it was better to capture 60-80 pips profits. If I did that often enough, and limited the losses to 40-50 pips, I stood a good chance of making profits.

I incorporated these new insights into my trading method and my losses diminished and profits started picking up. This is how a good experience turned bad but forced me into deeper study, which, eventually making me a better trader.

For more research on Currency Amplitudes, you can access http://www.kshitij.com/research/ampl.shtml

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

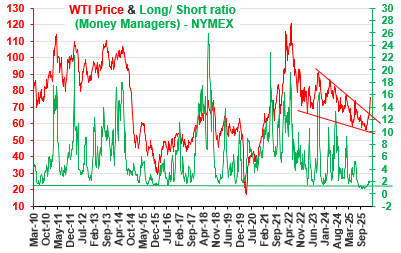

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Our view of a fall towards 1.14 seems to be playing out well so far as the tensions in the Middle East and the US-Iran conflict have triggered a rise in Dollar Index and crude oil prices, thereby weakening to Euro to 1.1507 so far in Mar-26. Will it again attempt to rise targeting 1.20? Or will it remain below 1.19/20 now and see an eventual decline to 1.10? …. Read More

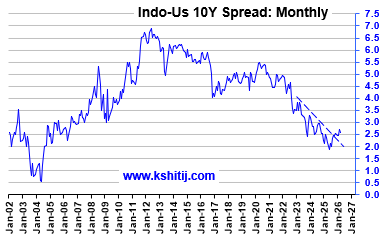

The Real 10Yr Yield at 0.90% plus CPI at 6.2% implies that the nominal 10Yr GOI rate can … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our March ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877