Excel Tip 2 - Use SUMPRODUCT for Weighted Average

Sep, 24, 2012 By Vikram Murarka 2 comments

Here's another very important MS Excel tip, one that I got from one of our clients. It has made my life so much simpler. Thank you, Krishnan!

Need for Weighted Average

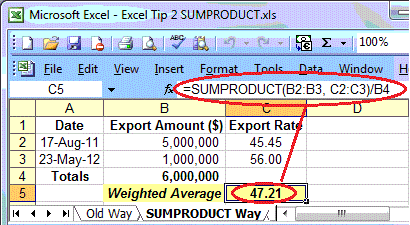

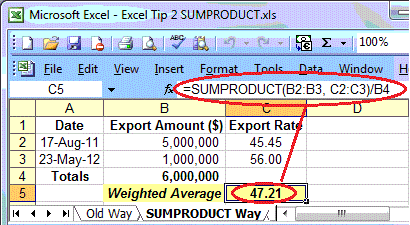

Let us say there is a company that exported goods worth $ 5 million and received payment at a Dollar-Rupee rate of 45.45 on 17-Aug-11. It then exported goods worth $ 1 million and received payment at a rate of 56.00 on 23-May-12.

What is the average rate at which the exports have taken place? You will be surprised at the number of people who reply saying 50.7250, the simple average of 45.60 and 56.00. However, as you know, the correct answer is actually 47.21, since the larger amount of $ 5 million was exported at the lower rate of 45.45 in August 2011, as compared to the smaller amount of $ 1 million which was exported at 56.00 in May 2012. The rate of 47.21, the weighted average rate calculated as (45.45 x 5 mln + 56.00 x 1 mln)/ 6 mln.

Not only do the export/ imports/ forward contract/ option transactions take place at different exchange rates, the transaction amounts are also always different. Therefore, there is always a need to calculate the weighted average rate at which forex transactions have taken place. Since the transaction amounts are different, calculating simple average is simply wrong.

Thankfully, while a few people do erroneously make do with a simple average, most people calculate the Weighted Average Exchange Rate. Unfortunately, the way most people (I was one of them) do the calculation is quite cumbersome.

Old Way of Calculating Weighted Average

The way I used to calculate weighted average earlier in Excel is as follows:

Calculate the Rupee equivalent of the Dollar amount

Sum the Dollar amounts

Sum the Rupee amounts

Divide the sum of Rupee amounts by the sum of Dollar amounts

SUMPRODUCT Way of Calculating Weighted Avg

Note the SUMPRODUCT function in the formula bar. The weighted average is now calculated as SUMPRODUCT(range with Dollar amounts, range with Export rates)/sum of Dollar amounts.

Much simpler, isn't it? Thanks are due to Krishnan, my client at Marico Ltd, and to MS Excel. I hope this function will be as useful to you as it is to me!

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877