Your Exposure is your Position

Mar, 23, 2012 By Vikram Murarka 0 comments

Most corporate risk managers refer to their hedges, such as forward contacts, as their "market position". They think that taking a hedge is the same as taking a trading position in the market. This is because taking a hedge is an act of volition, undertaken after due deliberation. Something is consciously done. The risk manager says he has taken a "market position". Further, there is a tendency to cancel and rebook forward contracts (something that has been curtailed by the RBI's Dec-11 guidelines), which has tended to give the hedge the flavour of a trading position.

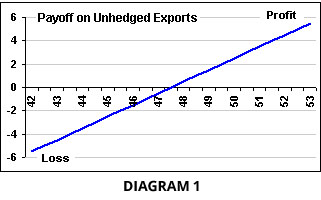

However, this is incorrect. The hedge is not the company's actual market position. It is a transaction undertaken to offset, or square off, or negate, the actual underlying position that the company has in the market, as a result of its fundamental business transactions. See diagram 1.

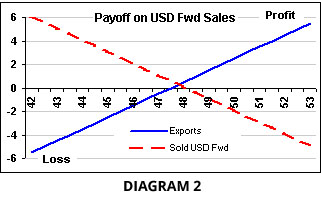

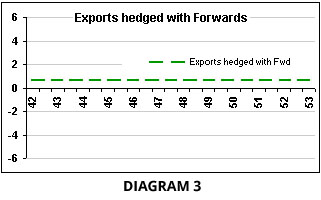

If the Exporter now sells Dollars Forward for 3 months against this export receivable, he is hedging or closing out or squaring off his export receivable position. If the Dollar moves up against the Rupee, the gain on the exports is offset by the loss on the forward contract. On a net basis, therefore, the value of the Export Receivable is no longer exposed to market fluctuations. The position has been closed through the hedge, through the Forward Sale contract. See diagram 3.

Similar, but opposite is the position of the Importer, who is Short Dollars in the market by virtue of his imports. He has to buy Dollars in the market to make good his payment obligation. When he actually buys Forward Dollars, he is not taking a fresh position in the market. He is simply covering his exposure, providing for his payment obligation, squaring off the risk of Rupee depreciation.

Unfortunately, since the Risk Manager does not himself undertake the export or import transaction, or because the actually underlying position is created by default, there is a tendency to not recognize it for what it is, viz. the company's actual position in the currency market. It is unfortunate because this misunderstanding causes the company to ignore and overlook the profit or loss on its actual position and instead focus on the profit or loss of its hedge. This is akin to losing sight of the woods for the trees, because, usually, the quantum of the actual underlying exposure is greater than the quantum of the hedge.

Thus, when a hedge, whose quantum is, say, 30% of the actual underlying exposure, makes money, there is no reason to be overjoyed. Quite obviously, when the 30% hedge is making money, the balance 70% unhedged exposure is losing money. Similarly, if the 30% hedge loses money, that is no reason to crucify the risk manager - the balance 70% unhedged exposure is actually making money. In fact, therefore, if the hedge ratio is less than 50%, a loss making hedge is to be preferred to a profitable hedge.

Thus, when a hedge, whose quantum is, say, 30% of the actual underlying exposure, makes money, there is no reason to be overjoyed. Quite obviously, when the 30% hedge is making money, the balance 70% unhedged exposure is losing money. Similarly, if the 30% hedge loses money, that is no reason to crucify the risk manager - the balance 70% unhedged exposure is actually making money. In fact, therefore, if the hedge ratio is less than 50%, a loss making hedge is to be preferred to a profitable hedge.

Array

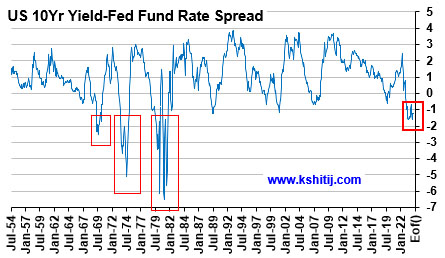

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

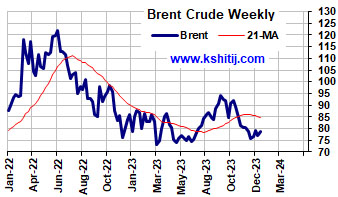

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

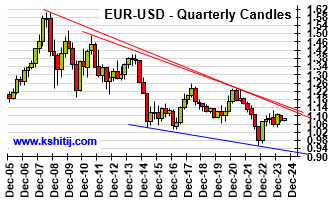

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877