First step to success in hedging: Sanction a Hedging Cost Budget

Jul, 18, 2012 By Vikram Murarka 0 comments

Every activity has a budget

Every activity has a budget

Hedging forex risk is a necessary part of business. This realization is slowly dawning on more and more companies now, thanks to the sharp increase in Rupee volatility. However, the understanding and belief is not fully entrenched yet. But, thankfully, it is slowly seeping in.

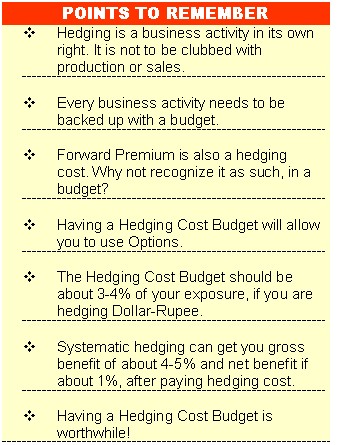

Still, no one has yet started setting aside an explicit budget for hedging. Budgets are duly allocated for even mundane activities like cleaning the staff toilets, for tea and biscuits for visitors, for stationery. And, of course, there are budgets for manufacturing and marketing and for salary payments. But, there are no budgets for forex hedging. It's almost as if hedging is supposed to be costless.

Why is there no Hedging Cost Budget?

- Most of the hedging is done using Forward Contracts, wherein the hedging cost or forward premium is built into the price. Since it is not paid separately upfront, it does not get recognized as an explicit cost. That does not mean, however, that it is not hedging cost.

- Most companies use the Forward Rate for budgeting their imports/ exports and as such the hedging cost is implicitly added to the raw material cost or product cost. In this manner the cost of the activity of hedging is shifted to the activity of procurement or manufacturing or sales.

Why a Hedging Cost Budget is needed

That most people are doing things this way does not necessarily mean it is the best way to do things. In earlier articles we have explained how Forwards are not forecasts and are therefore not the best way to budget for future forex transactions and that it is better to use explicit currency forecasts for budgets instead.

The benefit of using currency forecasts for budgeting is that you end up focusing more clearly on FX risk. From that emerges the need to manage that risk. And thereby arises the need to hedge as a means of mitigating such risk and from that, again, emerges the need to budget for the cost of hedging.

Have you ever wondered why most companies tend not to use Options as a hedging tool, even though Options are sometimes more effective than Forwards for hedging? It is because there is no budget available for paying the upfront option premium. That is also the reason why many companies who do use Options are attracted towards "zero cost options" and end up losing money in times of excessive volatility. Not having a hedging cost budget also acts as a disincentive for companies to exit unprofitable hedges.

If a company were to sanction a budget for hedging costs, it would be able to pay for Options and it would be able to accept "stop losses" on unprofitable hedges. In total, it would be able to hedge more efficiently.

How much to budget? And, is it worth it?

How much to budget? And, is it worth it?

Good questions. From our experience of hedging Dollar-Rupee risk through the KSHITIJ Hedging Method over the last 6 years, we'd say that a company should budget about 3-4% of its exposure as hedging cost. And, if that sounds like a very expensive proportion, let us assure you that it is worth it. If you hedge systematically, say as per the KSHITIJ Hedging Method, you stand to save or gain about 1% of your exposure, after accounting for the hedging cost.

In other words, hedging can give you a gross benefit of 4-5% and a net benefit of about 1% over and above the hedging cost.

Is it really necessary?

We would say, yes, it is necessary to explicitly sanction a Hedging Cost Budget. By doing so, you explicitly recognize hedging as a necessary and legitimate business activity; and you commit yourself to the act of hedging.

As soon as you've done that, you've taken the first step towards success in hedging!

To know more about hedging, its costs and how to go about it, you can write to us at info@kshitij.com

Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877