Kiska Sikka Chalega - RUSSIA, ROUBLE, GOLD, DOLLAR

Mar, 31, 2022 By Vikram Murarka 0 comments

Please click here to download the full report.

Understandably, the whole world is in a tizzy on the twin news that

- Russia has asked to be paid in Roubles or Gold for its oil and gas and

- Russia is fixing a price of 5000 Roubles per gram for Gold

The big questions it throws up are

- Will this end the US Dollar hegemony?

- What will happen to the price of Gold?

- Where is the Dollar rate headed, against various currencies?

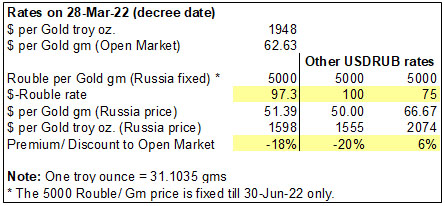

Before we try to answer these questions, let us understand what has been decreed. The table below translates the current open market Gold price ($/troy ounce, with 1 troy ounce = 31.1035 gms) into various Dollar prices using various Dollar-Rouble exchange rates for the declared Russian price of RUB 5000 per 1 gm of Gold.

We see that at a USD-RUB rate of 97.3, the Russian Gold price is at a 18% discount to the open market price; at a USD-RUB rate of 100, the Russian Gold price is at a 20% discount and at a USD-RUB rate of 75, it is at a 6% premium.

A couple of things become clear from this. Firstly, now there will be two prices of Gold, one being the open market price and the other being the Russia declared price. Secondly, the premium/ discount of that Russian Gold price vis-à-vis the open market price will be dependent on the going Dollar-Rouble rate.

So, we are now talking about fragmentation of the Gold market. This is completely different from the already created fragmentation of the Crude market, with Russian Crude being offered at a steep discount to Brent. This is different because (a) there are no quality gradation differences in Gold as might apply to Crude. Gold is gold is gold (b) therefore, this is now, fully, a question of “Kiska sikka chalega? Tera ya mera?” In brass tacks it is an open challenge to the existing ruler of the world, a rejection of his currency, his rule and his laws.

To make this stick, Russia (and the world) need to work out answers for the following observations, thoughts and questions. None of the answers are easy, if feasible at all in the first place.

Who will pay in Gold? Or in Rouble? Or in Rupee or Euros?

- Will Germany agree to buy Russian gas by paying Rouble or Gold? Rouble maybe 45% chances. Gold 0% chances.

- Will India buy Russian Crude by paying Rouble or Gold? Maybe India wants to pay for Russian Crude in Rupees, not Roubles, because USA might be OK with Rupee payments but would not want the payments to happen in Rouble.

Not enough Gold to go around

Gold amounts available are finite, not enough to finance global trade into perpetuity. The inability of Gold (as a means of exchange) to finance ever expanding levels of global commerce is, perhaps, an underappreciated reason behind the abandonment of the Gold Standard in the first place. Going back to the Gold Standard means the wheels of global commerce will grind to a halt. See last page.

If payments are in Rouble

- Maybe, in a crunch, the countries (even Germany ) will agree to pay in Rouble.

- Maybe countries will want to leverage on their Gold holdings, to finance Rouble purchases?

- Who will lend the Roubles to the paying countries? Will it be the Central Bank of Russia? What are the systems that exist for that, or will have to evolve? Will it be, as is being currently talked about between Russia and Germany, that Germany opens an account with Gazprombank in Russia, remits Euros into that account and the bank then buys Roubles with that money? If so, how is that essentially different from the already existing payment mechanisms?

- Will there be bilateral deals on deciding the Rouble-Rupee rate, Euro-Rouble rate or the Yuan-Rouble rate?

- How will they be captured onto a single, global Rouble rate?

- Different bilateral rates for RUB-INR, EUR-RUB and CNY-RUB will also throw up different Euro-Rupee, Yuan-Rupee and Euro-Yuan rates than those that will be quoted in the global open currency markets.

- If there are several different bilateral Rouble Rates, that don't square with each other, they will give rise to clandestine arbitrage deals. Be ready for black marketing, smuggling and increased terrorism.

- If there are several different exchange rates between two currency rates, which don’t happen to square with each other, it will also mean that the currently functioning global currency market system will start to unravel.

The above are some of the issues and questions that come to our mind. Certainly we don’t have answers or explanations for them. It is also quite possible that some of our thoughts are half-baked and questions are incorrect. Quite likely, these are some of the issues (among many others), that various diplomats, ministers and heads of states are negotiating on in the flurry of diplomatic visits that India is witnessing at the moment. There will be a lot of to-ing and fro-ing going on just now, testings of each other and lots of promises that will be made only to be promptly broken.

What can we make out of it all?

- On the face of it, there will be increased demand for Gold and Rouble for the purpose of payments.

- The US Dollar hegemony has been challenged and the coming years will certainly see the emergence of global payment systems, other than SWIFT

- Countries will look for avenues other than the Dollar and US treasury bonds, for deploying their FX Reserves.

- So maybe there will be demand for Gold, not so much for Roubles, as a store of wealth.

Collateral Damage

- Global economic activity will certainly reduce.

- With crude, wheat, edible oil and fertilizer prices going up, Inflation will certainly increase.

- Even if India can get some Russian Crude at a discount, it cannot be that we can get Russia to fill in all our crude requirement at those discounts. Our crude bill will certainly go up.

- In the longer term, the Rupee can weaken.

- Also, we should be prepared for greater degrees of volatility.

- The currency market itself could bear collateral damage as a consequence of all the current going ons. Just as an illustration, as we witnessed earlier in March, getting a quote on the Rouble was/ is difficult, let alone to do a deal. Imagine get three wildly different quotes for Dollar-Yuan with dealing restrictions.

We now look at the charts of Rouble and Gold to try and see where they could be headed in the months ahead.

DOLLAR-ROUBLE SUPPORT AT 75

The losses in the Rouble from 75 in February to 155 at the beginning of March have been entirely recouped.

In fact, there is scope for some Rouble strength up to 75. However, 75 can be a good Support for USDRUB because below that the Russian Gold can come into a large premium and people might not want to buy.

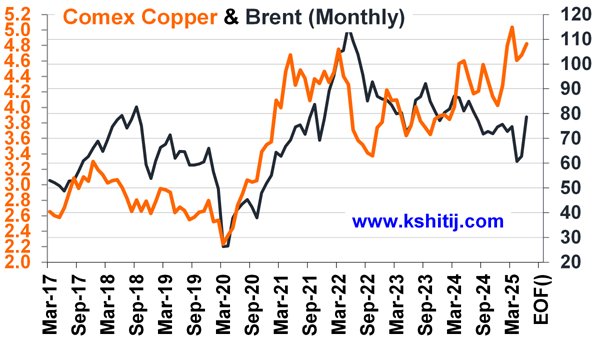

GOLD ($1940) HAS SUPPORT AT 1900-1850

Gold had shot up to $2078 in the beginning of March, from where it has come down to $1940. It can possibly fall some more towards $1850 by mid-April.

From there, however, it can start moving up again towards $2100 initially by Sep-22 or Dec-22. Thereafter, it will be interesting to see if it breaches $2100 to move up to $2200 in year 2023. Interesting times ahead.

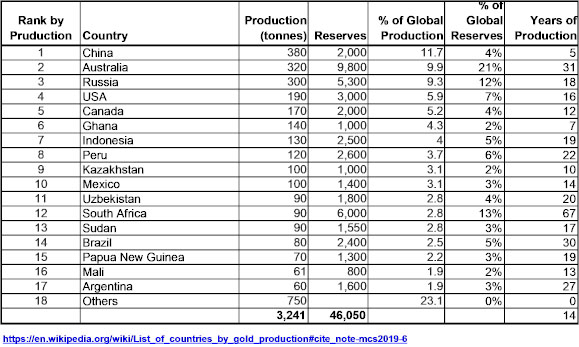

GLOBAL GOLD PRODUCTION

Lastly, we see in this table below that China and Russia are in the top three producers of Gold. So, they can well be feeling miffed for having to kowtow to the US Dollar despite being such large producers of the yellow stuff.

It really boils down to this that Putin has called a showdown on the mega question, “Kiska sikka chalega? Tera ya mera?”

Any of several scenarios might unfold in the coming months: Europe is able to do without Russian gas; USA and Europe either back down or up the ante; armed conflict escalates; anything else imaginable/ unimaginable. The point is, the joust is for real and is unlikely to end soon and without some ugliness.

A new world order is widely expected to emerge at the end of it all. Any number of possibilities are being talked about, such as: the likelihood or unlikelihood of the Yuan taking over the mantle of the global reserve currency;

a revival of SDRs (Special Drawing Rights); Crude being traded against a basket of currencies; CBDCs (central bank digital currencies) coming into their own; a greater role for Bitcoins; even a mishmash of all of these together. One of the things not being talked about is a full-fledged return to the Gold Standard, because the world understands that there is not enough Gold to around for it to be a global medium of exchange.

In the meanwhile, till the dust settles, we might as well brace for some degree of chaos.

Array

In our last report (29-May-25, UST10Yr 4.45%) we had stuck to our previous forecasts, calling for the US2Yr to dip to 3.2% and the US10Yr to 3.6%. Although those levels are …. Read More

Brent rose sharply from $58.20 itself instead of extending the fall to our expected $55, meeting our long-term target of $70 much sooner than expected. The acceleration in crude prices have been triggered by … Read More

Euro has moved up sharply over the last 4-5 months and faced volatility admist the trade tariff talks and other geopolitical tensions globally. Will the uptrend continue and take it to fresh highs in the coming months? Or can there be any corrective consolidation or decline? …. Read More

Our June ’25 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our June’25 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877