India’s Forex Policy – beyond just the exchange rate

Apr, 28, 2022 By Vikram Murarka 0 comments

Quiz question: Which was the last Indian crisis that led to sharp Rupee weakness?

Answer: The BOP crisis, back in 1991.

Rupee depreciation not home-grown

Surprised? After the BOP crisis of 1991 (which had led to devaluation of the Rupee), there has been no crisis originating in India, that has impacted the country’s external sector to an extent that would lead to Rupee weakness.

Yet the Rupee has depreciated 492% since Rs 13/$ in 1991 to Rs 76.98/$ in 2022. How come? There have indeed been a series of crises that have contributed to Rupee’s weakness, but they have all originated overseas: the Asian Crisis (1997), the Russian debt default and the LTCM meltdown (1998), Y2K (2000), the 9/11 attack (2001), the GFC (2008), European Crisis (2011), Taper Tantrum (2013), Covid-19 (2020) and the Russia-Ukraine War (2022).

During this period, Bharat’s economy has continued to grow, per capita income in $ terms has grown (despite the Rupee’s weakness), structural improvements have happened in the economy, the stock market has boomed, and most importantly, improvements have been made on several human development indices. Most recently, the IMF has commended India in pushing back against extreme poverty even during the pandemic years. We would have to be extremely churlish to say that overall our country is in a worse place than it was in 1991, when we had to ignominiously pawn our gold overseas.

Incongruously, however, the Rupee is in a much worse position than it was in 1991. Why? Two explanations are commonly, almost axiomatically, offered by the cognoscenti. One, we have a chronic Balance of Trade deficit. Therefore, QED. Two, we are an emerging market currency and all emerging market currencies have got the short end of the stick during all international crises. What’s the big deal? QED.

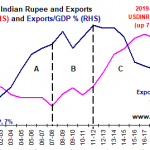

It is almost as if the question “Why” is to be given a withering look or, rather be given the fraction-of-an-inch-twitch-of-the-eyebrow treatment, a la Jeeves. However, these stock answers do not explain why have we had secular Rupee depreciation (except for in 2002-2007) when we have also had Balance of Payment surpluses and why the RBI has actively prevented Rupee strength on several occasions.

Costs of the weak-Rupee Policy

There is no quantification of how much the synthetically manufactured chronic Rupee weakness has contributed to Bharat’s systemically high inflation (through imported inflation) and thereby prevented interest rates from coming down systemically. There needs to be an objective attempt to calculate the cost of loss to Bharat’s competitiveness due to chronic Rupee weakness. To press a point, the focus would be on competitiveness of the economy as a whole, not only on the competitiveness of exporters.

It is common knowledge that foreign buyers negotiate Dollar prices lower for India exporters whenever the Rupee weakens. It needs to be asked as to why does the RBI persist with the policy of engendering Rupee weakness when data has irrefutably shown that Rupee weakness does not and has not contributed to export growth? Rather, export growth is achieved through enabling business conditions, not Rupee depreciation. A case in point is that the $400+ bln merchandise exports figure in FY 2021-22 has been achieved not due to Rupee weakness, but due to a combination of non-Rupee factors such as the emerging China+1 preference in global supply chains, an infrastructural push and the PLI schemes in India.

The negative impact of a chronically weak currency on the effort to attract infrastructure capital would also need to be assessed.

It may also be asked as to why does the RBI, as the regulator of the forex market, regularly intervene in the market? Can we imagine the SEBI being in the market almost daily to nudge the Nifty in one direction or the other?

Internationalise Rupee in Trade

“You should sweat in peace so that you do not bleed in war,” is an old Indian Army adage. We have been found to be woefully lacking in the direction of promoting the Indian Rupee as a means of global trade and are suffering collateral damage because of that. The imposition of sanctions on Russia by USA and moves to restrict Russian banks’ access to SWIFT has made it difficult for India to conduct normal trade with Russia. This is a sorry pass compared to the time when the Rupee was legal tender in the Middle East (till around 1959) and trade with Russia was largely Rupee settled in the 1970s. Mind you, while countries like Nepal have recently requested that the Rupee be allowed as legal tender, it is India that has baulked at the idea!

This is in sharp contrast to China’s policy of actively promoting the use of the Yuan in international trade.

Further, the Russia-USA stand-off calls into question the advisability of concentrating our forex reserves in the US Dollar. There is more than a tail-end risk that the US might prevent any country of its choice from accessing its reserves.

Therefore, rather than focus only on the exchange rate, the RBI needs to get over its cold feet and make the Rupee fully convertible, as per the Tarapore Committee recommendations, take steps to actively encourage the use of the Rupee in global trade and diversify away from the US Dollar in the composition of India’s forex reserves.

Make the market work for importers/ exporters

Like the SEBI works for the benefit of investors in the Equity market, rather than for the brokers, the RBI, as the forex market regulator, should actively work for the welfare of the importers and exporters rather than shying away from dismantling the banks’ monopoly on the forex trade flows of their customers.

This can be achieved through three measures:

- To its well deserved credit, the RBI has empowered CCIL to create the very powerful FX Retail platform, which enables retail customers to access the interbank Spot Dollar-Rupee market online. The RBI should now make it mandatory for all banks to route all their customer trades through the FX Retail platform in order to increase volumes and promote usage. Also, while FX Retail allows companies to access the interbank Spot market, the Forward quotes to the customer are still given by single banks. Even the Forwards need to be competitive, multi-bank interbank quotes.

- Allow corporates to transact forex with any bank of choice, and not be mandatorily tied to the bank through which the underlying trade transaction is routed.

- Allow delivery against exchange traded currency futures.

Lastly, let the Rupee be

Lastly, we should also study whether the country might have been better off had the RBI allowed the Rupee to trade on its own and find its own levels, whether weak or strong? Would not Corporate India have developed more robust risk management practices when forced to confront risk rather than being shielded from it?

A lot has been written on the cross of the Impossible Trilemma that the RBI has to carry on its shoulders. Maybe the RBI would do well to heed the Beatles and just “Let It Be”?

Or maybe even be like Atlas Shrugged.

References:

https://colourofmoney.kshitij.com/rbi-risk-172/

https://theprint.in/ilanomics/why-rbi-should-learn-from-china-and-internationalise-the-rupee/175034/

This article has got published on Hindu Businessline on 27th April'22

Array

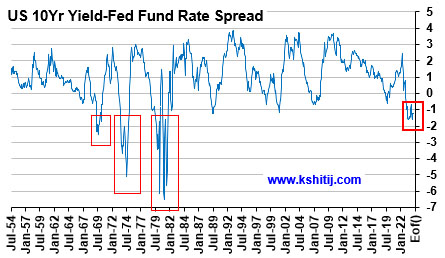

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

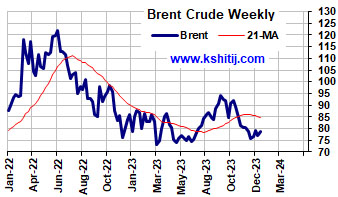

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

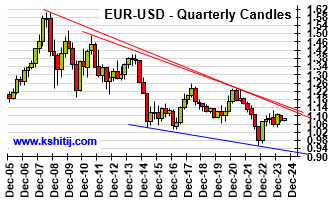

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877