India’s Forex Policy – beyond just the exchange rate

Apr, 28, 2022 By Vikram Murarka 0 comments

Quiz question: Which was the last Indian crisis that led to sharp Rupee weakness?

Answer: The BOP crisis, back in 1991.

Rupee depreciation not home-grown

Surprised? After the BOP crisis of 1991 (which had led to devaluation of the Rupee), there has been no crisis originating in India, that has impacted the country’s external sector to an extent that would lead to Rupee weakness.

Yet the Rupee has depreciated 492% since Rs 13/$ in 1991 to Rs 76.98/$ in 2022. How come? There have indeed been a series of crises that have contributed to Rupee’s weakness, but they have all originated overseas: the Asian Crisis (1997), the Russian debt default and the LTCM meltdown (1998), Y2K (2000), the 9/11 attack (2001), the GFC (2008), European Crisis (2011), Taper Tantrum (2013), Covid-19 (2020) and the Russia-Ukraine War (2022).

During this period, Bharat’s economy has continued to grow, per capita income in $ terms has grown (despite the Rupee’s weakness), structural improvements have happened in the economy, the stock market has boomed, and most importantly, improvements have been made on several human development indices. Most recently, the IMF has commended India in pushing back against extreme poverty even during the pandemic years. We would have to be extremely churlish to say that overall our country is in a worse place than it was in 1991, when we had to ignominiously pawn our gold overseas.

Incongruously, however, the Rupee is in a much worse position than it was in 1991. Why? Two explanations are commonly, almost axiomatically, offered by the cognoscenti. One, we have a chronic Balance of Trade deficit. Therefore, QED. Two, we are an emerging market currency and all emerging market currencies have got the short end of the stick during all international crises. What’s the big deal? QED.

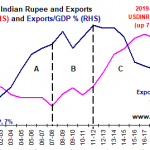

It is almost as if the question “Why” is to be given a withering look or, rather be given the fraction-of-an-inch-twitch-of-the-eyebrow treatment, a la Jeeves. However, these stock answers do not explain why have we had secular Rupee depreciation (except for in 2002-2007) when we have also had Balance of Payment surpluses and why the RBI has actively prevented Rupee strength on several occasions.

Costs of the weak-Rupee Policy

There is no quantification of how much the synthetically manufactured chronic Rupee weakness has contributed to Bharat’s systemically high inflation (through imported inflation) and thereby prevented interest rates from coming down systemically. There needs to be an objective attempt to calculate the cost of loss to Bharat’s competitiveness due to chronic Rupee weakness. To press a point, the focus would be on competitiveness of the economy as a whole, not only on the competitiveness of exporters.

It is common knowledge that foreign buyers negotiate Dollar prices lower for India exporters whenever the Rupee weakens. It needs to be asked as to why does the RBI persist with the policy of engendering Rupee weakness when data has irrefutably shown that Rupee weakness does not and has not contributed to export growth? Rather, export growth is achieved through enabling business conditions, not Rupee depreciation. A case in point is that the $400+ bln merchandise exports figure in FY 2021-22 has been achieved not due to Rupee weakness, but due to a combination of non-Rupee factors such as the emerging China+1 preference in global supply chains, an infrastructural push and the PLI schemes in India.

The negative impact of a chronically weak currency on the effort to attract infrastructure capital would also need to be assessed.

It may also be asked as to why does the RBI, as the regulator of the forex market, regularly intervene in the market? Can we imagine the SEBI being in the market almost daily to nudge the Nifty in one direction or the other?

Internationalise Rupee in Trade

“You should sweat in peace so that you do not bleed in war,” is an old Indian Army adage. We have been found to be woefully lacking in the direction of promoting the Indian Rupee as a means of global trade and are suffering collateral damage because of that. The imposition of sanctions on Russia by USA and moves to restrict Russian banks’ access to SWIFT has made it difficult for India to conduct normal trade with Russia. This is a sorry pass compared to the time when the Rupee was legal tender in the Middle East (till around 1959) and trade with Russia was largely Rupee settled in the 1970s. Mind you, while countries like Nepal have recently requested that the Rupee be allowed as legal tender, it is India that has baulked at the idea!

This is in sharp contrast to China’s policy of actively promoting the use of the Yuan in international trade.

Further, the Russia-USA stand-off calls into question the advisability of concentrating our forex reserves in the US Dollar. There is more than a tail-end risk that the US might prevent any country of its choice from accessing its reserves.

Therefore, rather than focus only on the exchange rate, the RBI needs to get over its cold feet and make the Rupee fully convertible, as per the Tarapore Committee recommendations, take steps to actively encourage the use of the Rupee in global trade and diversify away from the US Dollar in the composition of India’s forex reserves.

Make the market work for importers/ exporters

Like the SEBI works for the benefit of investors in the Equity market, rather than for the brokers, the RBI, as the forex market regulator, should actively work for the welfare of the importers and exporters rather than shying away from dismantling the banks’ monopoly on the forex trade flows of their customers.

This can be achieved through three measures:

- To its well deserved credit, the RBI has empowered CCIL to create the very powerful FX Retail platform, which enables retail customers to access the interbank Spot Dollar-Rupee market online. The RBI should now make it mandatory for all banks to route all their customer trades through the FX Retail platform in order to increase volumes and promote usage. Also, while FX Retail allows companies to access the interbank Spot market, the Forward quotes to the customer are still given by single banks. Even the Forwards need to be competitive, multi-bank interbank quotes.

- Allow corporates to transact forex with any bank of choice, and not be mandatorily tied to the bank through which the underlying trade transaction is routed.

- Allow delivery against exchange traded currency futures.

Lastly, let the Rupee be

Lastly, we should also study whether the country might have been better off had the RBI allowed the Rupee to trade on its own and find its own levels, whether weak or strong? Would not Corporate India have developed more robust risk management practices when forced to confront risk rather than being shielded from it?

A lot has been written on the cross of the Impossible Trilemma that the RBI has to carry on its shoulders. Maybe the RBI would do well to heed the Beatles and just “Let It Be”?

Or maybe even be like Atlas Shrugged.

References:

https://colourofmoney.kshitij.com/rbi-risk-172/

https://theprint.in/ilanomics/why-rbi-should-learn-from-china-and-internationalise-the-rupee/175034/

This article has got published on Hindu Businessline on 27th April'22

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877