I am thinking

Feb, 06, 2024 By Vikram Murarka 0 comments

"Bharat teesri sabse badi arthvyavastha hoga... Yeh Modi ki guarantee hai"

Audacious, but not outlandish, because Germany and Japan will not grow fast (due to aging/ declining population et al) whereas Bharat will certainly continue to grow. Whether it will grow at 7% or higher, or at 6.5%, or at 6% or lower, is the question.

So, around 12% nominal growth is possible, not outlandish, assuming inflation averages between 5-6%.

Is this good enough for me to invest in stocks?

Firstly it is not too much of a roaring comfort that nearly 40-50% of the nominal growth will be inflation, UNLESS there is a sustainable decline in inflation towards 4%. Shall come back to this.

Secondly, even if we are not too concerned with the previous question, the question I definitely have to answer is whether I can get 15% upside on the Nifty from current levels (assuming I want 3% margin of safety). With major long term Resistances hovering overhead, I am not getting enough confidence about getting 15% from current levels. I would be more comfortable about that at lower levels.

Thirdly, is there any alternative investment avenue for my money? For the first time in my life, I am thinking that maybe Gold might be better than Equity. Is that because I am getting older and my age is influencing my thinking? No, it is because of the charts. Gold looks like it has solid Support at $2000 and can rise to $2200.

Contrast this with Nifty which has solid Resistance at 22500 and can fall to 21000, if not 20000.

Fourthly, while the Dow Jones and Nifty (and even Nikkei and DAX) are kissing their long Resistances, the Shanghai is looking as bedraggled as something the cat dragged in. Unless we can safely assume that China is done with and can never get up from here, would it not be worthwhile to explore Shanghai as an alternative investment avenue, from a relative risk-reward perspective?

Fifth, things tend to go wrong when they are least expected to. Is there any danger to the world growth, especially to Bharat's growth?

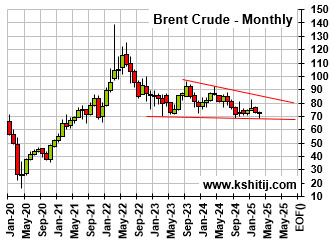

Within this, we are looking for Brent Crude to start rising in a few months and head up towards $90 and higher. Of course, our reading could be wrong. We will come to know that in case Brent breaks below $70 and falls towards $65-60.

If Crude happens to rise towards $90 (an at least 50% probability), it could upset the inflation outlook. Can we get real growth at 7% if inflation is near 6%, preventing the 10Yr GOI from falling below 6.9%?

Another thing is, why is Gold looking like it can rise to $2200? Could be because of continued central bank purchases across the world (de-dollarisation?). Could be because of low belief that inflation has been tamed or that Crude can flare.

I am thinking.

When I have to think SO MUCH about buying Equities, I feel safer on the sidelines.

#equity #equitymarkets #stocks #stockmarket #nifty #gold #bharat #stockmarketindia #equities #brent #brentcrude #nikkei #dax #shanghai #dowjones #india

Array

In line with expectations in our last report (07-Mar-25, UST10Yr 4.27%), Yields have come down across the Curve. Although the Citi Surprise Index moving up during the month, the economic data has been mixed. While the IIP, Capacity Utilisation and Retail Sales have risen by varying …. Read More

Brent has been narrowing its trade range since Oct-23, keeping its bottom floored near $67/68 region. Will the Mar-25 low of $68.33 hold and help the crude prices to move up to the higher end of the range in the coming months? Or will global scenario impact crude and force it to break below the $68/67 floor? … Read More

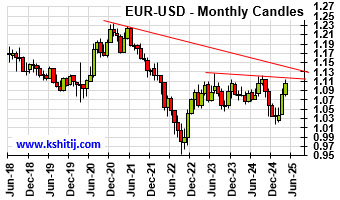

Admist Global trade tariff announcements, market volatility ECB rate cut expectations and economic growth concerns will the Euro manage to hold below the immediate resistance near 1.12? Or will the global scenario force the Euro to surge beyond 1.12? ……. Read More

Our April ’25 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our April ’25 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877