GIVE THEM BREAD (money), SO THEY CAN EAT CAKE!

Mar, 19, 2020 By Vikram Murarka 0 comments

As the origin of the word itself suggests, Economics has concerned itself with the distribution of limited resources. The evolution of Economic theory has reflected the evolution of the human economic experience over time of what limited resources means.

Given that after the Greek and Roman eras, Western thought emerged only in the Renaissance after the struggles for survival through the Dark Ages and bloody wars through the Middle Ages, it is no surprise that the Western philosophers took a rather dim view of the world. So we have Thomas Hobbes (1588–1679) calling life “nasty, brutish, and short”. Quite understandably, therefore, the worldview of the Classical economists was centered on the concept of limited resources. Hence the choice of the word “economics”.

In contrast, India, the land of milk and honey since as far back as human history goes, never experienced any material shortages before the white man came in. However, that is a different line of thought and I should not digress so early in my ramblings.

Coming back, the central concept of limited resources was reflected in the inflexible and vertical Long Run Aggregate Supply (LRAS) curve of the Classical Economists. With time, theory evolved to the point where Keynes depicted the AS (aggregate supply curve) as horizontal at lower levels of GDP before it curved up to become vertical at higher levels of GDP. This small video from Khan Academy is a nice primer on this. With this, there were two important transitions in economic thought that happened. Firstly, with the change in the shape of the AS curve, the productive capacity (or AS) was no longer seen as a major limiting factor on the economy. Secondly, the focus shifted, instead, to AD (aggregate demand) being seen as a limiting factor on the economy. Today, with a globalised economy and globalised supply chains, if anything, the developed world (certainly) finds itself dealing with the problem of more than ample supplies and less than adequate demand.

Keynes onwards, it is the non-availability of Money (as a means of exchange), that has been seen as the factor that constrains demand. No money, can’t spend. So, in the beginning, the government was allowed to run a deficit. Later, the Gold Standard was abandoned by Nixon in 1970 and the USA was free to print as many Dollars as it wanted, unencumbered by any obligation to moor the Dollar to its Gold reserves. While there might be a tendency to baulk at this, we have to concede that these two developments have been crucially vital enablers for the post-War global economic growth and for the post-1970s globalization which has helped billions to come out of poverty, a process that still continues.

More recently, only the most churlish will refuse to admit that had Helicopter Ben not invented QE (quantitative easing) and had Draghi not done “what it takes” after the Great Financial Crisis of 2008 and the European Crisis soon after, the developed world would have had to go “back to the future” to the Great Depression. These two keen students of Keenes (oops, Keynes) freed central banks from the obligation to link money supply to any fiscal considerations.

Today, with the advent of the coronavirus crisis, the world is willing to run up huge deficits in order to send cheques to everyone as everyone is being forced to work from home as country after country and economy after economy goes into lockdown. Western thought has come a long way from the time when Marie Antoinette said “If they don’t have bread, let them eat cake” to the time today when Trump is willing to say “Let us give them bread (cash) so that they can eat cake”.

Welcome to the emerging world of Modern Monetary Theory (MMT) which cites Japan as an example and says there is no reason why governments cannot run deficits that are several times the size of their GDPs. Listen to Stephanie Kelton, one of the champions of MMT, explain this theory. Notice that inflation is no longer a monster to be scared of. Supply not being a constraint, Demand-Push Inflation is dead. Further, with Crude now likely to stay well below $70 for some years ahead and to be eventually replaced by solar power, Cost-Push Inflation may also be a demon that might get slain. In this environment, when government bond yields are headed towards zero and are likely to stay there for years together, why should not governments run unlimited deficits?

There are merits to this evolution of thought that says non-availability of money should not be allowed to constrain demand. If governments do not have money, they can run deficits. If central governments need to expand money supply, they may simply create. Human population has grown and everyone is seen to have a right to not only the minimum of roti-kapda-makan, but also to education, holidays, smartphones and Netflix. Is there any philosopher or politician anywhere in the world with the gumption to deny this? If people do not have money, they should be given money. Today the daily wage earner (whether in the United States or in Uttar Pradesh) should be given money due to the coronavirus. Tomorrow it will be given as a part of Universal Basic Income. At no point of time should peoples’ demand be curtailed and the wheels of commerce should not grind to a halt due to the non-availability of money.

Let the leviathan juggernaut roll on! Yaavat jivet sukham jivet, Rrinam kritva ghritam pibet!

References:

Aggregates Supply curve in Classical and Keynesian economics

Modern Monetary Theory explained by Stephanie Kelton

Cartoon copyright acknowledged with thanks.

Array

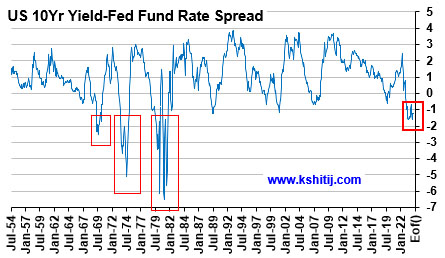

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

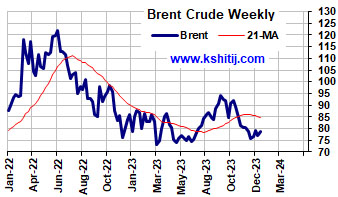

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

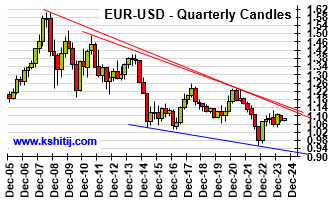

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877