How the wheels are beginning to turn on the NEER

Aug, 27, 2025 By Vikram Murarka 0 comments

Last week, through the red alert and torrential rain, waterlogged roads and WFH, we met 10 corporate forex risk management teams in Mumbai, all the way from Fort in the south to Thane in the north.

Getting 10 meetings in 4 days was a welcome change after the meetings-drought during the last two years when the RBI had artificially pushed Dollar-Rupee volatility down to near zero. Now that the RBI is not breathing down the Market’s neck, a modicum of normal volatility is back in the Dollar-Rupee market and risk needs to be managed again.

It helped, of course, that we have recently been ranked #1 worldwide by Bloomberg for our Dollar-Rupee forecasts for the last two quarters in a row, June-2025 and March-2025. Besides, we have also been ranked in the Top 5 worldwide by Bloomberg for the last 12 months.

People were happy to talk with us as we had something path-breaking to offer to them. We provide specific-rate hard-number Open-High-Low-Close forecasts for each month from 1-month out to 12-months for Dollar-Rupee, Euro-Dollar, Crude Oil, US 10Yr Yields and 10Yr GOI Yields. This is part of our regular monthly forecasting service. These are extremely useful for strategizing and planning long-term hedges. Our forecasts come with 60% documented reliability helping the corporate risk managers gain confidence in using them.

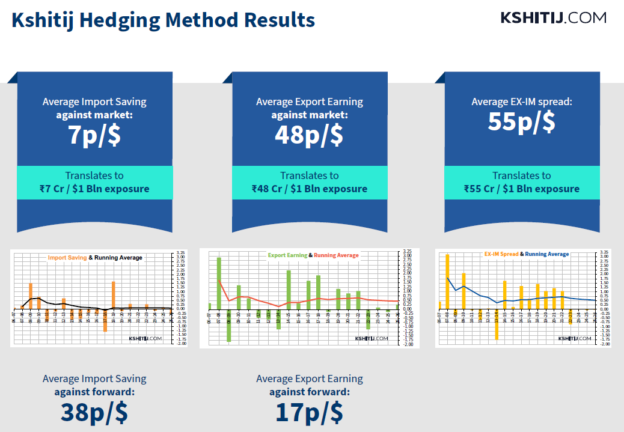

While this is good in itself, the story gets more interesting from here. Building on the reliability of our forecasts, the KSHITIJ Hedging Method model has, on average, helped Importers pay 8 paise/ $ LESS than the open market spot. It has also helped Exporters earn 17 paise/$ MORE than the Forward rate over the last 19 years. Apart from being the only people to publish our forecast track record history, we are perhaps the only people in the Market who can share the results of our Hedging Advice over the last 19 years.

This is because we religiously, regularly and systematically calculate the NEER or Net Effective Exchange Rate for both Importers and Exporters and have started sharing the results publicly as well.

Earlier, the concept of NEER was alien to most corporate forex risk management teams because it has never been a management “ask”. Financial accounting standards never demanded it and forex hedging has never been examined from the cost accountancy perspective, as it has been long held (erroneously, of course) that “Forex is not my business”.

To our delight, except for a few, most of the corporates are now at least aware of what the NEER is, some are already calculating their NEER and some are looking to start. We can help here with the KSHITIJ Hedging App, which calculates the NEER on the fly, for both imports and exports. This, besides providing a robust hedging decision support framework powered by the KSHITIJ Hedging Method.

The NEER calculated by the KSHITIJ Hedging App enables the corporate to compare it with the Accounting Rate on the one hand to arrive at the Accounting P/L and with the Open Market Spot on Cash Flow Date on the other hand to arrive at the Opportunity P/L. In a utopian world the aim would be to maximise the Accounting Profit and minimize the Opportunity Loss. However, since that might not be possible all the time, the forex risk management team can try to balance both so that the ratio between the Accounting Profit and the Opportunity Loss can be 1:1. If a corporate can come close to that over a period of time, it will surely enjoy a competitive advantage over its industry peers, proving that managing forex risk is an integral part of the business for every importer and exporter.

We at KSHITIJ are glad to be offer game changing services to corporate hedgers through our 1-12 month hard-number OHLC forecasts, through the time-tested KSHITIJ Hedging Method and through the upcoming KSHITIJ Hedging App.

To wrap up, if the tone of the 10 meetings we had in Mumbai last week is any indication, more corporates are now interested to hear what we are saying, and the wheel is beginning to turn on the NEER. It is a concept that will start rolling soon enough and will eventually become a juggernaut.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

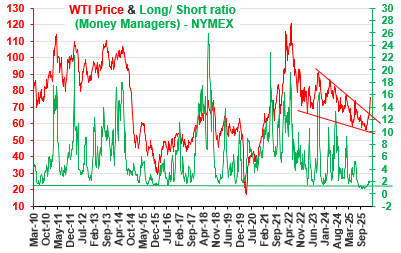

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877