followup-in-sterling

Mar, 28, 2004 By Vikram Murarka 0 comments

FOLLOW UP - Bear SHS in Sterling?

In the last issue we had pointed out a three decade old Downtrend Resistance on the GBPUSD Monthly chart, which presaged weakness in GBPUSD. Technical Analysis is based on the assumption that ALL factors governing Price are in the Price itself and we can predict Price movements through the study of Charts. This assumption seems to be proving correct yet again. The Sterling seems to be developing a Bearish Shoulder Head on the Weekly chart (shown alongside), confirming the prognosis of the monthly chart.

If this works, Cable can fall to 1.73-1.70 over the next 4-8 weeks Negation would need a Week Close above 1.8589, as compared to the current level of 1.8158.

Array

In our last report (29-May-25, UST10Yr 4.45%) we had stuck to our previous forecasts, calling for the US2Yr to dip to 3.2% and the US10Yr to 3.6%. Although those levels are …. Read More

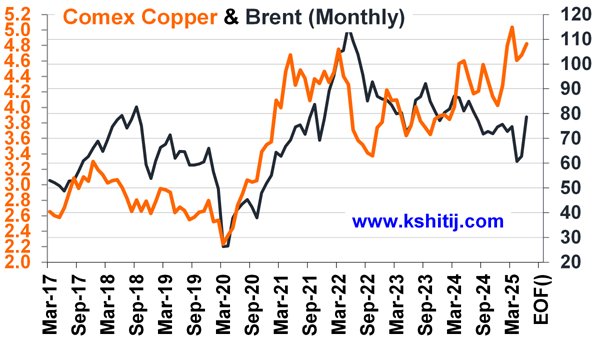

Brent rose sharply from $58.20 itself instead of extending the fall to our expected $55, meeting our long-term target of $70 much sooner than expected. The acceleration in crude prices have been triggered by … Read More

The Dollar Index has high chances of rebounding from support at 96, in which case, it could limit the immediate upside for Euro and lead to a decline in the coming months …. Read More

Our July’25 Dollar-Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our July ’25 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877