Built, not Borrowed: The Kshitij Way of Hedging

May, 22, 2025 By Vikram Murarka 0 comments

Operation Sindoor isn’t just about military strategy — it’s a declaration of self-reliance. By bypassing advanced air defences and intercepting drones and missiles of Chinese and Turkish origin, India proved the power of homegrown technology. A country that barely exported defence equipment a decade ago is now clocking ₹24,000 Cr in exports — targeting ₹50,000 Cr by 2029 and aiming to be the largest arms exporter by 2047.

This isn’t a moment. It’s a mindset.

It reminds us of Dr. Vijay Bhatkar, who, when denied access to Western tech, built India’s first supercomputer — Param 8000 — from scratch.

We embody much of the same spirit in the work we do at KSHITIJ

From building one of the most comprehensive databases (going back to the early 1900s), to creating proprietary charting frameworks (3-day, 13-day, bi-monthly), analysing 60+ market drivers, and pioneering the Kshitij Hedging Method (KHM) — our risk management philosophy honed over 18+ years — we’ve always believed in building, not borrowing.

We’ve built tools, and we’ve built RELIABILITYwith our published forecast and hedging TRACK RECORD, perhaps the only firm in the market that puts its performance for public scrutiny.

Innovation and building intellectual property aren’t optional. It’s the only way we know at Kshitij.

How does this matter to YOU, the Client? All the work we do adds up to the value addition we bring to our clients, ranging anywhere between 20-50 paise per dollar.

Now, a saving of 20 paise per dollar may not look that big on surface but can add up to ₹20 crores per annum or more, depending on the size of your exposure.

So, if you are looking for somebody with…

Proprietary tools

A proven methodology and

A Risk Philosophy that really works

… talk to us

Or in other words if you are looking to save some serious real money in forex hedging, TALK TO US.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

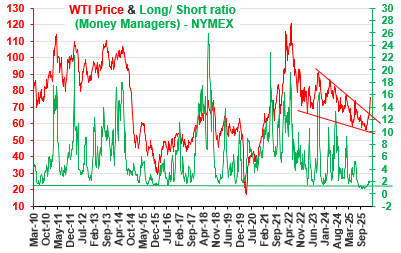

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877