Thereafter, the exporter/ importer hopes that the rate on the date of actual receipt/ payment should remain the same as that on the date of the business contract, so that he does not have any forex profit/ loss. Thus, most export/ import deals are, by default, cost-budgeted on the present. But, the future is usually different from the present and when the time for payment/ receipt comes, there is a forex profit/ loss compared to the booked value of the deal. This is a problem. How does one budget for the future transaction?

If the future were known, one could have used the future rate to price the export/ import transaction and to budget accordingly. But, nobody knows the future, right? So, some businesses tend to use the Forward Rate as a proxy for the future, simply because it is a rate that pertains to the future.

If the future were known, one could have used the future rate to price the export/ import transaction and to budget accordingly. But, nobody knows the future, right? So, some businesses tend to use the Forward Rate as a proxy for the future, simply because it is a rate that pertains to the future.

THE FORWARD IS A FAULTY BENCHMARK

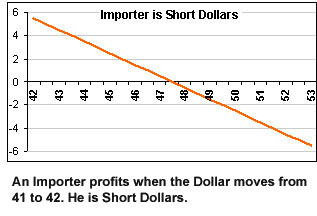

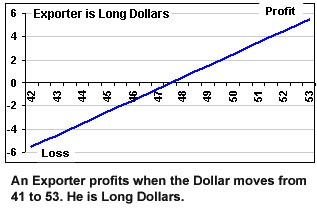

But, using the Forward Rate has two problems. The first is that the Dollar is usually at a premium to the Rupee in the forward market. This premium is an earning for an exporter, but is a cost for the importer. The Exporter may be able to accept a lower Dollar price for his goods (being compensated by the premium for the dent in his profit) but the Importer would have to be ready to pay a higher Rupee cost. This is a conundrum for companies that have both exports and imports. A true benchmark should be impartial to both the exporter and the importer.

The second problem is that the forward rate is not a forecast and it is incorrect to use it to budget for a transaction that is to take place in the future. So, what is the solution?

USE A FORECAST AS A BUDGET

The answer is to use a currency forecast as the budget rate for the future payment/ receipt. “If only it were possible!” you would say, Dear Reader. “I would do it, if I had a reliable forecast. But, nobody can forecast currencies!”

This notion is true to some extent and untrue to some extent. Yes, currencies cannot be forecasted exactly. However, they can be forecasted with a reasonable degree of accuracy, within an acceptable degree of variance. And, such forecasts can serve as better budget rates than the Forward rates.

MARKETERS DO IT ALL THE TIME

Currency forecasts are to be approached in the same manner. Neither the professional forecaster nor the user of the forecast should harbour the notion that the forecast is sacrosanct. The forecaster should also not stubbornly stick to his forecast (even as it is going wrong) just because he has done the forecast. Nor should the user berate the forecaster for getting it wrong.

Of course, this does not mean there should be no accountability and the forecaster can say just anything and get away with it. The professional forecaster should pursue his craft with diligence, keep track of his performance, inform the user of the reliability of his forecast, of the degree of variance that may be expected and will constantly try to improve upon his work. Our own forecasts have a reliability factor of 72%.

Working with a reliable currency forecast can yield dramatically improved results in forex risk management. Try it. It works.

Every activity has a budget

Every activity has a budget