Japanese Yen Long term Forecast - Mar'18

Mar, 05, 2018 By C S Vijayalakshmi 0 comments

05-Mar-18: USDJPY 105.64

RECAP

In our 15-Jan-18 report (USDJPY was 110.70),we forecasted a possible range of 110-113 for the Feb-March period with a possible extension to 108-106.As it turns out, the market has indeed fallen to 106, much faster than the expected 2-3months!

EXECUTIVE SUMMARY

Dollar-Yen has fallen sharply to test crucial support near 105.50-105.00 in Feb. If that holds, some stability is possible in the 105-108 region. Thereafter, an eventual break below 105.00 targeting 103.50 looks likely because the currency pair has broken the long term support near 110-108 coming up from the level of 76 in 2012.

UPTREND SINCE 76 BREAKING?

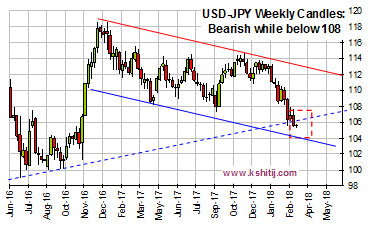

The monthlychart alongside shows that Dollar-Yen has fallen sharply in the last two months. It has broken below the earlier expected support near 110-108, on the five-year old red dotted trendline coming up from the low near 76 in 2012.

With 108.0-108.5 on the said trendline now likely to provide Resistance, the near to medium term outlook looks bearish for USDJPY. As such, there is now scope for it to move lower towards 103.50 (seen as a possible support) in the next 2-3 months.

NEAR TERM:SUPPORT AT 105.50-00

Looking at the period since 2016 on the Weekly chart, the important support level near 105.50-105.00 has held well on the first testing. If and while it holds in the near term, it could the market up towards 108.0-108.5 in March’18 followed by another downleg towards 103.50 or even lower by April-May’18. However, in case the Support at 105.00 breaks immediately, the fall to 103.50 can happen in March itself.

Between the two, we think that for the next 1-2 weeks could see some sideways ranged movement in the 108.5-105.5 region before coming off to lower levels.

USDJPY PROJECTIONS

While the weekly charts above show a possibleconsolidation within 108.5-105.5 in the 1st 2-weeksofMarch, the long term monthly chart shows apossibility of testing 103.50 on the downside.Keepingthis in consideration, we project the Dollar-Yen rates till Sep’18.

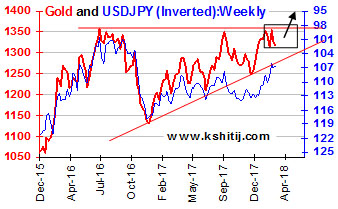

RISE IN GOLD ->RISE IN YEN

Historically, Gold has had a close directional correlation with the Yen. Gold rose in the first half of February testing1360 before coming off towards 1320. It is currently ranged between 1310 and 1370, but shows potential for an eventual rise towards 1400. A break above 1370 is needed as confirmation.

Historically, Gold has had a close directional correlation with the Yen. Gold rose in the first half of February testing1360 before coming off towards 1320. It is currently ranged between 1310 and 1370, but shows potential for an eventual rise towards 1400. A break above 1370 is needed as confirmation.

While Gold remains stable in the 1310-1370 region just now, Yen could trade in the 105.5-108.5 zone for the coming weeks. Fresh weakness in US Dollar, if seen, could lead to further upside in Gold towards 1400, thereby leading to strengthening of the Yen towards 103.50 in the longer term.

FALL IN EUR-JPY ->STRONGER YEN

Checking for possibilities of Yen strength on the EUR-JPY chart, we find that the pair has come off from levels near 137.50,just below the trend resistance at 140 and could be breaking below 130. While the current fall sustains, EUR-JPY could be headed towards 127 in March.

Overall while below 140, the trend is likely to remain down and the pair may eventually come off towards 127 in the next couple of weeks. A possible simultaneous test of 1.25 on EUR-USD gives us a target of 101.60 on Dollar-Yen. Even if we take 101.60 be an extremely bearish target, we can infer that the direction for Dollar-Yen is down, not up.

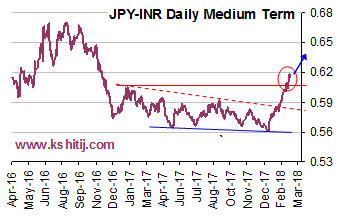

RISE IN JPYINR TOWARDS 0.63 OR HIGHER?

Yen strength is being seen against the Rupee as well. The JPYINR (0.6166) has risen well above the earlier 0.6050 horizontal resistance and may move higher if the rally sustains. The important Support to watch is now 0.60. If the pair is able to remain above 0.60 in the next couple of weeks, it can move up towards 0.63-0.65 over the next 3-6 months, with some interim corrective dips.

Yen strength is being seen against the Rupee as well. The JPYINR (0.6166) has risen well above the earlier 0.6050 horizontal resistance and may move higher if the rally sustains. The important Support to watch is now 0.60. If the pair is able to remain above 0.60 in the next couple of weeks, it can move up towards 0.63-0.65 over the next 3-6 months, with some interim corrective dips.

This sharp rise in JPYINR is because of combined strength in the Yen and weakness in Rupee against the US Dollar recently. A further rise in Yen-Rupee towards 0.65, combined with a target of 66 on Dollar-Rupee gives us a target of 101.55 for USDJPY, close the target of 101.60 from Euro-Yen above.

CONCLUSION

Overall, Dollar-Yen looks bearish while below 108. A break below 105, whether immediately or a little later, can target 103.50 eventually.

C S Vijayalakshmi

Vijayalakshmi has the rare ability to look at charts using both Classical charting as well as Elliot Waves, which she combines with excellent proficiency in Excel. A growing presence in the social media sphere, she is also an accomplished danseuse and choreographer.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877