Trading Lessons 2 - Trading ranges without stops

Jul, 17, 2006 By Vikram Murarka 0 comments

Here is another trading story, again with Dollar-Yen as the background. Many Traders, especially in the early years, do not realize that there are two kinds of market - a sideways ranging market and a trending market. And unfortunately, there are often two kinds of Traders - range traders and trend traders.

This story unfolds in the first half of 1999. The Dollar-Yen market had stabilized after the fall of 1998. It had been trading sideways in a 7-big figure range between 117-124 from Feb-99.

This story unfolds in the first half of 1999. The Dollar-Yen market had stabilized after the fall of 1998. It had been trading sideways in a 7-big figure range between 117-124 from Feb-99.

Range Traders were busy making money hand over fist, buying low and selling high. The secret of their success was that few worked with Stops, because Stops have a habit of getting triggered in a ranging market.

But then, the unexpected (though inevitable) happened. Dollar-Yen crashed in July-99 to hit 115. A lot of the Range Traders were caught Long and wrong. Moreover, they did not have Stops in place. Worse, the market paused a bit after hitting 115. Many Traders thought the market was going to rebound and doubled/ tripled their Long positions, again without Stops.

Oh misery! The market resumed its fall, refusing to stop till it hit 105. It was later heard that one particular trader, who had been the toast of the market when it had been trading between 117-124, had been eased out his job and had quietly left the country.

Moral of the Story:

Work with Stops, always. Your stops may be wide; they may even sometimes be mental. But, be disciplined and implement your Stops when the Stop Loss levels are triggered. Otherwise you are committing trading hara-kiri.

Array

In our last report (28-Jun-25, UST10Yr 4.28%) we had highlighted the stagflation dilemma faced by the US FED (which still remains); had said that the Inflation Expectation could rise (it did indeed rise); that Inflation is …. Read More

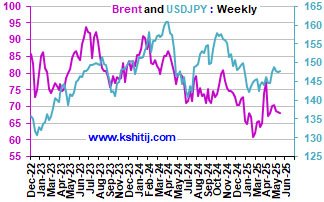

Our August 2025 Crude Oil Monthly Report covers updates on OPEC+ production, inventory changes and cross-commodity correlations. Our analysis includes both technical setups and broader market indicators shaping the near-term outlook for Brent. … Read More

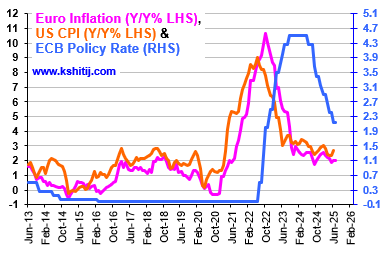

Markets see the ECB on hold through 2025, with slim odds of a September cut, while the Fed is 90% likely to ease next month after the downward revision in the recent US NFP data release on 01-Aug. …. Read More

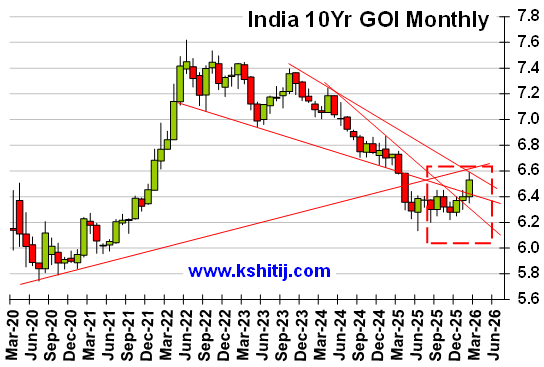

In our 10-Jul-25 report (10Yr GOI 6.38%) we said that Crude might have bottomed and could rise towards $82 (in the long term), limiting the downside for inflation … Read More

In our 09-Jul-25 report (USDJPY 146.81), an initial rise to 150-152 was expected, followed by a fall to 144.50-143.50 before eventually rallying towards 155 in the long term. As anticipated, the USDJPY observed … Read More

Our August ’25 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877