Series on Forex Hedging - Cash In On Cash-Spot

Jun, 25, 2012 By Vikram Murarka 0 comments

Cash-Spot is one of the lesser known technical concepts in the forex market. Nothing earth shattering, really, but it is always good to know the technical details of the market we operate in. The forex rates that we see in the normal course, quoted on the screens, in forecasts or in the papers, are all Spot rates (unless specifically mentioned otherwise) and do not pertain to today. Strange? To explain a little clearly, we introduce a few definitions, alongwith examples.

| CASH-SPOT: DEFINITIONS AND EXAMPLES | ||

| Term | Definition | Example |

| Cash date or Trade date | The date of the transaction, say “today” | If today is 25-June-12, then Cash date is 25-June-12 |

| Spot date | Second working day from the Cash date, or day after tomorrow | 27-Jun-12 |

| Tom date | Tom is short for “tomorrow” and is the next working day from the Cash date | 26-Jun-12 |

| Spot Rate | The rate quoted and transacted today for settlement (debit/ credit) on the Spot date | Say, the rate is 55.95. This is the rate we normally see, hear and talk about. |

| Cash Rate | The rate applicable for settlement (debit/ credit) today itself, on the Cash date | This is usually lower than the Spot Rate. Since the Spot Rate is 55.95, the Cash Rate may be 55.93. The difference between the two rates is known as the Cash-Spot rate or Cash-Spot difference. |

| Tom Rate | The rate quoted and transacted today for settlement (debit/ credit) tomorrow, on the Tom date | This is lower than the Spot Rate, but higher than the Cash Rate. Since the Spot Rate is 55.95, the Tom Rate may be 55.94. |

In simpler terms: Spot Date = Trade Date + 2 working days. Cash Rate = Spot Rate minus Cash-Spot Difference.

Depends on Interest Rates

In the case of Dollar-Rupee, the Cash Rate is usually lower than the Spot Rate in the same way that the Spot Rate is usually lower than a Forward Rate. In other words, compared to the Spot Rate, the Cash rate is usually at a Discount, whereas the Forward rate is usually at a Premium. Note: any date after the Spot date is a Forward date.

The Cash-Spot market is largely a high-volume interbank market as it is based upon banks borrowing in one currency and lending in the other, usually to meet overnight reserve requirements. Thus, the Cash-Spot Difference depends on the difference between the Overnight or Call rates between the two currencies concerned.

If there is a holiday, or a couple of holidays (as over the weekend) between the Cash and Spot dates, then also the T+2 definition applies. In such case the Cash-Spot difference understandably increases.

Market Timings

The Cash-Spot market usually operates between 9.00 AM and 11.30 AM, with some stray deals being done till 12.00 Noon.

Is the Cash-Spot quoted?

Yes, the Cash-Spot and Cash-Tom rates are quoted on most forex rate services such as Reuters, Bloomberg, Newswire 18 and Tickerplant. We also report it daily in the Forward Rate Sheet that is sent out by e-mail to the subscribers of our daily Rupee Update service.

What does it mean for Exporters?

When an Exporter sells Dollars to a bank at the Spot Rate (say 55.95), he should get a credit into his Rupee account on the Spot date. If he insists on a credit on the transaction date (Cash date), the bank may well deduct the Cash-Spot difference (say 2 paise) and credit his account at the Cash rate, say 55.93. So, as a general rule, an Exporter should not insist on a same day credit.

What does it mean for Importers?

When an Importer buys Dollars from a bank at the Spot Rate, his Rupee account ought to be debited on the Spot date, and not on the transaction date. This is something that the Importer should be careful about and check on a regular basis. On the other hand, it may be good for the Importer to pay for the Dollars at the Cash rate as it would be cheaper than the Spot rate. In such case a debit on the transaction date would be justified.

Array

In line with expectations in our last report (07-Mar-25, UST10Yr 4.27%), Yields have come down across the Curve. Although the Citi Surprise Index moving up during the month, the economic data has been mixed. While the IIP, Capacity Utilisation and Retail Sales have risen by varying …. Read More

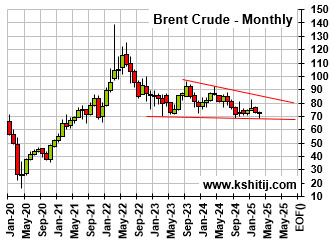

Brent has been narrowing its trade range since Oct-23, keeping its bottom floored near $67/68 region. Will the Mar-25 low of $68.33 hold and help the crude prices to move up to the higher end of the range in the coming months? Or will global scenario impact crude and force it to break below the $68/67 floor? … Read More

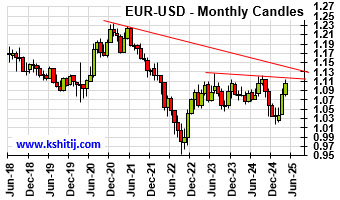

Admist Global trade tariff announcements, market volatility ECB rate cut expectations and economic growth concerns will the Euro manage to hold below the immediate resistance near 1.12? Or will the global scenario force the Euro to surge beyond 1.12? ……. Read More

Our April ’25 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our April ’25 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877