A few words on the KSHITIJ Forecasting Process

Feb, 22, 2018 By Vikram Murarka 0 comments

Forecasts? Everyone needs one.

“Nobody can forecast currencies” is an oft heard statement. This is a popular perception, perpetuated by academic literature of the time as well as statements from people in positions of power and responsibility.

Isn’t it strange, therefore, that everybody in the currency market wants to know where different currencies will go, whether they will strengthen or weaken? The simple fact is that it is a basic human need, even an essential business need, to want to know what the future holds.

Forecasts are needed by everybody, everywhere, not only in the currency markets. Everyone makes forecasts about everything and everyone wants to know the forecast about everything. Without forecasts, the business world and the financial markets would come to a stop. In the financial markets, traders closely track the forecasts made by the central banks, the forecasts or “guidance” made by companies and the forecasts made by the financial institutions on the quarterly results of the companies. Market prices react strongly when these “expectations”, which are nothing other than forecasts, are missed.

In the business world, the entire annual and quarterly budgeting process is an exercise in forecasting, without which it would be difficult to conduct operations efficiently. While budgeting, the businesses want to have an idea of what the demand scenario is going to be like, what will be the state of the economy, what will be the levels of interest rates and exchange rates in the next quarter, 2 quarters away, 1 year away or even 3 years away, how will commodity prices move? Forecasts are needed for all of these.

Where do we come in? We take on the “impossible” task of trying to forecast the currency markets and then even go further to take care of our Clients’ foreign exchange risks with the goal of reducing volatility and saving money for the Clients.

What makes our forecast valuable for our clients?

Our philosophy and approach to forecasting is what makes our forecast valuable to clients.

Synthesis is the cornerstone of our forecasting philosophy, in essence drawing strength from the “many”. There are many factors affecting a financial instrument in this intricately connected global financial market. We check all the factors that we know of closely and select the most pertinent ones. Nothing is unimportant unless it is proved worthless. Every month, we study some 50+ variables very systematically as part of our research process while making our monthly Dollar-Rupee forecasts.

We also synthesize many techniques within Technical Analysis – classical charting, trendlines, moving averages and Elliot Waves – while forecasting. In fact, we also synthesize three supposedly diverse techniques – Fundamental, Technical and Statistical analysis – to try and arrive at a more holistic forecast.

Our endeavour is to try and study the underlying ocean currents, so that we may better understand the waves on the surface. Most of the times, the underlying forces that drive the markets remain out of sight. To identify those forces and understand their implications is our primary target. In order to be able to do that, we not only study market variables themselves, but we also do a lot of inter-market and ratio analysis, correlation studies and regression studies.

Interestingly, we have also recently started studying the pattern of our own past errors to see if they can give us advance warnings of unanticipated market movements.

In short, we try and leave no stone unturned while trying to arrive at our forecasts.

Trying to minimize surprises

To think of it, why do forecasts tend to go wrong? A gross beginner’s forecasts tend to go wrong simply because he is new to the craft. Later on, a forecaster with 2-5 years of experience might go wrong because he might not have exercised the required due diligence. Even after rising further in experience, a more seasoned forecaster might end up making mistakes if he happens to succumb to his biases. It is to control all these factors that the need for more rigorous analysis starts being felt. And in fact, if these are dealt with there is a good chance that the forecaster may start to achieve reliability in the 55-57% region, maybe even in the 60-62% region.

Therefore, if all these factors are taken care of, a forecast would go wrong only if surprises happen to hit the market. So, to increase reliability levels to 70% and beyond that to 75-80%, the effort has to be to try and be as informed as possible, so as to minimize the chances of being surprised. In effect, this is the same as taking a look at as many factors as you can, in as many ways as you can, so that you leave no stone unturned.

In other words, a wide ranging study of variables and an approach of synthesis (as opposed to reliance on any one or two methods of analysis) is merely an enlightened survival technique.

Going into the next level

Thinking ahead, perhaps the way to pull forecast reliability above the 75-80% threshold would be to actively study the times when we have gone wrong, when we have been surprised, and to study the instances when correlations, that are normally seen to work in the market, happen to fail.

We intend to start working on these. There will surely be hurdles to cross, mistakes to be made, frustrations to be endured. However, at the end of it, hopefully we will be able to move our forecasting reliability to the next higher level.

Inshallah.

Array

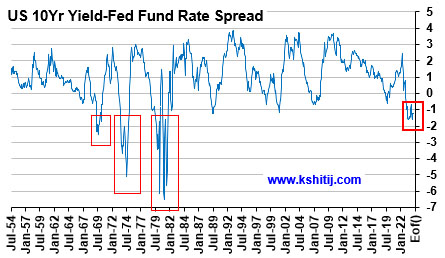

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

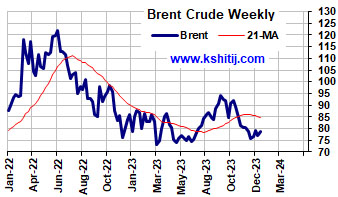

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

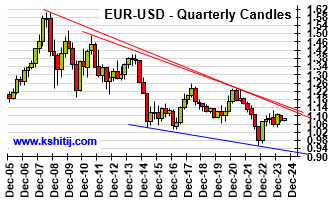

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877