The Future of Hedging

Nov, 06, 2020 By Gurumurthy 0 comments

When it comes to forex hedging, the Forward Contract offered by the banks is the most preferred instrument, used by all the exporters and importers. However, there are times when the banks are inaccessible (due to holidays in different cities even though the Mumbai market is working, over shooting the cut-off time, or due to limited trading hours in the interbank market etc) but the businesses would want to take a hedge, because there might be volatility in the exchange traded market. The USDINR Futures contracts traded on the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) will be a good alternate platform for hedging at such times. Here we take a look at how the exchange traded futures contract can be used for hedging and why is it necessary to have this as a supplement to forward contracts.

TIMING

The Dollar-Rupee is traded from 9am to 5pm. Currently the OTC (Inter-bank) market timing has been shrunk to 10am to 3:30pm from the earlier 9am to 5pm because of the pandemic situation. Having access to the Currency Futures will enable hedging post between 9am and 10am and after 2pm if any sharp move happens before the OTC market opens or after it closes.

For instance, on 29-Oct-20 (Thursday), the OTC market closed at 74.1050 at 2pm, but there was a sharp rise in USDINR to 74.50 on the exchange-traded market after 2pm. Such move can be captured for hedging if Corporates have access to Exchange Traded Futures (ETFs).

Earlier, both the Spot and Futures market traded between 9am and 5pm. But, even in that, banks have a cut-off time (which is normally 30 mins prior to the actual closing) before which all corporates will have to hedge. In contrast, deals can be done on the exchange till the last minute.

BANK AND LOCAL HOLIDAYS

Some times, banks have region specific holidays even when the Currency market is open in Mumbai. During such times, when it is not possible to book Forwards because of the local bank holidays, the access to Futures market comes in handy to tackle volatility.

For instance, recently the Bank holiday in Mumbai for Dussera was on 25-Oct-20. This was a Sunday. So the Currency market was open on the next day that is 26-Oct-20 (Monday). But, some centres like Kolkata, Chennai etc had their Duserra bank holiday on 26-Oct-20 (Monday). So, exporter/importers in these cities were unable to hedge Forwards as their local bank branches were closed. However, since the currency market itself was open on that day, the Futures segment stood as an alternate avenue in case an exporter/importer had wanted to hedge on that day.

TRANSPARENCY

Price on the exchanges for the Futures contract are more transparent than those obtained from the banks while taking forwards. Banks always quote a few paise higher/lower from the actual spot market prices and the forward premiums in addition to their margins. This makes it difficult to know the final price at which one is hedging instantly and there often is a need to negotiate with banks to get better rates. This is costly in terms of money, time and mental peace. When it comes to Futures contract, the prices visible on the trading terminal are final and applicable to everyone. Additional costs like the brokerage charge, tax, exchange fee etc are also fixed and known well ahead.

HOW TO USE

When the banks/spot markets are closed and if any abrupt movement happens in the currency market an importer or an exporter can use the Futures contract for hedging.

An importer can buy (go long) USDINR Futures contract to the equivalent amount that is intended to hedge. Similarly, an exporter can sell (go short) in the USDINR Futures contract to an equivalent amount that is intended to be hedged. At the time of actual realization, the importer/exporter can square-off the positions in the Futures market and convert the actual import/ export amount with its bank at the prevailing spot rate.

For example, assume that an importer has to make a payment of $200,000 on 30-Nov-20 and the Dollar-Rupee is currently at 74.20. Consider that the forecast for the Dollar-Rupee is that it can surge to 75.25 if it breaks above 74.35. If this break happens when the banks cannot be accessed for booking forwards but Futures market is open, then an importer can go and buy 200 lots (1 lot = $1000) of USDINR Nov Futures contract on the exchange. Let us say, the importer manages to buy 200 lots at a spot reference rate of 74.45. Assume thereafter, that the rate goes up to 75.10 on 30-Nov-20, the day on which the actual payment is done. At that time, the importer can square-off (Sell back) the position and book profits (75.10-74.45 = 65 paise) in the Futures market and make payment at the current market rate of 75.10. This gave the importer a very useful hedge when the bank was unavailable.

Further, depending on the market condition, the hedges taken in the Futures market can be squared-off ahead of the actual requirements also.

PROCESS OF GETTING ACCESS

An importer/exporter will need to open an account with a Brokerage firm. Margin amount should be deposited in that account in order to take positions.

Approximately, Rs 2,000 to Rs 2,500 will be the margin amount required for one lot. So for the purpose of hedging, to take say 200 lots ($200,000) or 250 lots ($250,000) positions one should have the margin in the range of Rs 4,00,000 to Rs 6,25,000 deposited in the brokerage account.

Finally, a very important internal rule to be followed as a discipline is that, this account opened with the brokerage firm will have to be used only for hedging purpose. Any intention to use it for speculative trades will dissolve the purpose.

Gurumurthy

Chief Research Analyst at KSHITIJ.COM. As a chartist / technical analyst, he keenly track movements and developments in both the domestic and global markets.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

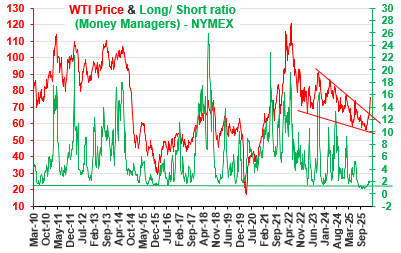

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877