Size Matters. Perhaps more than price.

Apr, 12, 2019 By Vikram Murarka 0 comments

Yes, it is true. Like in all other important aspects of life, in forex hedging also, size indeed matters.

Remember that old formula, R = p.q, or Revenue (or Outgo) = Price x Quantity?

The successful businessman keeps an eye on both variables, whether he is selling or buying. Depending on the nature of price movements in the market he is operating in, monitoring the quantity becomes less or more important. If the price tends to be fixed, then the only thing to do to maximise revenue is to try and maximise the quantity.

However, if there is a fairly large degree of variability in the prices, then it becomes very important to judiciously increase/ decrease the quantity transacted at each different price with the aim of maximizing the sale revenue or minimising the purchase outgo.

The same simple concept applies to successful forex hedging as well, except that most of the time our attention is so fixated on the Price (rate) only, that we tend to totally forget the importance of the Quantity (amount) part of the equation. Picture the professional card player. He keeps varying the amounts that he bets.

Here, we remind that one of the most fundamental tenets of successful hedging is that we should never hedge 0% (be totally open) nor should we ever hedge 100% (be totally covered) and that we should always hedge in parts.

When we do that, we equip ourselves with a variable (Amount) that we have greater control on that the Rate. If the rate is not very attractive but we are compelled to hedge, we can look to reduce the amount. If the rate is good, we can increase the hedge amount.

Further while the difference between two hedged rates tends to vary by 1-5%, the amount that is hedged tends to be in the region of 8-20% of the exposure amount and should therefore actually have a greater weightage in the R = p.q. formula.

Taking another analogy, while driving, all of us regularly use the accelerator also (apart from the brake) to reduce speed, perhaps more often than the brake. Imagine what would happen if we were to use only the brake whenever we needed to slow down! Similarly, in hedging also, we have to make effective use of the lever of the Amount apart from that of the Rate.

As we said, Size Matters!

Array

In our last report (29-May-25, UST10Yr 4.45%) we had stuck to our previous forecasts, calling for the US2Yr to dip to 3.2% and the US10Yr to 3.6%. Although those levels are …. Read More

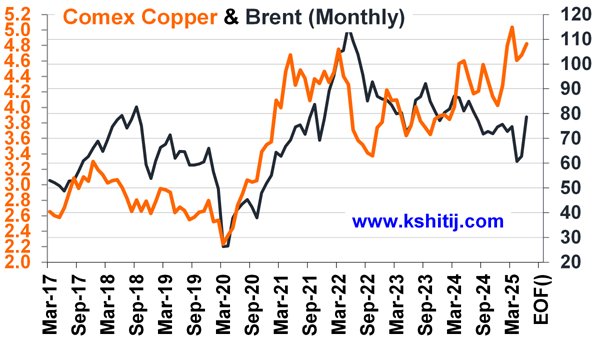

Brent rose sharply from $58.20 itself instead of extending the fall to our expected $55, meeting our long-term target of $70 much sooner than expected. The acceleration in crude prices have been triggered by … Read More

Euro has moved up sharply over the last 4-5 months and faced volatility admist the trade tariff talks and other geopolitical tensions globally. Will the uptrend continue and take it to fresh highs in the coming months? Or can there be any corrective consolidation or decline? …. Read More

Our June ’25 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our June’25 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877