Size Matters. Perhaps more than price.

Apr, 12, 2019 By Vikram Murarka 0 comments

Yes, it is true. Like in all other important aspects of life, in forex hedging also, size indeed matters.

Remember that old formula, R = p.q, or Revenue (or Outgo) = Price x Quantity?

The successful businessman keeps an eye on both variables, whether he is selling or buying. Depending on the nature of price movements in the market he is operating in, monitoring the quantity becomes less or more important. If the price tends to be fixed, then the only thing to do to maximise revenue is to try and maximise the quantity.

However, if there is a fairly large degree of variability in the prices, then it becomes very important to judiciously increase/ decrease the quantity transacted at each different price with the aim of maximizing the sale revenue or minimising the purchase outgo.

The same simple concept applies to successful forex hedging as well, except that most of the time our attention is so fixated on the Price (rate) only, that we tend to totally forget the importance of the Quantity (amount) part of the equation. Picture the professional card player. He keeps varying the amounts that he bets.

Here, we remind that one of the most fundamental tenets of successful hedging is that we should never hedge 0% (be totally open) nor should we ever hedge 100% (be totally covered) and that we should always hedge in parts.

When we do that, we equip ourselves with a variable (Amount) that we have greater control on that the Rate. If the rate is not very attractive but we are compelled to hedge, we can look to reduce the amount. If the rate is good, we can increase the hedge amount.

Further while the difference between two hedged rates tends to vary by 1-5%, the amount that is hedged tends to be in the region of 8-20% of the exposure amount and should therefore actually have a greater weightage in the R = p.q. formula.

Taking another analogy, while driving, all of us regularly use the accelerator also (apart from the brake) to reduce speed, perhaps more often than the brake. Imagine what would happen if we were to use only the brake whenever we needed to slow down! Similarly, in hedging also, we have to make effective use of the lever of the Amount apart from that of the Rate.

As we said, Size Matters!

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

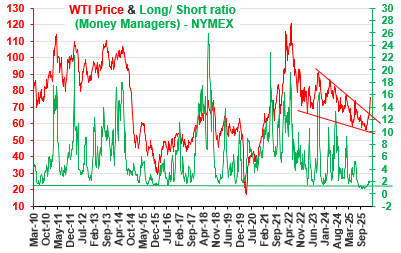

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877