Euro Long term Forecast - Feb'18

Mar, 01, 2018 By Saandhy Ganeriwala 0 comments

1-Mar-18: Euro 1.218

RECAP

In our Jan’18 report, (http://colourofmoney.kshitij.com/euro-long-term-forecast-jan18/) we had expected resistance near 1.235 to hold in Jan, to be followed by a dip towards 1.20-1.19 in Feb. However the Euro saw a high of 1.2556 in Feb-mid, post which a correction (towards 1.215) is presently underway. For the medium term, we had presented two possibilities – a straight rise past 1.25 towards 1.30 after April (which was more preferred), or a corrective fall towards 1.17 (which was less preferred).EXECUTIVE SUMMARY

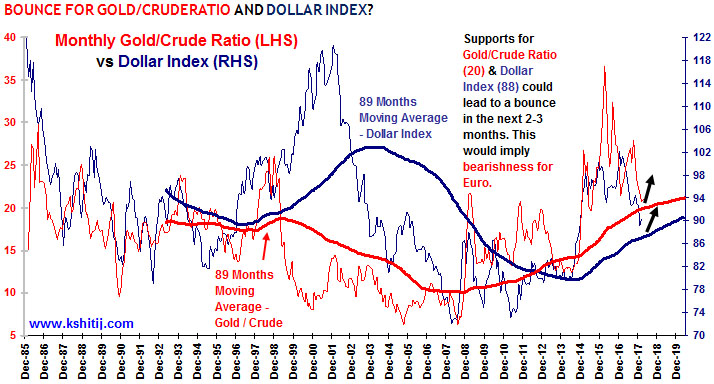

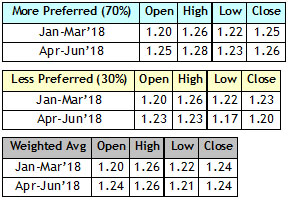

Immediate Support at 1.2200-2150 can produce a bounce to 1.255-1.26 in early Mar’18. While we retain our preference for a straight rise past 1.26, as a matter of ample caution, this report examines the chances of the less preferred alternative of a correction towards 1.18-1.16 coming true. Supporting factors for this correction are: a possible bounce in the Gold-Crude ratio triggering a bounce in the Dollar Index and a possible reduction in the record Net Long Euro positions among traders/speculators resulting in near-term Euro bearishness. Whenever Gold weakens vis-à-vis WTI Crude (Gold/WTI Crude ratio falls), the Dollar Index weakens and vice-versa, as the market presumably tries to maintain a parity between the Dollar and the “real” value of Crude. If WTI Crude (61.42) dips to $53 in Apr-June and if Gold (1312) remains below $1370, the Gold/Crude Ratio (21.36) could bounce towards 25, especially since, it has a Support near 20 on the 89-month moving average. If so, the Dollar Index (90.76) could bounce towards 94-95, implying a fall to 1.18-16 on the Euro. CORRECTION AFTER 5th WAVE? OR NOT?

CORRECTION AFTER 5th WAVE? OR NOT?

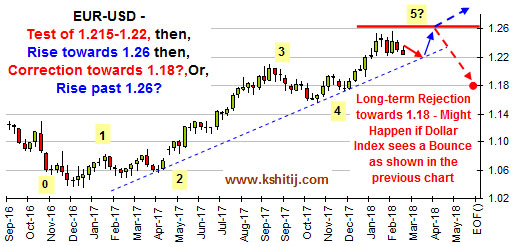

The weekly chart alongside shows a 5-wave upmove (from 1.035 in Jan-2017) which might end soon near 1.26 in Mar’18. If this wave count turns out to be correct, then a correction towards 1.18 is likely in Apr-June, supporting the “less preferred” scenario.

If, however, the wave count is incorrect, and the fractal study of Jan ’18 remains in force, the Euro may see a straight rise past 1.26.

A major reason why the Jan ’18 fractal study favouring a straight rise past 1.26

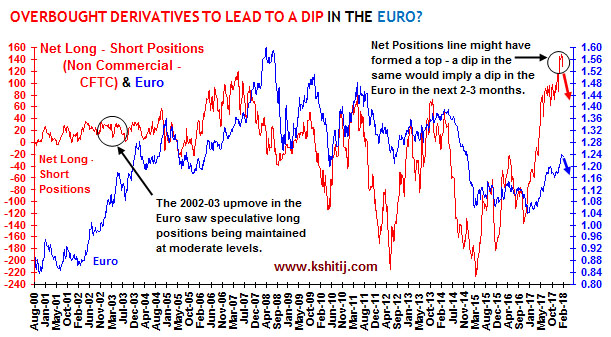

(http://colourofmoney.kshitij.com/euro-long-term-forecast-jan18/) might not work out is that, the speculative Long positions in the Euro are at a record high currently, unlike the situation in 2003, when the speculative Long positions were much more moderate. As such, the market might not have enough firepower to break above 1.26. In case the Euro Long positions are wound down to more reasonable levels, the Euro could dip towards 1.18-17, given the strong correlation between the Euro and the net long – short positions on CFTC.

JAN’18 ECB MEETING CUES: CONCERNS ON MUTED INFLATION & EURO STRENGTH

Close analysis of the press conference by Governor Draghi after the Jan’18 ECB meeting and the Minutes of the meeting reveal that the ECB was highly unimpressed by the attempt made by US officials to weaken the Dollar – their concern being that a strong Euro might suppress the ongoing rise in inflation. This rise in inflation (towards a target of just below 2% from the current 1.3%) is the bedrock of the ECB’s plan to reduce its monetary stimulus post Sep’18. Moreover, the drop in EU inflation from 1.54% in Nov’17 to 1.3% in Jan’18 could also be slightly discouraging for the ECB. The fact that the Governing Council did not even drop the ‘easing bias’ from their statement (‘easing bias’ is a commitment to unexpectedly increase monetary stimulus, if absolutely required) and is unlikely to do so in the 8th March meeting either, is a significant pointer to the fact that the ECB is uncomfortable with the Euro’s recent strength. Given this background, it will be interesting to see if the ECB tries to talk down the Euro in the 8th March meeting.CONCLUSION

While we retain our “more preferred” view of a straight rise past 1.26 towards 1.30, we are alive to the possibility of the “less preferred” scenario of a fall to 1.18-16. The “Stop Loss” levels to watch are: a break below 1.21 on the Euro and/or a rise past 23 on the Gold/Crude ratio and 91.5-92.0 on the Dollar Index. The trigger might be the ECB statements on the Euro in its forthcoming 8th March meeting next week.

Saandhy Ganeriwala

Saandhy is a postgraduate in Economics, but like all good market-men, he seeks confirmation from technical analysis charts for his macroeconomic ideas. His research is a good mix of charts, stats and econ. Apart from that, he calls himself a news junkie and an occasional writer.

Array

In our last report (29-May-25, UST10Yr 4.45%) we had stuck to our previous forecasts, calling for the US2Yr to dip to 3.2% and the US10Yr to 3.6%. Although those levels are …. Read More

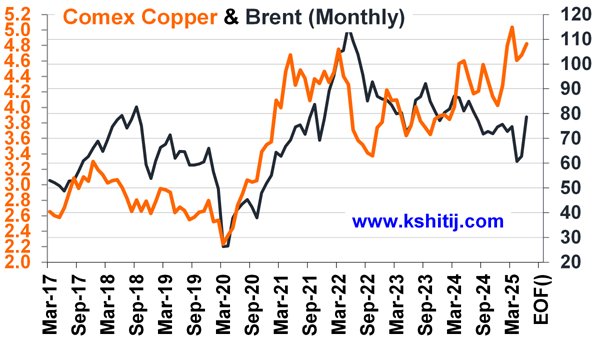

Brent rose sharply from $58.20 itself instead of extending the fall to our expected $55, meeting our long-term target of $70 much sooner than expected. The acceleration in crude prices have been triggered by … Read More

Euro has moved up sharply over the last 4-5 months and faced volatility admist the trade tariff talks and other geopolitical tensions globally. Will the uptrend continue and take it to fresh highs in the coming months? Or can there be any corrective consolidation or decline? …. Read More

Our June ’25 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our June’25 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877