Can the GOI rise to 8% in 2018, and then, 9% in 2019?

May, 09, 2018 By Saandhy Ganeriwala 0 comments

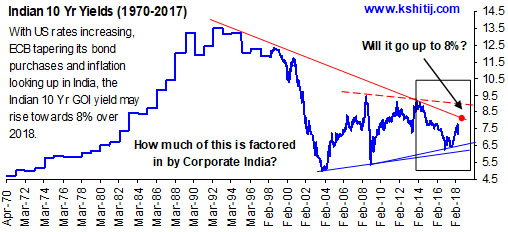

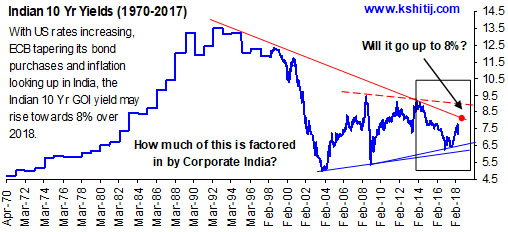

We asked the above question in Dec ’17, when the 10yr GOI yield was 7.09% and featured the below chart for the month of May in our 2018 Economic Calendar.

We asked the above question in Dec ’17, when the 10yr GOI yield was 7.09% and featured the below chart for the month of May in our 2018 Economic Calendar.

The GOI yield has indeed risen, to 7.77%, within kissing distance of 8%.

The US and German 10 Year yields have also risen from 2.38% and 0.31% towards 2.96% and 0.54% respectively. The global bond selloff was largely due to the rally in Brent to 75.5, plus a pick-up in growth and inflation expectations in US and Europe.

The GOI yield has indeed risen, to 7.77%, within kissing distance of 8%.

The US and German 10 Year yields have also risen from 2.38% and 0.31% towards 2.96% and 0.54% respectively. The global bond selloff was largely due to the rally in Brent to 75.5, plus a pick-up in growth and inflation expectations in US and Europe.

The GOI 10 Year yield rose also due to the initial fiscal deficit target (17-18) of 3.2% not being met. An interim attempt to control the Govt’s borrowing costs might be underway: through an increase in FPI investment limits for short-dated debt and through more Open Market Operations by the RBI this year.

However, with US yields likely to test 3.25% in the medium term, the 10Yr GOI yield should test 8% later this year. Beyond that, in case the US 10Yr happens to break above 3.25% also, then the 10Yr GOI might also rise towards 9.00% in the long-term, perhaps in 2019. For that, we might need Brent to break above $80 and target $90.

The GOI 10 Year yield rose also due to the initial fiscal deficit target (17-18) of 3.2% not being met. An interim attempt to control the Govt’s borrowing costs might be underway: through an increase in FPI investment limits for short-dated debt and through more Open Market Operations by the RBI this year.

However, with US yields likely to test 3.25% in the medium term, the 10Yr GOI yield should test 8% later this year. Beyond that, in case the US 10Yr happens to break above 3.25% also, then the 10Yr GOI might also rise towards 9.00% in the long-term, perhaps in 2019. For that, we might need Brent to break above $80 and target $90.

CAN LENDING RATES RISE?

CAN LENDING RATES RISE?

Movement in the 10Yr GOI is often mirrored in a similar move (after a lag) in the RBI’s Repo rate and in the SBI’s Lending Rate, as seen alongside.

With the RBI MPC members remaining hawkish, it is possible to see a Repo rate hike in the June RBI meeting. Also, since the MCLR is very responsive to the Repo rate, there could be a danger of lending rates also rising by 0.25-0.50%.

Saandhy Ganeriwala

Saandhy is a postgraduate in Economics, but like all good market-men, he seeks confirmation from technical analysis charts for his macroeconomic ideas. His research is a good mix of charts, stats and econ. Apart from that, he calls himself a news junkie and an occasional writer.

Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877