Amplitude Probability Distribution for Currencies

Apr, 26, 2002 By Vikram Murarka 0 comments

It is important to know the characteristics of any market that we trade. This helps us approach the market with more awareness and reduces the element of surprise. It also helps us formulate our trading strategies.

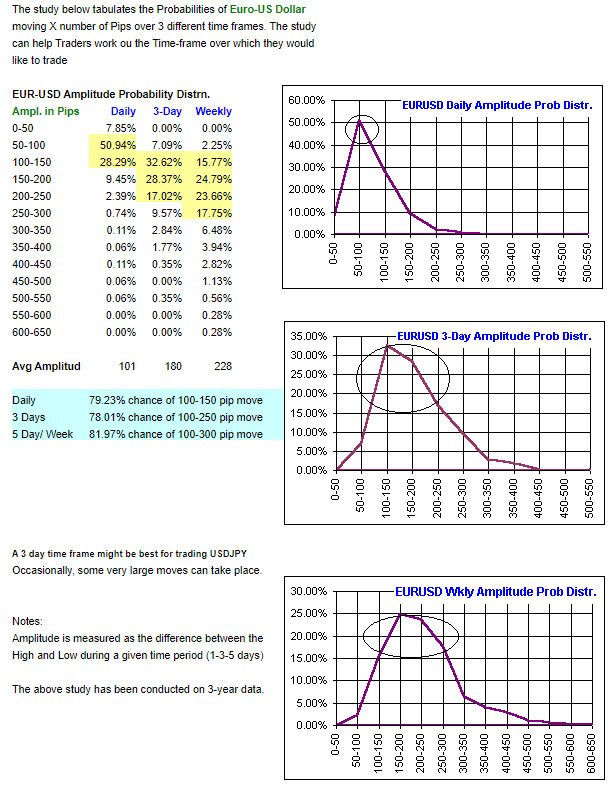

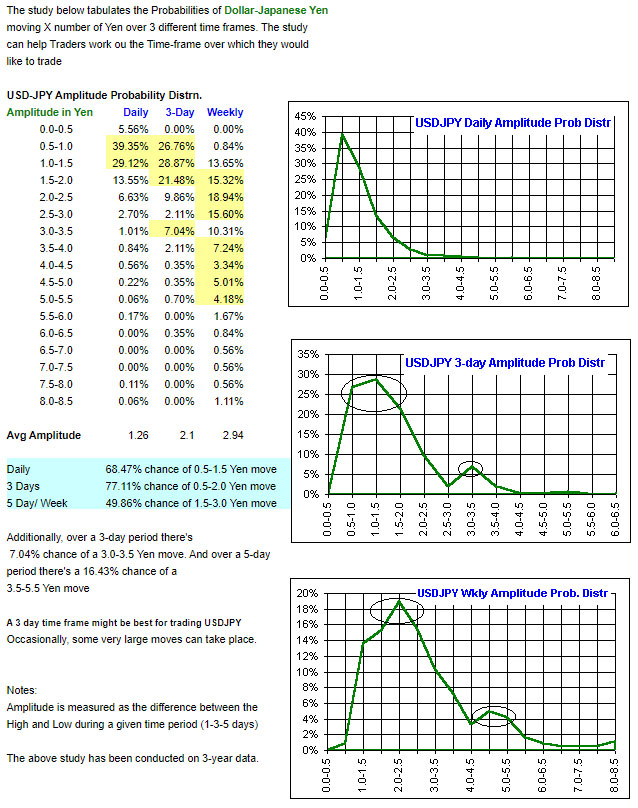

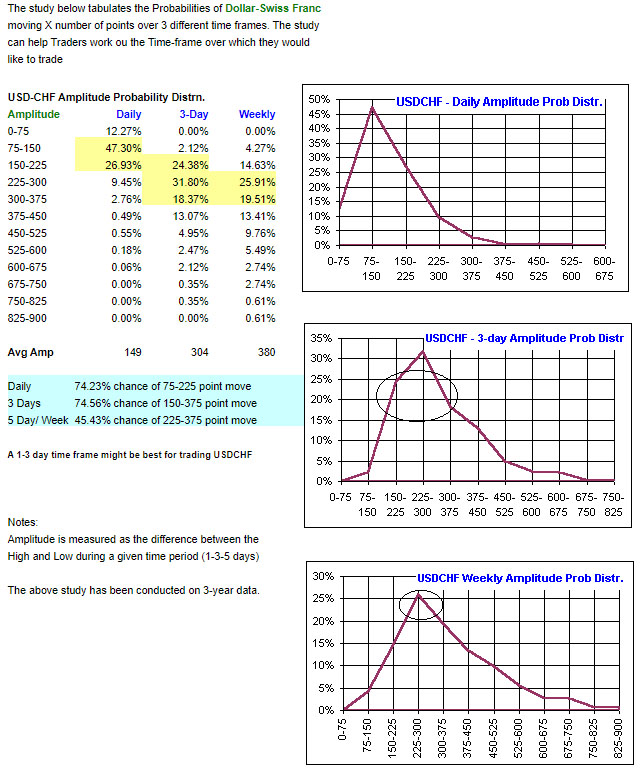

In the following pages we try to answer the question, "How much do currencies move over various time frames". We have examined price data for EUR-USD, USD-JPY and USD-CHF for the last 3 years to see what is the Amplitude (difference between the High and Low) for these currencies over 1, 3 and 5 day time frames.

We believe that this might be helpful in 1) enabling us to choose a suitable Time Frame for our trading activity and 2) forming an idea of how much profit/ loss might be reasonably expected in our chosen time frames.

Put into other words, this is also an examination of the Volatility of the subject currencies in various time frames.

Please click on

EUR-USD

USD-JPY

USD-CHF

EURUSD Amplitude

USDJPY Amplitude

USDCHF Amplitude

Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877