Japanese Yen Long term Forecast - Apr'18

Apr, 18, 2018 By C S Vijayalakshmi 0 comments

18-Apr-18: USDJPY 107.24/ EURJPY 132.80

RECAP

In our Mar-18 edition, we were looking for some stability in Dollar Yen within the 105-108 region. This has played out well with a bounce from a low of 104.64 in March to a high of 107.80 so far in April.EXECUTIVE SUMMARY

Dollar-Yen bounced from levels near 104.66 in March’18 and could now head towards 108.50 or even 110 in the near term as part of a corrective bounce after the sharp fall from 115 since Nov-17. The longer term trend targets 104.

TEST 110 BEFORE 104?

The channel support near 104.64 has held well pushing up the pair to current levels of 107.27. Note that 108.50 (21-week MA) is a crucial resistance from where the market may start coming off immediately. But, in case there is a sharp rise above the 21-Week MA (more likely) then we can see a further rise to 110. In either case, we would not look for a rise past 111.00 and our preference remains for an eventual fall towards 104. USDJPY PROJECTIONS

USDJPY PROJECTIONS

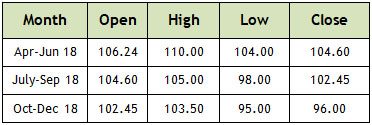

As mentioned, the overall long term view for USDJPY remains bearish, with a possible target of 106-104 levels by this quarter end, preceded by a rise to 108.50-110.00. Should the market close lower near 104.60 by June-July, it can accelerate further down, breaking below 100 to target 97 and 95 by the December quarter. The projections alongside reflect this possibility.

EUR-JPY UPSIDE LIMITED TO 133-135-138. TARGET 125.

EUR-JPY UPSIDE LIMITED TO 133-135-138. TARGET 125.

EUR-JPY (132.57) has came down from levels near 137 in Feb-18, pushed down by the trendline coming down from 170 in 2008. This trendline now provides Resistance near 138. While that holds, the EUR-JPY should eventually fall towards 125 in the longer term, say by September. Immediate Resistances at 133 and 135 could also push the Cross lower.

Assuming a level of 1.2450 on EURUSD and 130 on EURJPY, we get a projection of 104.60 for Dollar-Yen for end-June. Thereafter, a lower level of 1.22 on Euro-Dollar and 125 on Euro-Yen gives us 102.45 for Dollar-Yen for September end.

NIKKEI 22158.20/ NIKKEI-DOW RATIO 0.902/ USDJPY 107.24 /JPYINR 61.20/ USDCNY 6.2868

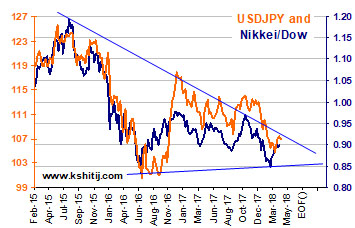

Nikkei (22158.20) moves strongly in line with the movement in Dollar-Yen. Looking at the chart above, Nikkei tested 20550 in Mar’18 on the downside before coming back to levels above 21800. This could limit the downside in the immediate time frame as the Bulls may take the Nikkei up towards 22320-22500 before another pause is seen. This would correspond with 108.50 on Dollar-Yen. In case the index moves breaks 22500, it could target 23500-24000 and trigger a rise in USDJPY towards 110. On the other hand if 22500 holds on Nikkei, immediate Yen weakness could be limited to 108.30-108.50 itself.

Nikkei (22158.20) moves strongly in line with the movement in Dollar-Yen. Looking at the chart above, Nikkei tested 20550 in Mar’18 on the downside before coming back to levels above 21800. This could limit the downside in the immediate time frame as the Bulls may take the Nikkei up towards 22320-22500 before another pause is seen. This would correspond with 108.50 on Dollar-Yen. In case the index moves breaks 22500, it could target 23500-24000 and trigger a rise in USDJPY towards 110. On the other hand if 22500 holds on Nikkei, immediate Yen weakness could be limited to 108.30-108.50 itself.

A strong correlation is also seen between the Nikkei/Dow (0.902) ratio and Dollar-Yen, with the Yen strength being manifested as a weaker Nikkei relative to the Dow. In the chart above, the Nikkei/Dow ratio has Resistance near 0.9230 and could trend down towards 0.85 in the longer term. If so, upside in Dollar-Yen would be limited to 110 and the longer term trend movement would be towards 104.50 on the downside.

The immediate scope of Nikkei-Dow ratio rising towards 0.9230 could take Yen to 108.50-110.00 by Apr-May’18 before the longer term downtrend reasserts itself.

YUAN SUGGESTS 108.50 MAY CAP USDJPY

A strong correlation is also seen between the Nikkei/Dow (0.902) ratio and Dollar-Yen, with the Yen strength being manifested as a weaker Nikkei relative to the Dow. In the chart above, the Nikkei/Dow ratio has Resistance near 0.9230 and could trend down towards 0.85 in the longer term. If so, upside in Dollar-Yen would be limited to 110 and the longer term trend movement would be towards 104.50 on the downside.

The immediate scope of Nikkei-Dow ratio rising towards 0.9230 could take Yen to 108.50-110.00 by Apr-May’18 before the longer term downtrend reasserts itself.

YUAN SUGGESTS 108.50 MAY CAP USDJPY

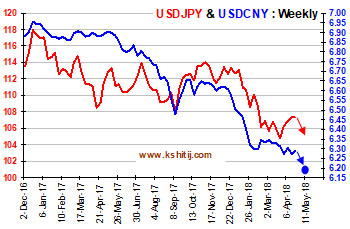

Strong correlation between the Chinese Yuan and the Japanese Yen is charted above with both currencies strengthening since Dec’16 as shown on the chart.

USDCNY has been in a multi-year down trend and after testing 6.3044 last week, the pair seems to have begun another sharp fall which could lead towards 6.25-6.20 in the coming 4-5 weeks (say by June’18). This could indicate a stronger Yen in the same period taking it down towards 105-104 levels. If USDCNY remains stable, and spends some more time near current levels, JPY could either remain stable too and the upside may be capped at 108.50, instead of 110.00.

RUPEE TO STRENGTHEN AGAINST YEN

Strong correlation between the Chinese Yuan and the Japanese Yen is charted above with both currencies strengthening since Dec’16 as shown on the chart.

USDCNY has been in a multi-year down trend and after testing 6.3044 last week, the pair seems to have begun another sharp fall which could lead towards 6.25-6.20 in the coming 4-5 weeks (say by June’18). This could indicate a stronger Yen in the same period taking it down towards 105-104 levels. If USDCNY remains stable, and spends some more time near current levels, JPY could either remain stable too and the upside may be capped at 108.50, instead of 110.00.

RUPEE TO STRENGTHEN AGAINST YEN

JPYINR () tested 0.6220 towards the end of Mar’18 and has come off from there. Note that 0.6225 is an important near term resistance and has a potential to push JPYINR down towards 0.6000-0.5850 over the next few weeks before attempting to rise towards 0.63-0.65 in the longer run.

Such a move would be in line with an immediate rise in Dollar-Yen to 108.50-110.00 before a longer term decline towards 104.50 and lower.

JPYINR () tested 0.6220 towards the end of Mar’18 and has come off from there. Note that 0.6225 is an important near term resistance and has a potential to push JPYINR down towards 0.6000-0.5850 over the next few weeks before attempting to rise towards 0.63-0.65 in the longer run.

Such a move would be in line with an immediate rise in Dollar-Yen to 108.50-110.00 before a longer term decline towards 104.50 and lower.

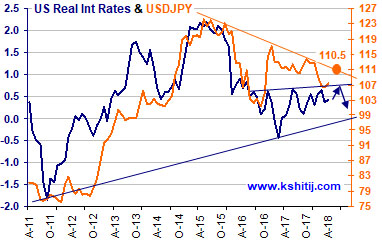

US REAL INTEREST RATE & USDJPY

US REAL INTEREST RATE & USDJPY

The US 10YR Real Interest rate (nominal minus CPI inflation) has scope to rise towards 0.74 before coming off from there. Given its broad correlation with Dollar-Yen, if the US 10YR real interest rate rises towards 0.74, it could pull up USDJPY towards 110 before the longer term fall towards 104.50 starts, as shown in the chart alongside,

Recently the volatility and movement in the Japanese Yen has been much higher compared to the movement in the US 10Yr Real interest rate which has been consolidating in a narrow range. Hence, it is also possible that the interest rate may not 0.74 but the USDJPY could fall faster.

CONCLUSION

Dollar-Yen is likely to move up towards 108.50 or maximum 110 by May ’18 followed by a fall towards 106-104 by June-July’18. Thereafter, the currency pair is likely to move down sharply below 100, targeting 97-95 by the Dec’18 quarter. Overall long term view is bearish for USDJPY.

C S Vijayalakshmi

Vijayalakshmi has the rare ability to look at charts using both Classical charting as well as Elliot Waves, which she combines with excellent proficiency in Excel. A growing presence in the social media sphere, she is also an accomplished danseuse and choreographer.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

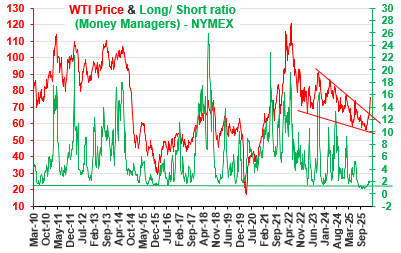

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877