How do our forecasts compare with those of our peers?

Mar, 06, 2018 By Saandhy Ganeriwala 0 comments

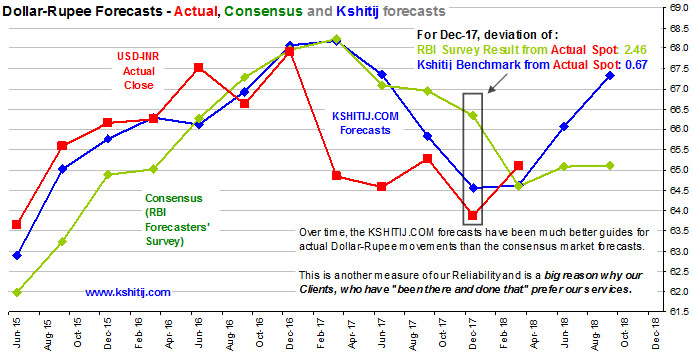

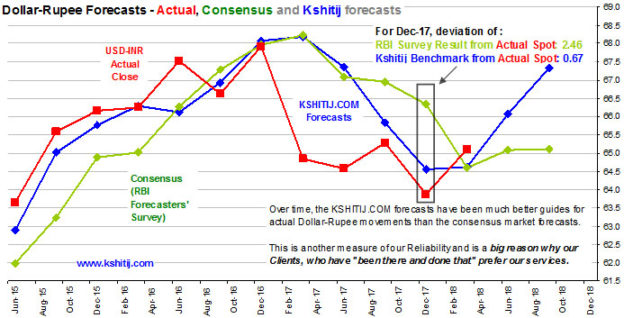

Anyone wanting to evaluate our service would ask the above question. As an answer, we compare our forecasts with the results of the RBI’s bimonthly Survey of Professional Forecasters (SPF), which captures the market’s consensus expectation for USDINR for forthcoming quarters.

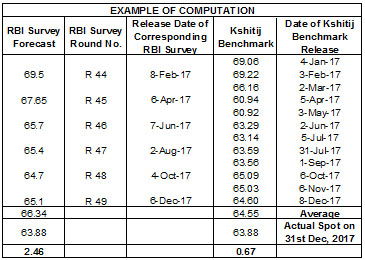

As an example, for the USDINR rate at end of Dec ‘17, there were 6 forecasts which the RBI’s survey pool of professional forecasters made. These are displayed in the 1st column of the adjacent table. The mean of these 6 forecasts ie 66.34 can be regarded as the market’s consensus forecast for USDINR for 31ST Dec, 2017. Correspondingly, over the preceding year, we had made 12 Kshitij monthly forecasts for the USDINR rate expected to prevail on 31ST Dec, 2017 (see column 4). The mean of these 12 Kshitij forecasts ie 64.55 ultimately turned out to be closer to the actual spot rate (63.88) of USDINR on 31ST Dec, 2017.

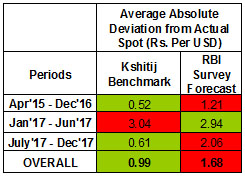

In fact, over the period Apr-2015 till Dec-2017, the average absolute deviation of Kshitij forecasts from the actual quarter end spots has been Re 0.99 per USD, much narrower than the deviation of the RBI SPF’s forecasts of Rs 1.68 per USD.

We might be the first and only forecasting service to carry out such an analysis, comparing ourselves with our peers, as a means to judge how much value we can add compared to others. This is part of our effort to increase our Reliability. Please also read:

How much of the market movement do our forecasts capture

Stop Press! Or, why KSHITIJ.COM is Reliable

View our March Economic Calendar.

Saandhy Ganeriwala

Saandhy is a postgraduate in Economics, but like all good market-men, he seeks confirmation from technical analysis charts for his macroeconomic ideas. His research is a good mix of charts, stats and econ. Apart from that, he calls himself a news junkie and an occasional writer.

Array

As expected in our last report (09-Dec-25, UST10Yr 4.16%) the US Fed indeed reduced the Fed Rate further by 25bp to 3.75%. We had also said that we expect another …. Read More

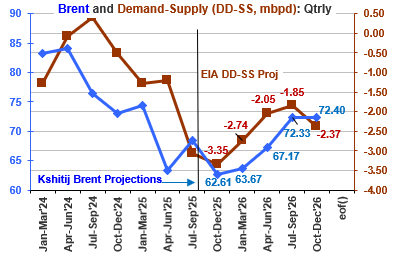

Crude prices have been steady and tilted to the downside over the last few months. Hovering near $60, can it gradually move up towards $70? Or could there be room for more fall towards $55/50? … Read More

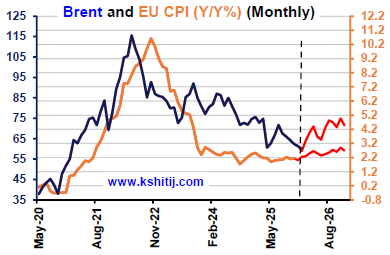

Brent and EU Inflation has been low in the last few months. If both the EU Inflation and Brent see a gradual rise in 2026, the upside could be …. Read More

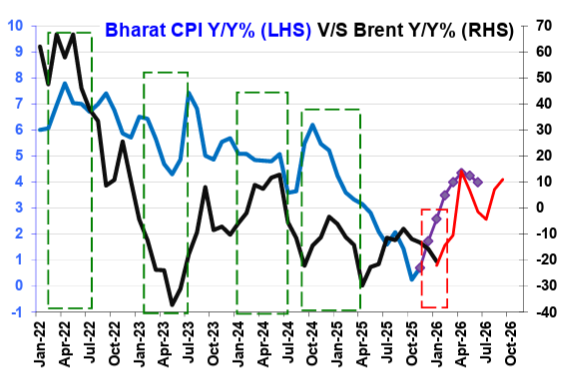

In our 04-Dec-25 report (10Yr GOI 6.54%) we conceded that RBI may cut the Repo due to the unexpectedly sharp fall in the Oct-25 CPI to 0.25%. The RBI then indeed … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our January ’26 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877