The Dow and the Dollar - Strong Correlation

Dec, 28, 1999 By Vikram Murarka 0 comments

28 Dec, '99

Trends in 1999

The currency market witnessed two main trends in 1999 - the Euro's decline and the rise of the Yen. These trends coalesce into a 21.5% decline in Euro-Yen, from 132 in the beginning of the year to 102 in December. In the last quarter of the year, the market witnessed a very strong correlation between the strength of the US Equity market and the strength of the US Dollar a gainst the Euro. The common refrain in the currency market was, "The Dow leads the Euro pip-by-pip." In this paper we examine the relationship between the Dow Jones Industrial Average and the Dollar-Euro rate (EURUSD inverted) more closely.

Dow-Dollar are highly correlated

As can be seen in the Chart above, the DJIA and the Dollar have moved largely in tandem after 1995. The period 1994 to 1999 itself displays a high correlation on 78.9%, but this can be broken into 2 periods, as seen in the table alongside (detailed table provided at the end). From this we draw an obvious conclusion - the Dollar strengthens along with the Dow.

Vulnerability

There is a flip side to this observation - When the Dow is not rising, the Dollar falls. In fact, the Dollar tends to fall more (in relation to its own range) than the Dow in such periods.

Observe the periods Aug-Oct '97, May-Aug '98 and July-Oct '99. In these periods, each lasting 3-4 months, the Dow fell an average of 14% (6.8% of its entire 1994-199 range) and correspondingly the Dollar fell an average of 7%. (64.42% of its entire 1994-199 range). Even the period Jan '94 to March'95 exhibits the same features - the Dow rose very slowly, accompanied by a prominent downtrend in the Dollar.

The Dollar is disproportionately vulnerable to weakness in the Dow.

Polynomial Curves

We have plotted Polynomial curves of the 6th degree for both markets. Their projected values 60 trading days hence can be seen on the graph above.

According to these projections, the Dow should continue to rise (but with lesser momentum than seen till now) to reach a little higher than 11500. This is in keeping with our earlier analysis (see "The Colour of Money" dated 21/12/1999) wherein we have contended that the Dow should not see a sustained rise beyond 11600 over the next 2-3 months.

The curve for the Dollar-Euro rate indicates a sharp increase in the Dollar's strength, taking the rate to 1.10 (or the Euro-Dollar rate to 0.9090). We are inclined to take this projection with a pinch of salt. Here is why:

- the polynomial has never risen so sharply (as projected) in the period considered. The natural question is, can it now rise exponentially?

- If the Dow is not expected to rise very sharply, then it should not be possible for the Dollar to rise sharply either. As such, once again the projection is suspect.

And if the actual market does turn out to obey the polynomial's projection, the Dollar's strength can be expected to be capped near 1.10 (or 0.9090 on the Euro-Dollar rate).

Conclusion - Careful on the Dollar, please

If, for any reason (fundamental and or technical), you happen to view the bullishness for the US economy (read Nasdaq / Dow) and the US Dollar with caution or dread, this piece should give you another reason to add to your list of worries.

There would have to be some sea-change, something totally unexpected, something not yet priced into the market, something which is exceptionally favourable to the USA for the Dow and the Dollar to continue to soar.

Apart from all of the above, in the markets, they say, it pays to Buy Low and Sell High.

Study reviewed on 2 Jul, '01

Recap

We had last studied the relationship between the Down Jones Industrial Average and the $-Euro (inverse of Euro-$) rate on 28th December '99, and had detected a strong positive correlation between the two. This correlation suggested that the Dollar would weaken against the Euro due an expected fall in the DJIA Index.

Ironically, soon after we completed the study, the market proceeded to prove its findings to be incorrect. Over the period 30th Dec to 14th March, while the Dow fell from 11497.12 to 9811.24, the Dollar actually strengthened against the Euro as the Euro-$ rate fell from 1.0088 to 0.9680. In fact the Dollar continued to strengthen against the Euro right through to May when the Euro hit an all-time low of 0.8845.

Inversion

We thought it would now be a good idea to re-examine this relationship. The graph alongside strongly suggests that the positive correlation seen uptil Dec '99 has been broken and that in the months ahead the Dollar can continue to gain against the Euro even as the DJIA Index falls. The thick Orange and Green "Trend Curves" are Polynomial curves generated by the statistical Method of Least Squares and have traced the overall direction and movement of the two series (Dow and Dollar) till now. Since these can be used to predict the future movement of the underlying series and these two curves are seen to be crossing each other now, we are forced to seriously consider the possibility that the Dollar can now continue to rise even as the DJIA falls.

Rationale

What could, however, bring about such a change in the relationship, a change which seems to fly in the face of economic logic (how can a country's currency strengthen over a long period of time while its stock market falls?)

1) The best explaination that we can find is that a strong Dollar (against the Euro) continues to be in the best interests of the USA, which continues to be dependent on foreign investments to fund its massive trade deficit. The Dollar is the symbol of US supremacy and the USA will do everything within its means (and more) to safeguard it.

2) The Dollar is an international issue, while the DJIA is more of a domestic issue. The US can afford to let the Dow lose ground as long as the Dollar remains strong.

3) If the Dollar weakens along with a weakening of the Dow, the foreign investor will suffer on account of both a fall in the Dow as well as currency depreciation. Surely a strengthening Dollar has been a big incentive drawing investors to the USA. It is in the interest of the USA to see that this incentive remains intact.

4) Oil prices, now ruling near $30-31 per barrel are unlikely to go up much further from here and thus, going forward, they may not add significantly to inflation. On the other hand, if the Dollar weakens at this juncture, the trade gap will increase much more.

5) The Oscillators on the Daily and Weekly chart support a bearish Euro view.

6) If a currency is to be manipulated, the US can be expected to do a much better job than the hamhanded ECB.

So continues the battle of the Dollar versus the Euro, for it is a battle to own the rights to the universal symbol of Wealth - will Wealth be symbolised by the $ or by an "E".

Study reviewed on 6th Feb, '01

We last studied the relationship between the Dow Jones Industrial Average and the Dollar-Euro rate(inverse of the conventional Euro-Dollar rate) on 28th Dec. '99 and on 2nd July 2000.

The conclusions so far have been that:

(a) The Dow and the Dollar are positively correlated (the Dollar strengthens alongwith the DJIA) and that

(b) The Dollar can strengthen even if the Dow does not.

The second conclusion comes in for greater scrutiny in this Research.

The clue that it is not only the Dow that drives the Dollar-Euro rate comes from the fact that the Dollar strengthened over 1999-2000 even though the Dow remained largely rangebound between the two extremes of 11700 and 9800 (Period C alongside). Further, in the period Jan-March 2000, the Dollar strengthened even while the Dow fell and then later, over the period Oct-00 to Jan-01, USD fell while the Dow was steady.

|

We can say that during these two periods, the Dollar was following the NASDAQ rather than the Dow, with Correlation between the Nasdaq and Dollar-Euro during these periods being in the region of 55-77%(as shown in the Correlation Table above). |

Looking ahead, while the Dow Jones stays above 10300, and certainly above 9700, the chances of it climbing above 11000 again remain alive. If the recent Interest Rate cuts in USA and the proposed Tax cuts fail to deliver the goods, only then would the Dow fall below 10300. As of now it might be a little early to write off the Dow.

It has been a very long time since Fiscal Policy was used as a tool in Economy management. It is also much more difficult to track and analyse the effects of Fiscal Policy and as Alan Greenspan's Monetary Policy has held sway over the past decade, the markets are probably not factoring in the Tax Cuts proposed by President Bush well enough. The possibility that these Tax Cuts may prove to be a positive catalyst for US Stocks has to be borne in mind.

Forecasting for the Nasdaq is tantamount to taking a stance on the future of "Technology". The bottom line, signified by the very strong Support at 2000-1700, is that Technological (and IT) advancement cannot be reversed.

At the same time, we are not going to see the logic-defying valuations of early 2000. Unless there is indeed a "Hard Landing", it would not be inconceivable for the Nasdaq to rise to 3400 by the end of the year, as compared to 2627 on 12th January 2001.

The first and obvious implication is that taking a stance on Dollar-Euro (or Euro-Dollar) is almost the same as taking a stance on the US Equity markets. Thus, a Long-Dollar / Short Euro position can be hedged with Put Options on the DJIA and on the Nasdaq. Or, looking at it the other way round,investments in US Equities can be hedged with a Short-Dollar / Long Euro position or with a Euro Call Option.

Array

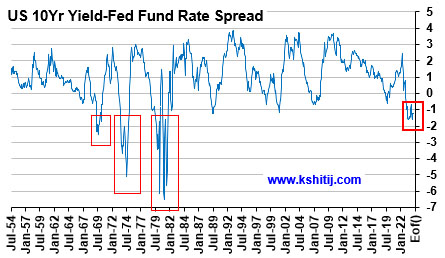

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

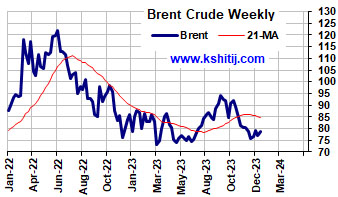

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

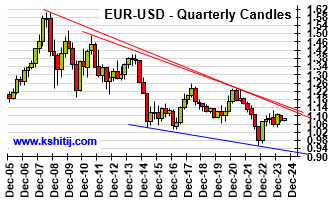

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877