Study on US Treasury Yields

Feb, 24, 2017 By Vikram Murarka 0 comments

EXECUTIVE SUMMARY:

Our last reading was for chances of slow decline towards 2.3-2.2% through Feb and March which did not happen, as Yellen possibly does not want to fall "behind the curve" and has kept even a March hike as a possibility. Going forward, it is quite possible that the Yield Curve may actually steepen in the coming months as US Inflation is moving up towards 2.0%, labour market conditions continue to strengthen and US data is doing relatively better than other countries.

US 10Yr (2.38) – Immediate Support at 2.34% and at 2.25%

The 10Yr (2.43%) is now caught between Support at 2.25% and Resistance at 2.60%.

The 10Yr (2.43%) is now caught between Support at 2.25% and Resistance at 2.60%.

It may break higher to target long-term Resistance at 3.00% (high of Dec 13) over the course of the year. Given that the market is pegging a March rate hike at 27%, there will be huge volatility in case the Fed moves early.

The uptrend is still the dominant trend but there could be chances of sideways movement till March 15th. Support seen at 2.25%.

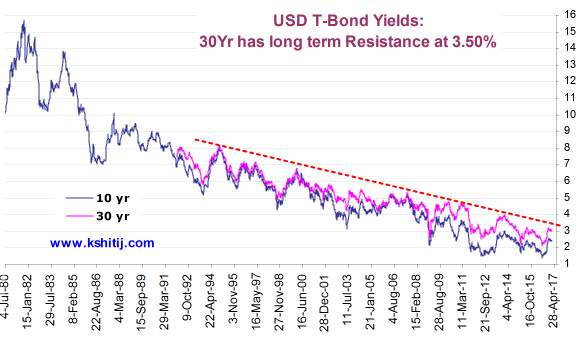

US 30Yr (3.02) - Resistance at 3.06, 3.13 and 3.50% for Mid to Long Term

In line with our expectation of a dip to 2.90%, the 30Yr (3.04%) made a low of 2.96%.

In line with our expectation of a dip to 2.90%, the 30Yr (3.04%) made a low of 2.96%.

It now hovers just above its near-term Support at 3.00% so far. It continues to face medium term resistance (since 2010) near 3.13%, and a rise past 3.13%, if seen, can target 3.25% or maximum 3.50%, the long-term resistance since 1994.

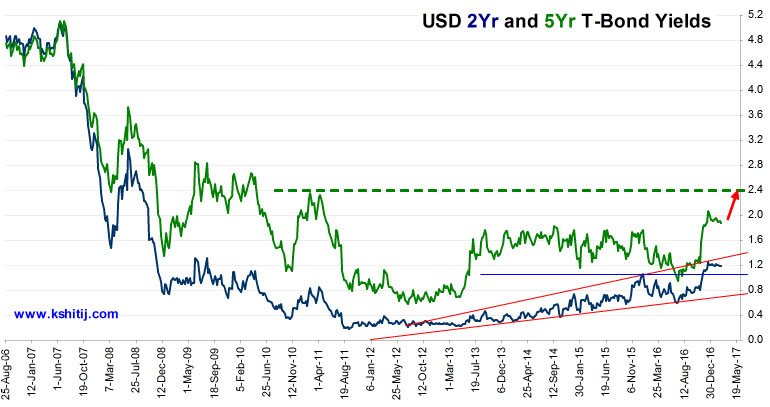

US 2Yr (1.18) – Key Resistance at 1.26; 5Yr (1.87) –Could move up towards 2.50

The 2Yr (1.22%) may rise only till 1.50% or max till 1.60%. The US 5Yr (1.93%) could see a sharp rise towards 2.50% in the coming months.

The 2Yr (1.22%) may rise only till 1.50% or max till 1.60%. The US 5Yr (1.93%) could see a sharp rise towards 2.50% in the coming months.

Yields may remain sideways, or even rise a bit till the next FOMC meeting on 15th March. Apart from Fed action, yields could rise because of Selling of bonds by the Administration to fund the proposed fiscal push of US$1 trillion, as announced by Trump government.

On its part, the Fed is unlikely to be impetuous in cutting its US$ 4 trillion balance sheet by selling bonds. Its caution is evidenced by the fact that it has said it will stop re-investing funds from maturity of bonds only when it is confident of inflation and when Fed Rates are high enough that they can be pushed down again (to foil a slowdown) if needed.

CONCLUSION:

One of the major global macros the Fed may keep an eye on is Brent, as that may have a direct impact on the CPI. Currently Brent trades near $56.34, but is inching higher. In case it rises past $58, it could gather steam and try to break above $60 also. Should that happen fast enough, it could push the Fed into hiking in March itself. While Brent remains below $58, the Fed might wait till June.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877