Japanese Yen Long term Forecast – May’17

May, 09, 2017 By Vikram Murarka 0 comments

09-May-17 / Yen 113.72/ US-Japan 10Yr yield spread 2.36%

EXECUTIVE SUMMARY:

Recap: Dollar-Yen has bounced back from levels just above 108, mentioned as the low for Apr-Jun quarter in our previous report. Now, looking at the next 2-3 months, the currency pair could remain ranged within 108-115 region with a possible extension to 116-118 levels.

USD/JPY Monthly Candles

Dollar Yen has come down from levels near 118.66 since the last 4-months. While the important support near 108 holds, we could possibly expect a rise towards 114.50 in the coming weeks with a possible extension towards 115-116. Thereafter a fall back towards 108 is possible. Overall a sideways movement within 116-108 is possible till Sep’17 before a sharp break on either side (120 or 105).

Alternatively, we also look for possibility of breaking above 115-116 resistance levels in the first attempt. This is less preferred for now but has a decent chance that the current bounce from 108 could extend towards 120.

Quarterly Projections

We keep readings for 3-quarters within the 116-108 region intact with a possible extension to 118 or 106 on either side of the range. Thereafter, we would have to wait for confirmation of a break on either side to decide on further course of movement.

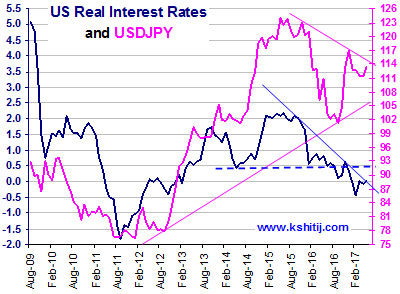

US Real Interest Rates

US Real Interest Rates

The US Real interest (0%) rates and Dollar-Yen have good directional correlation and both seem to be heading towards a near term resistance above current levels. In case the respective resistances near 0% and 114.50 hold, we may see a sharp decline in the near term.

We prefer continuation of the current rise at least till mid-June before a decline starts. Although there is enough room on the downside for a sharp decline in both the yield spread and Dollar-Yen, there could be some consolidation or range bound movement before the actual fall. Only on a break above the current resistances would we shift our focus to an upside possibility (120 on USDJPY, 0.44% on US Real Interest Rates).

US-Japan 10Yr Yield Spread

US-Japan 10Yr Yield Spread

The US-Japan 10Yr yield (2.34%) spread could rise towards 2.40-2.50% before coming off to test 2.2%. in that case there could be a possible triple top formation followed by a corrective fall.

Good directional correlation is visible between the yield spread and Dollar-Yen. Overall both could remain range bound for the next couple of months before taking a call on further direction.

Conclusion

A rise in Dollar-Yen towards 115-116 before falling off towards 108 is the preferred course of movement for the next 3-4 months. A possible extension towards 106 or 118 is open.

Alternate Scenario: The current bounce from support near 108 could break above 115-116 and rally towards 120 without seeing any correction from 115-116. In that case the medium term outlook would be very bullish. We give lesser preference to this just now (about 40%).

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877