A Tale of Two E-mails

Jul, 14, 2004 By Vikram Murarka 0 comments

A Tale of Two E-mails.....As many of you know, we provide a twice-daily trade recommendation service called "FX Thoughts of the Day". We are one of the several such services on the Internet and cannot claim any special superiority for ourselves. The one thing we do try and provide at all times is honesty.

A couple of weeks ago we received the following e-mails. One gentleman had lost 75% of his account trading our recommendations, while another had made 25%. We ourselves had lost 2% of our account. Our trade recommendations being the same, what accounted for the wide difference in results achieved?

The Angry E-mail

What is this for a service !!!!!!!!!!

If I followed your trading advices for the last 10 days I lost 3/4 of my account!!!!!!

It is always the same, or your adviced entry is never touched (so a so called winning trade could never happen) and when touched, it was always stopped out.

And for such a service YOU DARE TO ASK MONEY FOR !!!!!!!!!

The Satisfied E-mail

Tiz sad to see so many losing. I have gained about 25% this week alone, using both your information and also using other guides. What brings the losses to mind is that people are not researching the market before investing. With the information you provide, plus studying the charts, financial news, etc, can't see why there is so much loss.

Reminds me of when I started this FX. Cold and green, I lost 50% of my account in ONE DAY, doing nothing but following information others provided without knowing what to do in the proper way.

Those who lose do so through not knowing what to do. Keep sending me the information please. It is a vital tool in helping me to continue to grow in understanding the financial markets.

The Trader who lost 75% was obviously very highly leveraged. Should he have been? In this issue of "The Colour of Money" we take up some issues that are seldom touched upon in the usual discussions on Forex trading. Certainly, we wish somebody had told us about these earlier - we would have lost lesser money and might have started making money faster.

In this Issue

- Hype, myths and misconceptions in the Retail FX market

- Contours and Parameters of the FX market

- Survival Tips. May lead to eventual success

HYPE, MYTHS and MISCONCEPTIONS

Hype:-

I/ we/ he/ she made 200%!

The reality, according to Parker FX Indexes, is that professional forex managers as a whole have lost 2.99% over the last 12 months and have made only 6.44% over the last 36 months on an UNLEVERAGED basis. The reality, also, is that most professional forex money managers employ very conservative Leverages of only about 5-10 times. Why? Because the lower the Leverage, the lower the Risk. The higher the leverage, the higher the risk.

So, the next time you look at someone's stupendously high Returns, the immediate question to ask is "What is your Leverage level?" That gives you an idea of the level of Risk the Trader carries. A high leverage magnifies Profits, no doubt, but it also magnifies Losses. That's the reason our Reader lost 75% of his account while we lost only 2%.

Myth:-

Trading FX for a living is easy/ Is the way to get rich quick

That is what most trading platforms/ brokerages would want a newcomer to believe, where ridiculously high leverages are touted as the keys to trading heaven. The other day we saw a brokerage offering 400:1 leverage on a Mini account! If things were so easy, why don't you see several more millionaires on Internet FX Forums?

The reality is that, like every other business (please remember that Forex Trading is as much a business like any other business), success comes over the long haul. In the beginning you start by losing money. Then you learn how not to lose money. Then you learn how to make money. After that you can start thinking about how to make big money. You have to have the patience, willingness and the requisite capital to stay the course. Obviously, shunning high leverage is the first thing to do while you are learning the ropes

You might want to read "The Evolution of a Trader" on our website in this regard.

Misconceptions:-

here are several misconceptions in the FX marketplace. We'll take up just two examples:

Indicators, indicators, indicators!

Many believe that knowing all the indicators offered with the normal charting software is the way to become a successful Trader. The fact is, Indicators are merely TOOLs to help us in devising a trading plan/ method. They are certainly not a substitute for the discipline and skill needed to execute the trading plan. Most professional traders/ investors usually employ just one or two indicators and that too of the simplest kind. Most of them adhere to the KISS (Keep it Simple, Stupid) principle.

Trading is the same as Investing

Many websites exhort you to "invest for your future" by trading forex. There is a big misconception here. Investing is closer to saving for the long term whereas trading is closer to buying and selling during relatively short periods of time. People can and do grow rich by doing either or both of these. But, by no stretch of imagination can trading on 1-minute and 15-minute charts be equated with "investing for the future". This is not to say that there aren't any genuine Investors in the currency markets. There certainly are, but their methods are different. They are the ones who would have been buying EURUSD in small lots on every 150-200 pip rise from 0.98 in March 2002 to 1.18 (at least) in May 2003. They might still be holding onto some of their positions, aiming for 1.40 next year. Why? Because they see the Euro as a better place to keep their savings than in the Dollar. As simple as that. They're not into the FX sweepstakes or championships of the "I made 200%" kind.

CONTOURS/ PARAMETERS of the FX MARKET

It is important to know the contours/ nature/ parameters/ dynamics of the market you operate in. Here are some of the things we've been able to figure out (no guarantees as to correctness, though):

Low intra-day movements

Since the currency markets are very liquid and very big on volume, the margins are thin. Daily movements are also small, as compared to other financial markets, like Equities. While it is not uncommon for individual Stocks to move 2-3% on an intra-day basis, individual currencies usually move only 1.0-1.25% on an intra-day basis. As such, in the currency markets, it might be easier to make money (in the long run) by trading on an intra-week (or better still intra-month or intra-year) basis than on an intra-day basis. This is especially true for those who are not full time traders and are able to devote only a couple of hours a day to trading.

Reasonable returns

In any business, you are doing a reasonably good job if you are making a consistent 10% net profit on capital employed, or even if your net profit margin (to sales) is 10%. Most businesses generate returns in the 10-15% range. The numbers thin down considerably as you start to go over 20%. Similarly, very few investments (especially in today's low interest rate environment) give you returns in excess of 6%. So, you would be doing very well if you generate 6% returns on your FX trading over the year (whether on an leveraged or unleveraged basis). In business, it pays to know what reasonable returns can be expected, and not to harbour unnatural expectations.

Low interest rates lead to low returns

The best of currency traders have been showing lower returns over the past few years, as compared to the 1990-95 period. In fact, we suspect that the same may be true for Equity and Bond traders in the G3 countries. Why? Its not they've all suddenly lost their touch. Look at the abysmally low interest rates prevailing worldwide (never mind the 25bp Fed rate hike last week). If the Interest Rate is the Cost of Capital, low interest rates tell us that there is very little demand for capital in the world right now. And if there is very little demand for capital, how can Traders of Capital (all currency, equity and bond market traders are essentially traders of capital) generate supernormal returns?

Perfect Competition

The currency market is the closest you can ever come to the textbook utopia of Perfect Competition. That being so, it is theoretically impossible for anyone to generate super normal profits.

SURVIVAL TIPS

Does all of the above mean that there's no point in trading FX? Certainly not. Perhaps there's no better market to trade than the currency market to trade in precisely because it is a perfect competition. While it is not possible to generate super normal profits for long periods of time in a perfect competition, it is also generally true that a perfectly competitive allows for survival and sustenance for all market participants. The only condition is that the Trader should not commit professional harakiri. Here are some Survival Tips that we've learnt from the School of Hard Knocks:

- Trade Small, which also translates into "Don't over leverage yourself"

- In fact, if you are new to trading, do Paper Trading/ Demo trading for at least two years. But do it with complete honesty and sincerity. That way you'll be saving a lot of tution fees which you would otherwise pay to the market. And learning will be cost less.

- Spend the money you've saved thus, on books and services which give you good, down to earth advise. Such as ours, of course :)

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

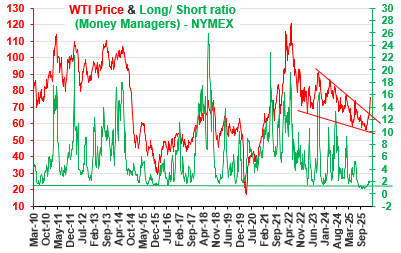

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877