Global Equities: Why we are unable to buy

Oct, 26, 2017 By Vikram Murarka 0 comments

26-Oct-17

Dow 23329/ Sensex 33056

RECAP

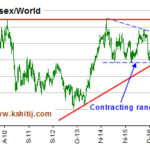

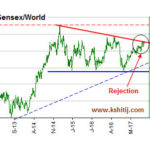

Our apologies that we were unable to publish this report in October 2017. In our last report dated 04-Sep-17, we said, “We remain cautious on the Dow and Sensex and bullish on the Shanghai, which is likely to outperform both.” We have been surprised by the continued strength in Dow Jones (23329) which has broken well above 22500 instead of starting a decline towards 20000. The Sensex (33056) has also moved up from 31809 instead of falling towards 30000. Thankfully, our bullishness on the Shanghai paid off a bit, although it could not compensate for our bearishness on the Dow and on the Sensex.

EXECUTIVE SUMMARY

While we have been surprised by the continued bullishness in global Equities in the last couple of months, we still see limited upside over the next month or two and still see chances of a corrective fall thereafter.

To read the full report.......... DOWNLOAD

Array

You may also like:

Global Equities: Time for a breather?

17, Apr 2017

Global Equities: Powering to the upside

16, May 2017

Global Equities: Time for Caution

10, Jul 2017-

Global Equities: Where should you put your money?

9, Jun 2017

Global Equities: Something for both Bulls and Bears

4, Aug 2017

Global Equities: Chinese Stocks to outperform USA and India

6, Sep 2017

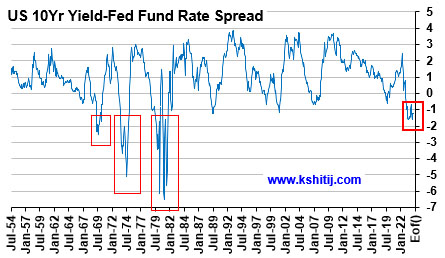

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

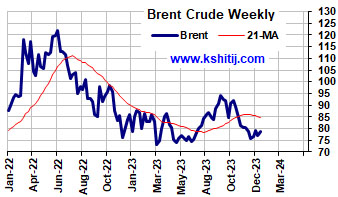

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

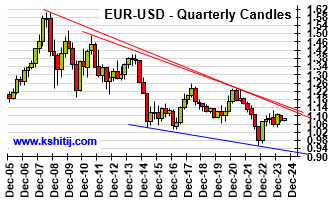

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877