Global Equities: Why we are unable to buy

Oct, 26, 2017 By Vikram Murarka 0 comments

26-Oct-17

Dow 23329/ Sensex 33056

RECAP

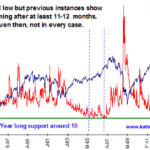

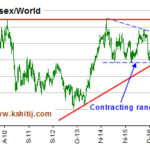

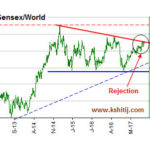

Our apologies that we were unable to publish this report in October 2017. In our last report dated 04-Sep-17, we said, “We remain cautious on the Dow and Sensex and bullish on the Shanghai, which is likely to outperform both.” We have been surprised by the continued strength in Dow Jones (23329) which has broken well above 22500 instead of starting a decline towards 20000. The Sensex (33056) has also moved up from 31809 instead of falling towards 30000. Thankfully, our bullishness on the Shanghai paid off a bit, although it could not compensate for our bearishness on the Dow and on the Sensex.

EXECUTIVE SUMMARY

While we have been surprised by the continued bullishness in global Equities in the last couple of months, we still see limited upside over the next month or two and still see chances of a corrective fall thereafter.

To read the full report.......... DOWNLOAD

Array

You may also like:

Global Equities: Time for a breather?

17, Apr 2017

Global Equities: Powering to the upside

16, May 2017

Global Equities: Time for Caution

10, Jul 2017-

Global Equities: Where should you put your money?

9, Jun 2017

Global Equities: Something for both Bulls and Bears

4, Aug 2017

Global Equities: Chinese Stocks to outperform USA and India

6, Sep 2017

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877