Global Equities: Time for a breather?

Apr, 17, 2017 By Ranajay Banerjee 0 comments

Dow 20453 / World 1843/ BRIC 270 / Nifty 9150 / Russell 2k 1345

The global equities are seeing a booming bull market, ignoring all the anxiety, worries and distrust among pundits. As the market adage goes, “a bull market climbs the wall of worries”. The current bull markets in the US and India are doing just that.

Within this context, the major uptrend may consolidate for a few months before climbing to greater heights. In this report we examine the outlook for the US markets, the World Index, the BRIC Index and Indian equities.

EXECUTIVE SUMMARY:

The global equity markets are in a strong uptrend and the rise may continue in the long term, but in the near term, the markets may take a long overdue rest as the overextended price needs to come down a bit before the rally can extend to the higher levels. We check both Dow Jones and Russell 2000 for the US market, the World Index, MSCI BRIC and Nifty, all of which point towards a rest period in the next few months.

Dow Jones: Higher chances of rally continuation

As seen above, the Dow has dipped from a channel resistance. As per Elliot Waves, the (3)rd of the 3rd might have gotten over at 21169 in early March, near the trendline and if so, a corrective dip towards 20450-20050 may be seen before the 5th of 3rd may start. Alternatively, the 3rd of 3rd may still continue till 21800 or even 22000-400 before any significant correction emerges. But as long as the resistance at 21100 holds, a dip towards 20450-20050 may be more likely. The greater chance of a correction is suggested by the broader small cap universe, the Russell 2000 Index below.

Russell 2000 – Broader market index

The Russell 2000 is a good indicator of the broader market strength of US equities, and it closely follows Dow Jones. As the log chart above clearly shows, the index is facing rejection at a 17-year old channel resistance and may find it difficult to break above 1420 immediately. As long as Russell 2000 stays contained, Dow may struggle to rise too.

World, Long Term: Strongly bullish but testing resistance

The chart above shows the MSCI World Index testing the long term resistance near 1850 which may not give way in the very first attempt and may produce a dip to 1750. That said, the overall uptrend remains intact while above 1750.

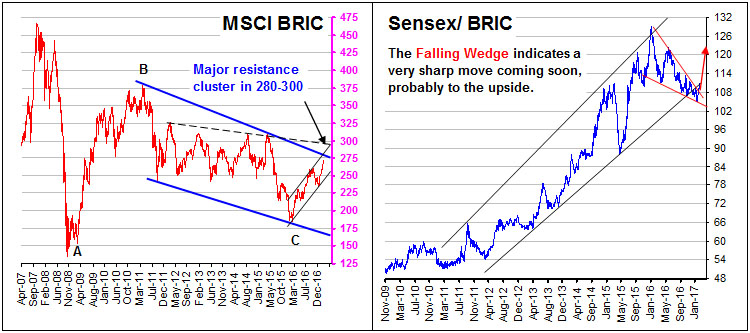

MSCI BRIC Index:

A similar kind of resistance is seen on the MSCI BRIC Index also, as evident from the left side chart above. The index may struggle near the resistance at 280-300 for a while before breaking above 300 successfully. In the meanwhile, Sensex may outperform the BRIC as signaled by the Sensex/BRIC chart on the right hand side. The falling Wedge formation indicates severe lack of downside momentum and a strong possibility of a breakout to the upside targeting 325-50. That said, while the Sensex may be in a huge bull market, it may also first take a pause for a few months.

Nifty long term: Shallow correction likely before huge rally

The chart above essentially shows the similarity of the two corrective phases seen in 2010-11 and 2015-16. If the two major corrective phases are similar, then the following price action may be expected to unfold”

In the first corrective phase in 2010-11, the correction from 6339 (A) to 4531 (C) was clearly divided into two clear parts (marked by blue AB and BC). Price wise, AB was 599 points against 1209 points of BC, a nice ratio of 1:2. Time taken by AB was 36 weeks against 24 weeks taken by BC, again a perfect ratio of 3:2. Both the time and price implied strong geometry at work which confirmed the bottom and unleashed the next bull market.

In the second corrective phase (2015-16), a similar market geometry was at work. Again, the entire decline from 9119 (A) to 6825 (C) was divided into 2 clear parts with the price ratio approaching 1:2 and the time ratio matching the price ratio here was 2:1.

This kind of price-time harmony generally indicates very significant top or bottom and in the first case, Nifty had doubled from the low of 4531 in the year 2011 to 9119 by year 2015. In the current and second instance, an appreciation of more than 30% has already been seen from the 2016 low of 6825 to the high of 8969 in the same year.

In the first instance, the initial rally from 4531 topped out at 6229 (D), about 1.6% lower from the previous high of 6339 (A). Similar rally and top was seen in 2016 too, as the rally from 6825 topped out at 8969 (marked by D), again 1.6% lower from the previous high of 9119 (A). In both the cases, corrections of 1100 points took place (marked by E).

If the list of these similarities continues in the same way, then we may expect the current bounce from 7894 (E) to fade in a long sideways phase in a loose range for 2-3 months, helping the currently overstretched Nifty to come down for a while before the next huge rally emerges.

Conclusion:

The Dow may have already started a corrective phase from the resistance of 21169 and may trace a long overdue sideways phase in the range of 20300-21500 (+/- 300). That would match nicely with the Nifty, which may also be entering a sideways phase between 8800-9300 (+/-200) for the next few months. This stable period could be followed by a year-end rally towards 22500 for Dow and 9900-10000 for Nifty.

Ranajay Banerjee

Leads the research team at KSHITIJ,COM. Has a deep understanding of Elliot Waves and a formidable memory of market history. Well known on Twitter as @ranajayb with a considerable fan following. Film scriptwriter by night.

Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877