Global Equities: Something for both Bulls and Bears

Aug, 04, 2017 By Ranajay Banerjee 0 comments

4-August-17 Dow 22026/ Sensex 32325

RECAP

In the report of Jul’17, we talked about caution for 3-4 months and expected relative underperformance of Sensex against BRIC and World. It was suggested that the Indian market be treated with caution till Oct’17. Despite the expected underperformance against other indices, Sensex itself has gained over 4% since our Jul’17 report.EXECUTIVE SUMMARY

The expected correction in the global markets has not materialized yet but the time for caution is also not past yet. At the same time, while we are cautious, some bullish factors (like weakening Gold/Copper ratio, and other emerging markets attracting strong inflows) are cropping up which may support increasing risk-appetite not only at the current high levels but even higher. Sensex underperformance relative to BRIC and World may continue.DOW: FACING MAJOR RESISTANCE

The rise of Dow from the 2009 low of 6470 to current high of 21681 can be divided into 3 major rallies. The current rally (upper red box) achieves equality with the first rally (lower red box) at 21813, only 0.6% higher from the current high of 21681. This projection equality coupled with the long term trendline resistance near 22100 makes 21800-22100 a formidable resistance and a place to be cautious.

The rise of Dow from the 2009 low of 6470 to current high of 21681 can be divided into 3 major rallies. The current rally (upper red box) achieves equality with the first rally (lower red box) at 21813, only 0.6% higher from the current high of 21681. This projection equality coupled with the long term trendline resistance near 22100 makes 21800-22100 a formidable resistance and a place to be cautious.

SENSEX: TIME FOR CAUTION

A similar combination of long term trendline resistance and equality projection can be seen in Sensex above. The current rally from 25754 (black box) achieves equality with the earlier rally from 22495 to 29077 (blue box) at 32300. The trendline resistance comes slightly higher at 32850-900. Therefore unless Sensex rises above 32900, downside risks cannot be negated completely and caution is recommended.

A similar combination of long term trendline resistance and equality projection can be seen in Sensex above. The current rally from 25754 (black box) achieves equality with the earlier rally from 22495 to 29077 (blue box) at 32300. The trendline resistance comes slightly higher at 32850-900. Therefore unless Sensex rises above 32900, downside risks cannot be negated completely and caution is recommended.

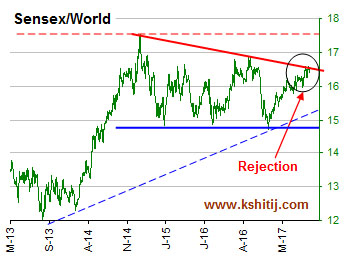

SENSEX MAY UNDERPERFORM BRIC AND WORLD

|

|

The Emerging markets markets are seeing a lot of inflow and even a country like Mexico, which stands in a direct conflict with the President Trump of the USA (its most important neighbor and trading partner), is seeing major gains. As seen above, the Trump Presidency has failed to negatively impact Mexican equities. Contrarily, it seems to have been beneficial for Mexican equities.

The Emerging markets markets are seeing a lot of inflow and even a country like Mexico, which stands in a direct conflict with the President Trump of the USA (its most important neighbor and trading partner), is seeing major gains. As seen above, the Trump Presidency has failed to negatively impact Mexican equities. Contrarily, it seems to have been beneficial for Mexican equities.

TURKEY: BREAKOUT FROM MULTI-YEAR TRIANGLE CONSOLIDATION

Turkey is another country where the global perception about its economy has failed. The country has been in a phase of intense political disturbance in the last few months but it seems that the turmoil has actually helped the equity market to end its multi-year consolidation and resume the long term uptrend in a very sharp manner.

2016 saw a failed coup by a faction of the army, terrorist attacks and the Turkish Lira coming under intense pressure but a large government stimulus has helped the GDP to recover from -1.8% (Dec’16) to +5% (Mar’17) and boosted equities. Despite the fear of it turning to be a “gray rhino”, the index may rise another 10% in the coming quarters.

Turkey is another country where the global perception about its economy has failed. The country has been in a phase of intense political disturbance in the last few months but it seems that the turmoil has actually helped the equity market to end its multi-year consolidation and resume the long term uptrend in a very sharp manner.

2016 saw a failed coup by a faction of the army, terrorist attacks and the Turkish Lira coming under intense pressure but a large government stimulus has helped the GDP to recover from -1.8% (Dec’16) to +5% (Mar’17) and boosted equities. Despite the fear of it turning to be a “gray rhino”, the index may rise another 10% in the coming quarters.

SHANGHAI: PERSISTENT UPTREND

Despite all the worries about the Chinese economy, the Shanghai Index trades near a 19-month high. As long as the support at 3150 holds, the trend remains firmly up and a break above 3300 may open up 3450-3500, appreciation of another 4.5-6.0%. If China remains strong, the risk scenario could improve further.

We examine below two fundamental factors that are encouraging for global growth as a whole.

Despite all the worries about the Chinese economy, the Shanghai Index trades near a 19-month high. As long as the support at 3150 holds, the trend remains firmly up and a break above 3300 may open up 3450-3500, appreciation of another 4.5-6.0%. If China remains strong, the risk scenario could improve further.

We examine below two fundamental factors that are encouraging for global growth as a whole.

CHINA: RECOVERING FROM SLOWDOWN?

The world spent 2016 fearing a “hard landing” in China as the authorities tried to transition from an investment led economy to a consumption led economy.

However, as the chart above shows, growth seems to be picking up again in 2017 after a continuous decline since 2012. The Q2FY 2017 GDP came at 6.9% (yoy), better than the expected 6.8%. The Q3 and Q4 consensus forecasts stand at 6.7% and 6.6% currently, and could be revised upwards in the coming weeks, given that the Chinese PMI has seen a sharp pickup to 51.1 in July, compared to 50.4 and 49.6 in the earlier months.

The world spent 2016 fearing a “hard landing” in China as the authorities tried to transition from an investment led economy to a consumption led economy.

However, as the chart above shows, growth seems to be picking up again in 2017 after a continuous decline since 2012. The Q2FY 2017 GDP came at 6.9% (yoy), better than the expected 6.8%. The Q3 and Q4 consensus forecasts stand at 6.7% and 6.6% currently, and could be revised upwards in the coming weeks, given that the Chinese PMI has seen a sharp pickup to 51.1 in July, compared to 50.4 and 49.6 in the earlier months.

GOLD-COPPER RATIO: FRESH RISK-ON?

This chart shows that the Gold-Copper ratio (currently 439) is standing at a very important inflection point. A weekly close below the long-term channel support at 430 opens up much lower levels of 380-60, signaling increasing global risk appetite and stronger belief in the stability of the world economy.

Why does this matter? When the Gold-Copper ratio comes down, it implies more demand for Copper relative to Gold. This usually happens when either (a) there is lesser demand for Gold as a “safe haven” or (b) there is more industrial demand for Copper, or both. In either case, a decline in the Gold-Copper ratio is generally interpreted as a symptom of increase in global growth rates.

This chart shows that the Gold-Copper ratio (currently 439) is standing at a very important inflection point. A weekly close below the long-term channel support at 430 opens up much lower levels of 380-60, signaling increasing global risk appetite and stronger belief in the stability of the world economy.

Why does this matter? When the Gold-Copper ratio comes down, it implies more demand for Copper relative to Gold. This usually happens when either (a) there is lesser demand for Gold as a “safe haven” or (b) there is more industrial demand for Copper, or both. In either case, a decline in the Gold-Copper ratio is generally interpreted as a symptom of increase in global growth rates.

FOLLOW-UP ON KOSPI: TIME TO BE CAUTIOUS

This is a follow-up on the South Korean Kospi, which was last discussed in our Jun’17 report. It was written that the index may rise to 2500-2600 soon and in line with our expectations, the index has indeed hit a high of 2453 in July with 2500 in touching distance now. We had also discussed the possibility of a consolidation near 2500 and the time for that consolidation phase looks near and the long term bulls may take some profit away from the table.

Keeping with our previous view, we may see a multi-month consolidation if the index fails to rise above 2500 but the long term uptrend may resume for 2600 and higher in the months following the correction.

This is a follow-up on the South Korean Kospi, which was last discussed in our Jun’17 report. It was written that the index may rise to 2500-2600 soon and in line with our expectations, the index has indeed hit a high of 2453 in July with 2500 in touching distance now. We had also discussed the possibility of a consolidation near 2500 and the time for that consolidation phase looks near and the long term bulls may take some profit away from the table.

Keeping with our previous view, we may see a multi-month consolidation if the index fails to rise above 2500 but the long term uptrend may resume for 2600 and higher in the months following the correction.

CONCLUSION

Despite the US and Indian markets running the risk of severe correction in the near term, we must allow for the possibility of further upside before the expected correction materializes. The continued inflow into even unlikely emerging markets like Mexico and Turkey and the rally in industrial metals relative to safe havens like Gold point to still increasing risk appetite which may push the indices higher.

Ranajay Banerjee

Leads the research team at KSHITIJ,COM. Has a deep understanding of Elliot Waves and a formidable memory of market history. Well known on Twitter as @ranajayb with a considerable fan following. Film scriptwriter by night.

Array

You may also like:

Global Equities: Time for a breather?

17, Apr 2017

Global Equities: Powering to the upside

16, May 2017

Global Equities: Time for Caution

10, Jul 2017-

Global Equities: Where should you put your money?

9, Jun 2017

Global Equities: Chinese Stocks to outperform USA and India

6, Sep 2017

Global Equities: Why we are unable to buy

26, Oct 2017

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

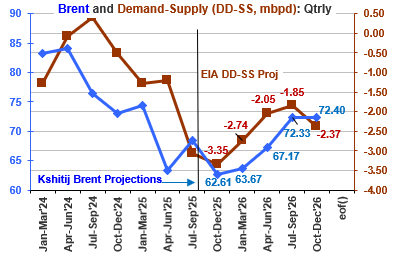

Crude prices have been steady and tilted to the downside over the last few months. Hovering near $60, can it gradually move up towards $70? Or could there be room for more fall towards $55/50? … Read More

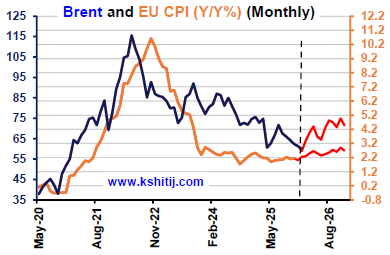

Brent and EU Inflation has been low in the last few months. If both the EU Inflation and Brent see a gradual rise in 2026, the upside could be …. Read More

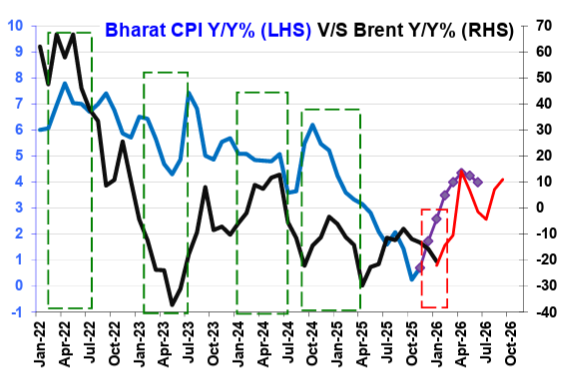

In our 04-Dec-25 report (10Yr GOI 6.54%) we conceded that RBI may cut the Repo due to the unexpectedly sharp fall in the Oct-25 CPI to 0.25%. The RBI then indeed … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our January ’26 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877