Forex Is your business

Aug, 30, 2012 By Vikram Murarka 0 comments

YOUR BOSS NEEDS TO SEE THIS

I would be a rich man if I had a Rupee for every time I have heard the phrase "Forex is not my business" from corporates with forex exposures. Please show this article to your boss, your CFO, your Chairman/ Managing Director; please show it to your Board. If you yourself are the CFO/ CMD/ or a member of the Board, please read this article twice over. If your company exports or imports anything, then forex is your business. You could be exporting software, soya meal or pharmaceuticals. You could be importing coal, oilseeds, machines or chemicals. You could be importing rough diamonds and exporting polished diamonds. In all cases, forex IS your business.Anything that impacts your business is your business.

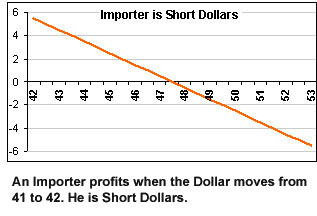

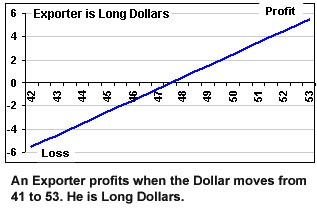

Unless you are a cash rich company, you would be taking loans from banks. You are not a banker, yet you constantly look for ways to reduce your borrowing costs. Why? Infosys Ltd. exports software. It is not in the education business. Yet, it conducts training for hundreds of technical graduates it hires every year, as a part of its normal activities. Why? The venerable Godrej Group has entered the residential real estate business only recently. Yet, it has been providing housing to its employees at Vikhroli in Mumbai for a very long time. Why? There are only a handful of power generation companies in India. Yet, many large manufacturers in India run captive power plants. Why? More than 90% of companies are not in the business of policing, but every company either employs security guards, or outsources the function to a security agency. Why? The point is any variable that critically impacts your business, is your business. You may not like it, you may feel it is an imposition on you; you may even want to outsource the function to an external service provider. But, ask Maruti. Security is very much a part of its business. Similarly, if you are into exports or imports, forex is very much your business.An Exporter is Long Dollars; an Importer is Short Dollars

|

|

Recognise. Commit. You will succeed.

Saying "forex is not my business" is a defeatist attitude. It is not going to make for success in forex risk management. Indians are acknowledged as good managers worldwide. Can they not succeed at forex hedging? Of course, they can. There are some very good forex risk managers in some of the companies we have met. They know how to do the job well. If you yourself are the Promoter/ CEO, are managing the forex risk and have been following the markets for a long time, you are most likely already on top of the markets. Why then do so many companies report large forex losses? It is because there is a lack of clarity on the key issues regarding forex risk management and hence a lack of commitment to it at the highest levels. It's only human. I myself will lose interest in an endeavour if I find that nothing tends to work on an ongoing basis in the long run. I try this, I try that, but nothing seems to work That is why, my last article highlighted the "Drawbacks of Common Hedging Methods". So, what is the way out? If you recognize that forex risk management is an essential part of the company's business and you commit yourself to it by sanctioning a hedge cost budget, you will be well on your way to hedging success. Our experience, and our work on the KSHITIJ Hedging Method, tells us that there is scope to generate forex benefits - whether profits on exporters or savings on imports - to the tune of 1% of the exposure. Try it. It's worth it. You can do it. Or ask us how to do it. Give us a call. We'll be glad to help.Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877