Focusing on the Currency Risk Management Process in the Corporate sector

Feb, 16, 2008 By Vikram Murarka 0 comments

Good to be with you again, Gentle Reader! This issue talks about:

- The need for focusing on the Currency Risk Management Process in the Corporate sector

Please keep those comments coming. We love ‘em!

Focusing On The Wrong Problem?

“RBI bars exotic forex products”. This headline in the Business Standard on 07-Feb-08 had the entire forex market in a tizzy. The report said that following losses of Rs 1000 Cr (about $253 mln) stemming from complex forex derivatives, the RBI has directed banks to sell only plain vanilla rupee-dollar derivative products for hedging corporate forex exposures, not for trading.

Although the ban has not been confirmed, the reactions to the headline have centered around whether or not the RBI has been justified in calling for a ban in the first place. Opinions have ranged from “Yes, it was justified” to “No, it wasn't” to “Don't know really.” Some voices, including ours, have called for greater education for the Buy side (Corporate sector) of the market.

Focus on Process missing

So far, the discussions have focused on the derivative “products” - whether or not they should be banned; and whether there is a need for greater education regarding these “products”. Ironically, there has been no talk about the need to strengthen the very process of corporate FX risk management .

So far, the discussions have focused on the derivative “products” - whether or not they should be banned; and whether there is a need for greater education regarding these “products”. Ironically, there has been no talk about the need to strengthen the very process of corporate FX risk management .

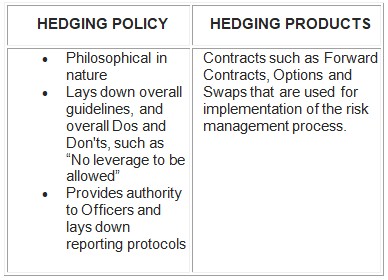

Of course, it is to be acknowledged that on the insistence of the RBI, many companies have adopted a Currency Risk Management policy at the board level. However, a policy is not the same as a process.

While a “policy” is more philosophical, outlining the overall guiding principles of an activity, a “process” is more practical, involving itself with the nuts-and-bolts issues of the day to day performance of the activity. And derivative “products” are something else altogether. They are merely the instruments used to implement the objectives of the hedging policy and process.

The global currency market has traditionally been driven by the “Sell Side” i.e. Banks. It is a testimony to the salesmanship of the Sell Side that the Buy Side has, quite often, been charmed into buying derivative products, without adequately evaluating their suitability. As in the case of any other product, while buying a derivative, it should be seen whether the product serves the overall objectives of the Customer.

Hedging Process needed

Herein lies the need for a Hedging Process, as outlined below. Notice that “Which product to use” is only one out of the seven questions that a Hedging Process is intended to answer. As can be seen, the overarching emphasis on derivative products leads to a neglect of the other equally vital aspects of a complete hedging process.

Hedging Process is more practical in nature. It provides answers to the following questions:

- What to hedge?

- How much to hedge?

- When to hedge?

- For what period to hedge?

- How to hedge?

- Which product to use?

- Why are we hedging in the first place?

- How do we measure performance?

Vital Questions

How does one go about formulating a Hedging Process? We suggest a set of questions that every Corporate FX Risk Management Team can ask itself. The answers to these questions will pave the way for the formulation of a Hedging Process for the company.

- What is our FX Risk Management Agenda for 2008?

- Have we quantified our FX Risk Management Objectives for 2008?

- The production and marketing guys have their budgets. Have we worked out a Hedging Cost Budget?

- How do we measure FX Risk Management performance? Are we trying to beat the market, or better a Benchmark?

- Is our Benchmark based on the past, present or future? Where does Risk lie: in the past, present or future?

- The market is ever changing. Is our benchmark fixed? Or Dynamic?

- Are we more concerned with the performance of our Hedges than of our Exposures? Why?

- What are the five greatest Risk Management challenges we face?

- What three wishes would we want to ask of the Treasury Fairy?

- Are we willing to explicitly pay for Advice? Should advice be paid for separately from the commission/ brokerage payable on hedging transactions?

Is it worthwhile?

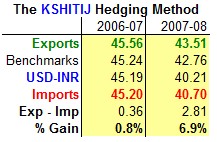

Is it worthwhile taking the trouble to answer these 10 questions and formulating a 7-step Hedging Process? The results of the KSHITIJ Hedging Method, a complete, end-to-end hedging process, suggest it is.

Under the method, Exports have been covered at an average rate of 45.56 and 43.51 in 2006-07 and 2007-08 respectively, while Imports have been covered at averages of 45.20 and 40.70 in the same periods. Thus, a corporate having both Exports as well as Imports has been able to earn a hedged Export-Import margin of Rs 0.36/ USD, or 0.8%, in 2006-07. This margin increased dramatically to Rs 2.81/ USD, or 6.9%, in 2007-08.

Under the method, Exports have been covered at an average rate of 45.56 and 43.51 in 2006-07 and 2007-08 respectively, while Imports have been covered at averages of 45.20 and 40.70 in the same periods. Thus, a corporate having both Exports as well as Imports has been able to earn a hedged Export-Import margin of Rs 0.36/ USD, or 0.8%, in 2006-07. This margin increased dramatically to Rs 2.81/ USD, or 6.9%, in 2007-08.

The KSHITIJ Hedging Method, which is centered around a revolutionary concept of Dynamic Benchmarks has enabled both Exporters and Importers to make money simultaneously. Importantly, this has been achieved without resorting to speculation or trading, even while being hedged to the extent of 60%.

The secret in the KSHITIJ method is that it addresses all the aspects of a complete Hedging Process. Derivative products have certainly been used, but merely as instruments, as and when needed, to achieve the objectives of the Method. To reiterate, the focus needs to shift to the overall FX Risk Management objective, and not be confined to the derivative products.

Once a person starts taking care of his health, he will automatically cut down on cigarettes and junk food.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

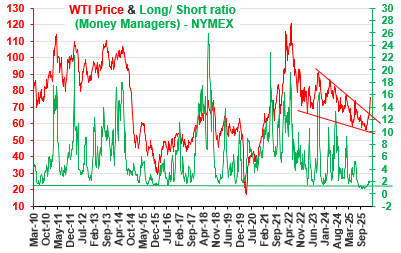

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877