Your Exposure is your Position

Mar, 23, 2012 By Vikram Murarka 0 comments

Most corporate risk managers refer to their hedges, such as forward contacts, as their "market position". They think that taking a hedge is the same as taking a trading position in the market. This is because taking a hedge is an act of volition, undertaken after due deliberation. Something is consciously done. The risk manager says he has taken a "market position". Further, there is a tendency to cancel and rebook forward contracts (something that has been curtailed by the RBI's Dec-11 guidelines), which has tended to give the hedge the flavour of a trading position.

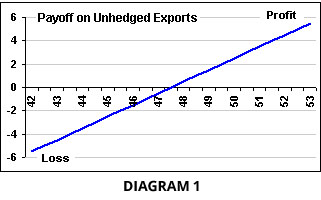

However, this is incorrect. The hedge is not the company's actual market position. It is a transaction undertaken to offset, or square off, or negate, the actual underlying position that the company has in the market, as a result of its fundamental business transactions. See diagram 1.

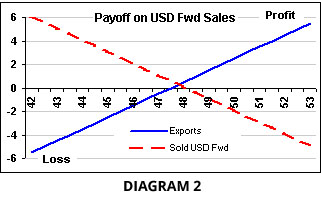

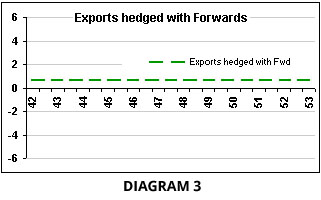

If the Exporter now sells Dollars Forward for 3 months against this export receivable, he is hedging or closing out or squaring off his export receivable position. If the Dollar moves up against the Rupee, the gain on the exports is offset by the loss on the forward contract. On a net basis, therefore, the value of the Export Receivable is no longer exposed to market fluctuations. The position has been closed through the hedge, through the Forward Sale contract. See diagram 3.

Similar, but opposite is the position of the Importer, who is Short Dollars in the market by virtue of his imports. He has to buy Dollars in the market to make good his payment obligation. When he actually buys Forward Dollars, he is not taking a fresh position in the market. He is simply covering his exposure, providing for his payment obligation, squaring off the risk of Rupee depreciation.

Unfortunately, since the Risk Manager does not himself undertake the export or import transaction, or because the actually underlying position is created by default, there is a tendency to not recognize it for what it is, viz. the company's actual position in the currency market. It is unfortunate because this misunderstanding causes the company to ignore and overlook the profit or loss on its actual position and instead focus on the profit or loss of its hedge. This is akin to losing sight of the woods for the trees, because, usually, the quantum of the actual underlying exposure is greater than the quantum of the hedge.

Thus, when a hedge, whose quantum is, say, 30% of the actual underlying exposure, makes money, there is no reason to be overjoyed. Quite obviously, when the 30% hedge is making money, the balance 70% unhedged exposure is losing money. Similarly, if the 30% hedge loses money, that is no reason to crucify the risk manager - the balance 70% unhedged exposure is actually making money. In fact, therefore, if the hedge ratio is less than 50%, a loss making hedge is to be preferred to a profitable hedge.

Thus, when a hedge, whose quantum is, say, 30% of the actual underlying exposure, makes money, there is no reason to be overjoyed. Quite obviously, when the 30% hedge is making money, the balance 70% unhedged exposure is losing money. Similarly, if the 30% hedge loses money, that is no reason to crucify the risk manager - the balance 70% unhedged exposure is actually making money. In fact, therefore, if the hedge ratio is less than 50%, a loss making hedge is to be preferred to a profitable hedge.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877