Euro Long term Forecast - Apr'18

Apr, 18, 2018 By Saandhy Ganeriwala 0 comments

18-Apr 2018: Euro 1.236

RECAP

In our last report dated 01-Mar-18, we explored the possibility of Euro falling to 1.18-16 in April-June due to a possibly bullish Gold/WTI ratio and seemingly overbought Euro derivatives positions. At the same time, we had retained our earlier “more preferred” view of a straight rise past 1.25-26 towards 1.30-35. The Euro has meanwhile ranged between 1.215-1.247 in March and April.EXECUTIVE SUMMARY

Euro is likely to test long term resistance (1.25-26; possibly 1.28) in Apr/May. After that, we prefer a dip towards 1.20-1.17 by Sep/Nov. A breach of 1.26-1.28 immediately after May is less preferred. This is because:- The expected rise to 1.26-28 could mark the end of a 5 wave up move since Jan ’17.

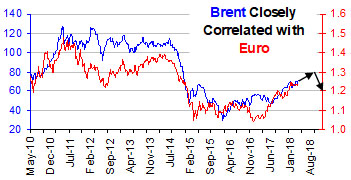

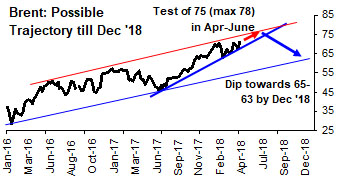

- Brent could rise to 75-78 by May ’18 and then fall to 65-63 by Dec ’18.

- Gold/Euro could bounce from support (1070) and a highly correlated Euro could simultaneously weaken.

CORRECTION AFTER 1.26-1.28

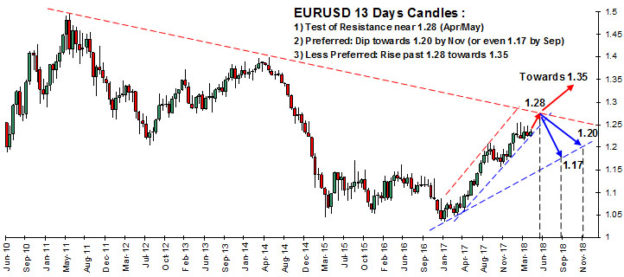

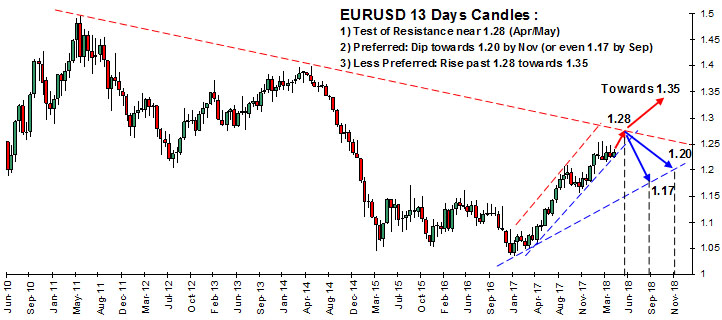

The adjacent long term chart presents the dilemma in question: There is striking similarity in pattern between the 2003 breach of long term resistance and the impending breach of long term resistance near 1.25-26 (possibly 1.28). The question is: Will this resistance be broken immediately (in Apr-May 2018) or, will there be a correction first?

Till now, we had preferred a straight break past 1.25-26, to target 1.30-35. However, mounting evidence suggests a dip towards 1.17 from 1.25-26 (possibly 1.28).

CORRECTION AFTER 1.26-1.28

The adjacent long term chart presents the dilemma in question: There is striking similarity in pattern between the 2003 breach of long term resistance and the impending breach of long term resistance near 1.25-26 (possibly 1.28). The question is: Will this resistance be broken immediately (in Apr-May 2018) or, will there be a correction first?

Till now, we had preferred a straight break past 1.25-26, to target 1.30-35. However, mounting evidence suggests a dip towards 1.17 from 1.25-26 (possibly 1.28).

Since Jan ’17, Euro (1.236) has been rising in a 5 wave upmove and is currently in the last leg of the 5th wave. This last leg is likely to extend up till 1.25-26, but could also move further till 1.28, which is seen as resistance in the above 13 day candlesticks chart. After the end of the 5th wave near 1.25-26-28, a correction till 1.20-1.17 is possible (1.20 and 1.17 are obtained as the 23.6% and 38.2% retracements of the upmove since Jan ’17.) Moreover, a support trendline joining lows from Jan ’17 also yields 1.20-1.17 as a possible target zone on the downside.

Since Jan ’17, Euro (1.236) has been rising in a 5 wave upmove and is currently in the last leg of the 5th wave. This last leg is likely to extend up till 1.25-26, but could also move further till 1.28, which is seen as resistance in the above 13 day candlesticks chart. After the end of the 5th wave near 1.25-26-28, a correction till 1.20-1.17 is possible (1.20 and 1.17 are obtained as the 23.6% and 38.2% retracements of the upmove since Jan ’17.) Moreover, a support trendline joining lows from Jan ’17 also yields 1.20-1.17 as a possible target zone on the downside.

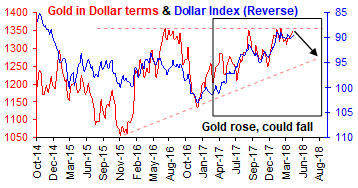

EURO TO TURN BEARISH WITH BRENT?

|

|

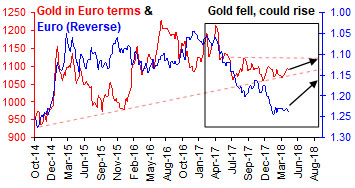

EURO COULD FALL AS GOLD/EURO RISES

|

|

CONCLUSION

Euro is likely to test long term resistance (1.25-26-28) by Apr/May. After that, we prefer a dip towards 1.20-1.17 by Sep/Nov. A breach of 1.25-26-28 towards 1.30-35 immediately after May is less preferred.

Saandhy Ganeriwala

Saandhy is a postgraduate in Economics, but like all good market-men, he seeks confirmation from technical analysis charts for his macroeconomic ideas. His research is a good mix of charts, stats and econ. Apart from that, he calls himself a news junkie and an occasional writer.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877