Drawbacks of Common Hedging Methods

Aug, 08, 2012 By Vikram Murarka 0 comments

Forex risk management is a frustrating experience for most companies. There seem to be a thousand things that can go wrong at any time - the economy, the market, the forecasts, the regulations, the shipment and payment dates - and generally they do seem to go wrong all together, all the time, every time. If by any chance, or maybe by design, there is profit in any one year, it does not seem to last. Losses, when they inevitably come, tend to wipe out the profits of earlier years. Little wonder that most companies tend to give up on forex risk management in disgust, saying, "Forex is not our business!"

Forex risk management is a frustrating experience for most companies. There seem to be a thousand things that can go wrong at any time - the economy, the market, the forecasts, the regulations, the shipment and payment dates - and generally they do seem to go wrong all together, all the time, every time. If by any chance, or maybe by design, there is profit in any one year, it does not seem to last. Losses, when they inevitably come, tend to wipe out the profits of earlier years. Little wonder that most companies tend to give up on forex risk management in disgust, saying, "Forex is not our business!"

We disagree. Forex is very much the business of every importer and exporter. And, tackled with a common sense business approach, it can even add to the bottomline instead of constantly subtracting from it. But, that is material for another article. In this article, we shall look at how companies generally deal with forex risk management, and what problems they face.

Method 1 - Do nothing

The most common way to deal with forex risk, of course, is to wish it away, to do nothing. But sadly, as the School of Hard Knocks has taught all of us, avoiding a problem, turning a blind eye to it never works in the long run.

Method 2a - Hedge 100% on Day 1 with Forwards

The second most common way to deal with the issue is to hedge away the forex risk, by closing the original exposure or position straight away, usually with a forward contract, so that the risk is eliminated. This is a simplistic solution, commonly prescribed by textbooks and "purists" who espouse the belief that "forex is not your business." The implicit suggestion is that the company is incapable of managing forex risk.

The problem with this method is that although risk is eliminated no doubt, one ends up sacrificing all potential profit as well. An associated problem with this method is that it is easy to adopt for the exporter who earns the forward premium, but is difficult for the importer who has to pay the same premium.

Method 2b - Selective hedging with Forwards

A variation to this method is to hedge sometimes and not to hedge at other times, based on the available market forecasts.

The problem with this method is that one doesn't know whether the forecast is going to be right or wrong. One cannot have an idea of the chances of success. In case the forecast is prepared by the internal risk management team of the company, there is an additional risk of the forecast turning out to be biased. For instance, there's a danger that an importer will be biased towards a weaker Dollar while an exporter would say that the Dollar is going to rise. In this, it helps to take a forecast from an external, professional forecaster, whose work is considered reliable. For instance, 72% of our forecasts are reliable.

Method 3 - Hedge exclusively through Options

The third, much less common way to hedge against forex risk is to use Options as the hedging tool, rather than the forward contract. This is a better way, no doubt, but it is still not the best way. The benefit of course, is that Options allow the company to partake of potential profit if the market moves in its favour, while eliminating the risk of an unfavourable move. It is, in a manner, the best of both worlds. The sad part is that options tend to be costly and are profitable only in trending markets. Further, most companies, especially exporters (who are used to receiving forward premium) do not have a hedging cost budget, which would enable them to pay the premium for buying options.

What is the way out?

Very well, we've pointed out the flaws in all the common risk management methods. Does this mean there's no hope for beleaguered company managements? Thankfully, there is definitely a way out, and it works. In fact, it has worked for the last six years in various market conditions. We call it the KSHITIJ Hedging Method. It is built on common sense business principles and has been formulated after years of experience and trial and error.

Most importantly, it rejects the fatalistic belief that "forex is not my business." Instead we believe that forex is very much the business of every importer and exporter. And, there is no business issue that cannot be dealt with efficiently if approached proactively. The KSHITIJ Hedging Method is built on the belief that something proper can definitely be done in forex risk management, that the effort is not destined for failure.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

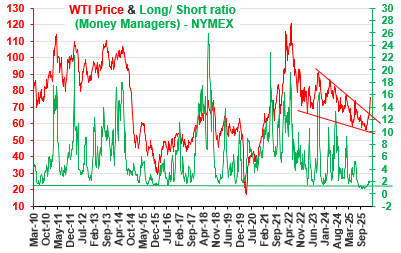

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877