Bund-Bond Yield Differentials suggest strength in EUR-USD going forward

May, 08, 2009 By Vikram Murarka 0 comments

- Yield Differentials suggests strength in EUR-USD going forward

- Corrigendum – The Sensex has strength of its own also

Yield Differentials suggest strength in EUR-USD going forward

Take a look at the Bund-Bond Yield Differential v/s EUR-USD chart below. The blue line on the graph represents the EUR-USD rates (tracked on the right hand scale) while the grey line charts the differential between 10-yr yields on EUR Bunds and US T-Bonds, on the left hand axis. There is a positive correlation between the Yield Differential and the EUR-USD exchange rate. Simply put, the Euro rises against the Dollar if the Bund yields rise in comparison to the Bond yields. Emerging trends in the yield differential can, therefore, provide a good idea on where the EUR-USD could be headed.

There is a trendline coming up from the Jun-06 low of –1.18% on the Yield Differential chart, joining the Nov-08 low of –0.2%, which now provides support just below the current differential level of 0.06%. Should this Support remain intact, the differential may increase going forward. That would be a positive for the Euro vis-à-vis the Dollar.

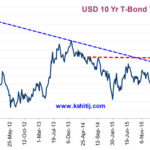

To determine the chances of the differential increasing going forward we first look at the US Yield chart alongside which shows yields on 10 and 30 yr T-Bonds. The 30-Yr Long Bond yield (4.29%) has reached a Resistance level (see the Red trendline). The 10-Yr yield (3.32%) has the potential to rise some more before it meets Resistance at 3.5%. If the Resistances on the 30-Yr and 10-Yr hold going forward, the yields could fall, sending the Bund-Bond differential up.

To determine the chances of the differential increasing going forward we first look at the US Yield chart alongside which shows yields on 10 and 30 yr T-Bonds. The 30-Yr Long Bond yield (4.29%) has reached a Resistance level (see the Red trendline). The 10-Yr yield (3.32%) has the potential to rise some more before it meets Resistance at 3.5%. If the Resistances on the 30-Yr and 10-Yr hold going forward, the yields could fall, sending the Bund-Bond differential up.

Further, Euro Yield chart alongside shows that the yields have been rising since the beginning of March ‘09 and have at least a 50% chance of rising further. If so, this too could boost the Bund-Bond yield differential.

Further, Euro Yield chart alongside shows that the yields have been rising since the beginning of March ‘09 and have at least a 50% chance of rising further. If so, this too could boost the Bund-Bond yield differential.

All of this, put together, would be bullish for the Euro. However, in case the Bund-Bund Yield Differential (currently +6 bp) goes into negative territory going forward, the Euro could take a big beating against the Dollar.

The make-or-break situation on the Bund-Bond Yield Differential chart is reflected in the Euro chart as well.

The make-or-break situation on the Bund-Bond Yield Differential chart is reflected in the Euro chart as well.

As can be seen on the 3-day Candlestick chart alongside, there is a trendline coming down from the Jul-08 high of 1.6038 that provides Resistance near 1.3550.

If and while this holds, there may be a chance of the Euro falling back towards 1.25 in the weeks/ months ahead. However, should this Resistance at 1.3550 break, the Euro could skyrocket to 1.40-42.

The Sensex vis-à-vis the World – A Corrigendum

The chart alongside plots the Log of the percentage move in Sensex, Dow Jones Industrial Average, Nikkei and MSCI's Emerging Market Asia indices since Jan-98. The Sensex is seen to have outperformed all the other indices, compared to the Jan-98 levels. The Sensex outperformed the others in the bull run of 2003-08. Even during the fall of 2008-09, it was beaten only by the Dow. It beat both the EM index and the Nikkei during the fall.

The chart alongside plots the Log of the percentage move in Sensex, Dow Jones Industrial Average, Nikkei and MSCI's Emerging Market Asia indices since Jan-98. The Sensex is seen to have outperformed all the other indices, compared to the Jan-98 levels. The Sensex outperformed the others in the bull run of 2003-08. Even during the fall of 2008-09, it was beaten only by the Dow. It beat both the EM index and the Nikkei during the fall.

This fresh finding contradicts and corrects our earlier assertion that the Sensex moves in tandem with the world, implying there is no diversification benefit in the Sensex (and by extension, India) vis-à-vis the rest of the world. The incorrect chart, which was published in our annual print Calendar, is given alongside for reference. The error occurred due to reference to an incorrect data series, and somehow escaped internal quality checks.

This fresh finding contradicts and corrects our earlier assertion that the Sensex moves in tandem with the world, implying there is no diversification benefit in the Sensex (and by extension, India) vis-à-vis the rest of the world. The incorrect chart, which was published in our annual print Calendar, is given alongside for reference. The error occurred due to reference to an incorrect data series, and somehow escaped internal quality checks.

We tender sincerest apologies to all concerned for the error.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

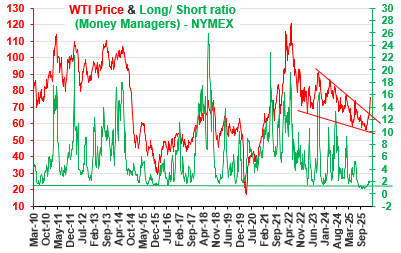

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877